An insurance quote request form streamlines the process of obtaining personalized coverage estimates by collecting essential information from applicants. These forms typically include fields for personal details, coverage preferences, and vehicle or property specifics to tailor accurate quotes. Examining a variety of example forms highlights best practices and key components for effective insurance quote requests.

Insurance Quote Request Form Sample PDF Viewer

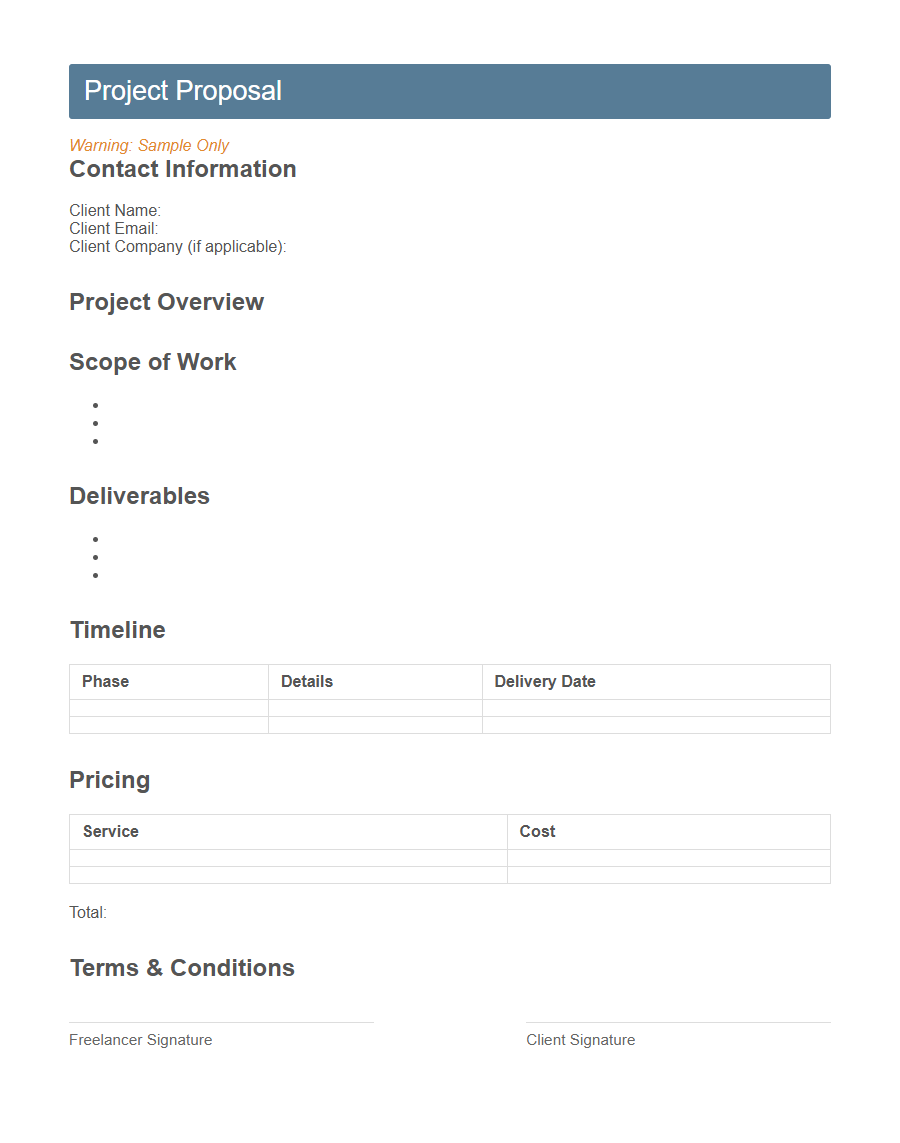

Image example of Insurance Quote Request Form:

Insurance Quote Request Form Samples

Freelance Designer Project Proposal Template - PDF - HTML

Pet Grooming Service Agreement Form - PDF - HTML

Mobile App Bug Report Submission Sheet - PDF - HTML

Virtual Assistant Onboarding Checklist - PDF - HTML

Handmade Candle Product Specification Sheet - PDF - HTML

Nutrition Coaching Progress Tracker - PDF - HTML

Wedding Venue Site Visit Evaluation Form - PDF - HTML

Local Farmers Market Vendor Application - PDF - HTML

Custom Furniture Order Specification Template - PDF - HTML

Social Media Influencer Collaboration Brief - PDF - HTML

Tattoo Studio Consent and Aftercare Form - PDF - HTML

E-commerce Return & Refund Claim Letter - PDF - HTML

Eco-Friendly House Cleaning Checklist - PDF - HTML

Drone Photography Service Quotation Sheet - PDF - HTML

Medical Billing Insurance Reimbursement Request - PDF - HTML

Introduction to Insurance Quote Request Forms

An Insurance Quote Request Form is a simple tool used to gather essential information from individuals seeking insurance coverage.

This form allows insurance providers to assess risk and offer personalized policy options. It streamlines the process of comparing quotes and selecting the best insurance plan for the applicant's needs.

Importance of an Insurance Quote Request Form

An Insurance Quote Request Form is essential for obtaining accurate pricing tailored to an individual's specific needs. It streamlines the process, ensuring all necessary information is collected upfront to provide precise quotes.

Completing this form allows insurers to assess risk effectively and offer the best coverage options.

Key Components of an Insurance Quote Request Form

An insurance quote request form gathers essential information to provide accurate pricing and coverage options. It streamlines communication between the insurer and the client, ensuring quick and efficient quote generation.

- Personal Information - Collects the applicant's name, contact details, and date of birth to verify identity and tailor the quote.

- Coverage Details - Specifies the type and amount of insurance coverage needed to align with the client's risk profile.

- Additional Information - Includes relevant details such as previous claims or existing policies to assess underwriting factors accurately.

These key components enable insurers to deliver precise and personalized insurance quotes promptly.

How to Fill Out an Insurance Quote Request Form

Filling out an insurance quote request form is a straightforward process that ensures you receive the most accurate and personalized insurance rates. Providing clear and detailed information helps insurance companies understand your needs and offer appropriate coverage options.

- Gather necessary personal information - Collect details such as your name, address, date of birth, and contact information to complete the form accurately.

- Provide specific coverage details - Specify the type of insurance and coverage limits you are interested in to help insurers tailor their quotes to your requirements.

- Review and double-check your entries - Verify all information for accuracy before submitting to avoid delays or incorrect quotes from the insurance provider.

Common Mistakes to Avoid on Quote Request Forms

Filling out an insurance quote request form accurately is crucial for receiving a precise estimate.

One common mistake is providing incomplete or incorrect personal information, which can delay the process or result in inaccurate quotes. Double-check all details like name, contact info, and policy specifics before submitting the form.

Benefits of Using Online Insurance Quote Request Forms

Why should you use an online insurance quote request form? It saves time by allowing you to quickly compare multiple insurance options from the comfort of your home. You can receive accurate estimates tailored to your specific needs without the hassle of phone calls or in-person visits.

How does an online insurance quote request form improve the insurance shopping experience? It provides instant access to detailed information and pricing, helping you make informed decisions. Online forms often offer user-friendly interfaces that simplify the process of submitting your details and receiving quotes efficiently.

What makes online insurance quote request forms more convenient than traditional methods? They are accessible 24/7, so you can request quotes at any time that fits your schedule. This flexibility reduces waiting times and speeds up the comparison process, helping you find the best coverage faster.

Can using an online insurance quote request form lead to better insurance deals? Yes, it enables you to easily gather multiple quotes and identify competitive rates. This transparency empowers you to negotiate or choose the best policy that suits your budget and coverage requirements.

Why is privacy and security important in an online insurance quote request form? Reliable online forms use encryption to protect your personal information during submission. This ensures your data remains confidential while you explore insurance options safely from anywhere.

Security and Privacy Concerns with Quote Request Forms

Insurance quote request forms collect sensitive personal information that requires robust security measures to prevent unauthorized access. Implementing encryption and secure data storage protocols protects user data from potential breaches. Transparent privacy policies ensure users understand how their information is used and build trust in the insurance provider.

Tips for Getting Accurate Insurance Quotes

Filling out an insurance quote request form accurately ensures you receive precise and reliable quotes. Understanding the key details to include can streamline the process and help you compare options effectively.

- Provide complete and accurate personal information - Insurers use your details to assess risk, so any inaccuracies can lead to incorrect quotes.

- Specify coverage needs clearly - Defining the type and amount of coverage helps tailor the quotes to your actual requirements.

- Review and update your information regularly - Keeping the form current reflects any changes in your situation that might affect your insurance rates.

Choosing the Right Insurance Provider with Quote Requests

Choosing the right insurance provider begins with accurately completing an insurance quote request form to receive tailored coverage options. Submitting detailed and honest information ensures the quotes reflect your specific needs and allows for effective comparison. This process helps identify a provider offering the best balance of price, coverage, and customer service.