A loan agreement form outlines the terms and conditions between a lender and a borrower, ensuring clarity and legal protection for both parties. This document specifies the loan amount, interest rate, repayment schedule, and any collateral involved. Reviewing various examples helps understand the essential components and tailor agreements to different financial situations.

Loan Agreement Form Sample PDF Viewer

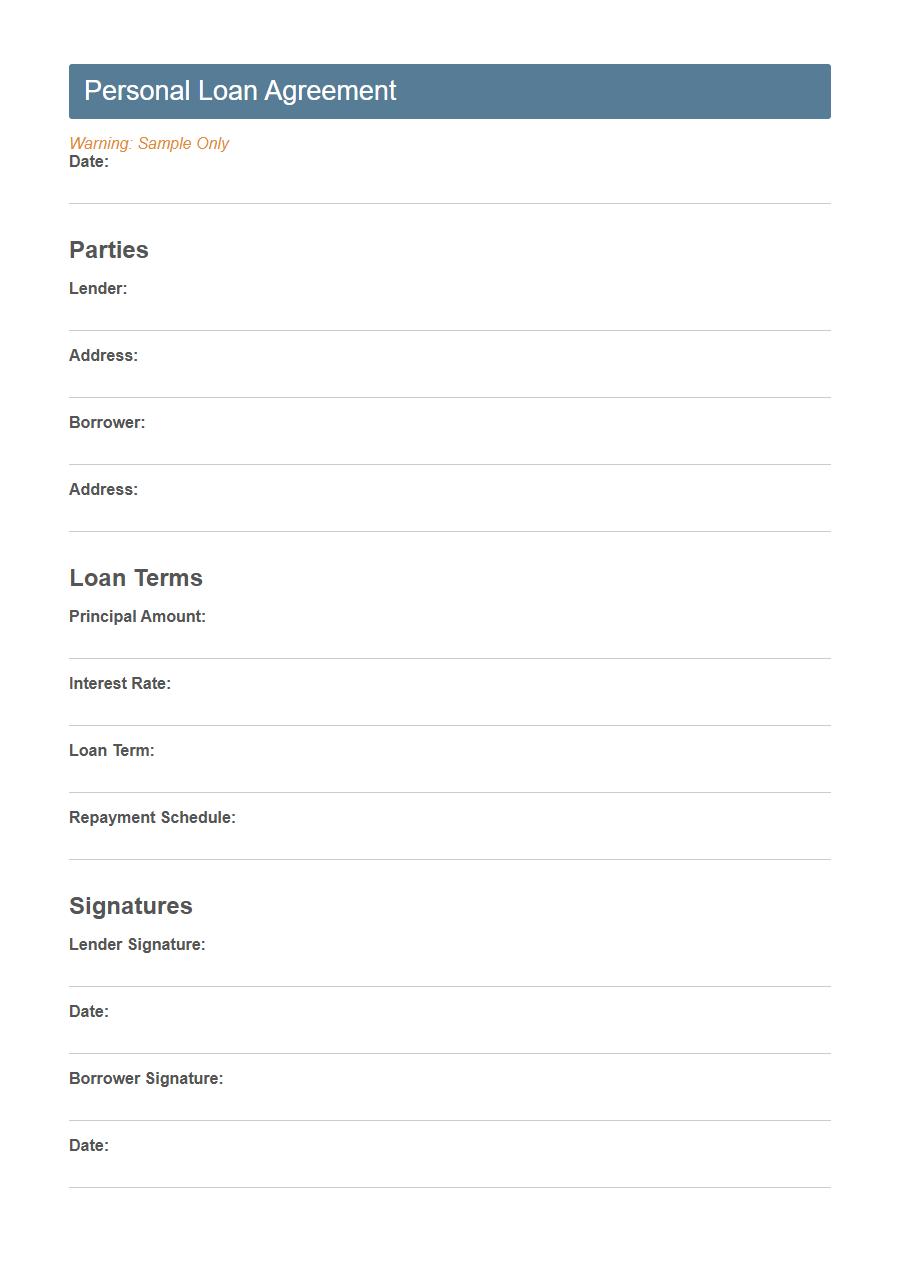

Image example of Loan Agreement Form:

Loan Agreement Form Samples

Personal Loan Agreement Template - PDF - HTML

Family Loan Agreement Template - PDF - HTML

Friends Loan Agreement Template - PDF - HTML

Car Loan Agreement Template - PDF - HTML

Student Loan Agreement Template - PDF - HTML

Small Business Loan Agreement Template - PDF - HTML

Equipment Loan Agreement Template - PDF - HTML

Employee Loan Agreement Template - PDF - HTML

Real Estate Loan Agreement Template - PDF - HTML

Secured Loan Agreement Template - PDF - HTML

Unsecured Loan Agreement Template - PDF - HTML

Demand Loan Agreement Template - PDF - HTML

Short-Term Loan Agreement Template - PDF - HTML

Understanding the Loan Agreement Form

A Loan Agreement Form is a legal document outlining the terms and conditions of a loan between a lender and a borrower.

This form details the loan amount, interest rate, repayment schedule, and responsibilities of both parties. Understanding each section ensures transparency and protects the interests of everyone involved.

Key Components of a Loan Agreement

A Loan Agreement Form is a legal document outlining the terms and conditions between a lender and a borrower. It establishes the responsibilities and expectations for both parties involved in the loan transaction.

Key components of a loan agreement include the loan amount, interest rate, repayment schedule, and maturity date.

Types of Loan Agreement Forms

Loan agreement forms outline the terms and conditions between a lender and a borrower. They vary based on the nature and purpose of the loan.

Promissory notes are simple loan agreements used for personal loans or small transactions. Secured loan agreements involve collateral to reduce lender risk, commonly used in mortgages and auto loans.

How to Draft a Loan Agreement

Drafting a loan agreement requires careful attention to detail to ensure all terms are clear and legally binding. A well-structured loan agreement protects both the lender and the borrower by outlining obligations and expectations precisely.

- Identify the parties involved - Clearly state the names and roles of the lender and borrower to avoid any confusion.

- Specify loan terms - Detail the loan amount, interest rate, repayment schedule, and any fees to provide transparency.

- Include default and termination clauses - Define consequences for missed payments or breach of contract to safeguard both parties.

Reviewing the loan agreement with legal counsel before signing helps ensure compliance with applicable laws and reduces risks.

Essential Clauses to Include

A Loan Agreement Form is a critical document that outlines the terms and conditions between a lender and a borrower. It ensures clarity and legal protection for both parties involved in the loan transaction.

- Loan Amount and Disbursement - This clause specifies the principal amount being loaned and the method and timeline for disbursing the funds.

- Repayment Terms - Details the schedule, frequency, and amount of repayments including any interest rates applied to the loan.

- Default and Remedies - Defines what constitutes a default and the actions the lender can take if the borrower fails to meet the agreement's terms.

Legal Requirements and Compliance

A Loan Agreement Form must clearly outline the terms and conditions agreed upon by both parties to ensure legal enforceability. It should comply with relevant laws, including interest rate regulations and disclosure requirements, to protect the rights of lenders and borrowers. Proper signatures and notarization may be required to validate the document and prevent future disputes.

Tips for Borrowers and Lenders

What should borrowers consider before signing a Loan Agreement Form? Borrowers need to carefully review all terms to understand their repayment obligations and interest rates. Clarity on fees and penalties helps prevent unexpected financial burdens.

How can lenders protect their interests in a Loan Agreement Form? Lenders should specify clear repayment schedules and include clauses for late payments or defaults. Detailed documentation ensures legal protection and smooth conflict resolution.

Why is it important for borrowers to verify the loan amount and purpose in the agreement? Confirming these details ensures the loan meets their financial needs accurately. Misunderstandings about amounts can lead to insufficient funds or excessive debt.

What steps can lenders take to assess borrower credibility before agreement signing? Conducting thorough credit checks and evaluating income stability reduces the risk of default. Proper assessment leads to more secure lending decisions.

How does clear communication benefit both borrowers and lenders in a Loan Agreement Form? Transparent terms help build trust and prevent disputes during the loan period. It promotes a better financial relationship and smooth repayment experience.

Common Mistakes to Avoid

Loan agreement forms are essential legal documents that outline the terms and conditions of a loan between parties. Avoiding common mistakes ensures clarity, protects both lender and borrower, and prevents future disputes.

- Incomplete Terms - Failing to detail the loan amount, interest rate, repayment schedule, or collateral can lead to misunderstandings.

- Lack of Signatures - Omitting signatures from all parties invalidates the agreement and reduces its enforceability.

- Ignoring Legal Requirements - Not adhering to state or federal laws regarding loan agreements might result in penalties or the contract being deemed void.

Customizing Loan Agreement Templates

Customizing loan agreement templates allows lenders and borrowers to tailor the terms and conditions to fit their specific needs. This flexibility ensures clarity on repayment schedules, interest rates, and collateral requirements. Personalized agreements reduce misunderstandings and provide legal protection for all parties involved.