A mortgage insurance coverage request form template streamlines the process of applying for or adjusting mortgage insurance. Clear, accurate examples help borrowers and agents complete these forms efficiently, ensuring all necessary information is provided. Using standardized templates reduces errors and speeds up approval, enhancing overall mortgage application experience.

Mortgage Insurance Coverage Request Form Template Sample PDF Viewer

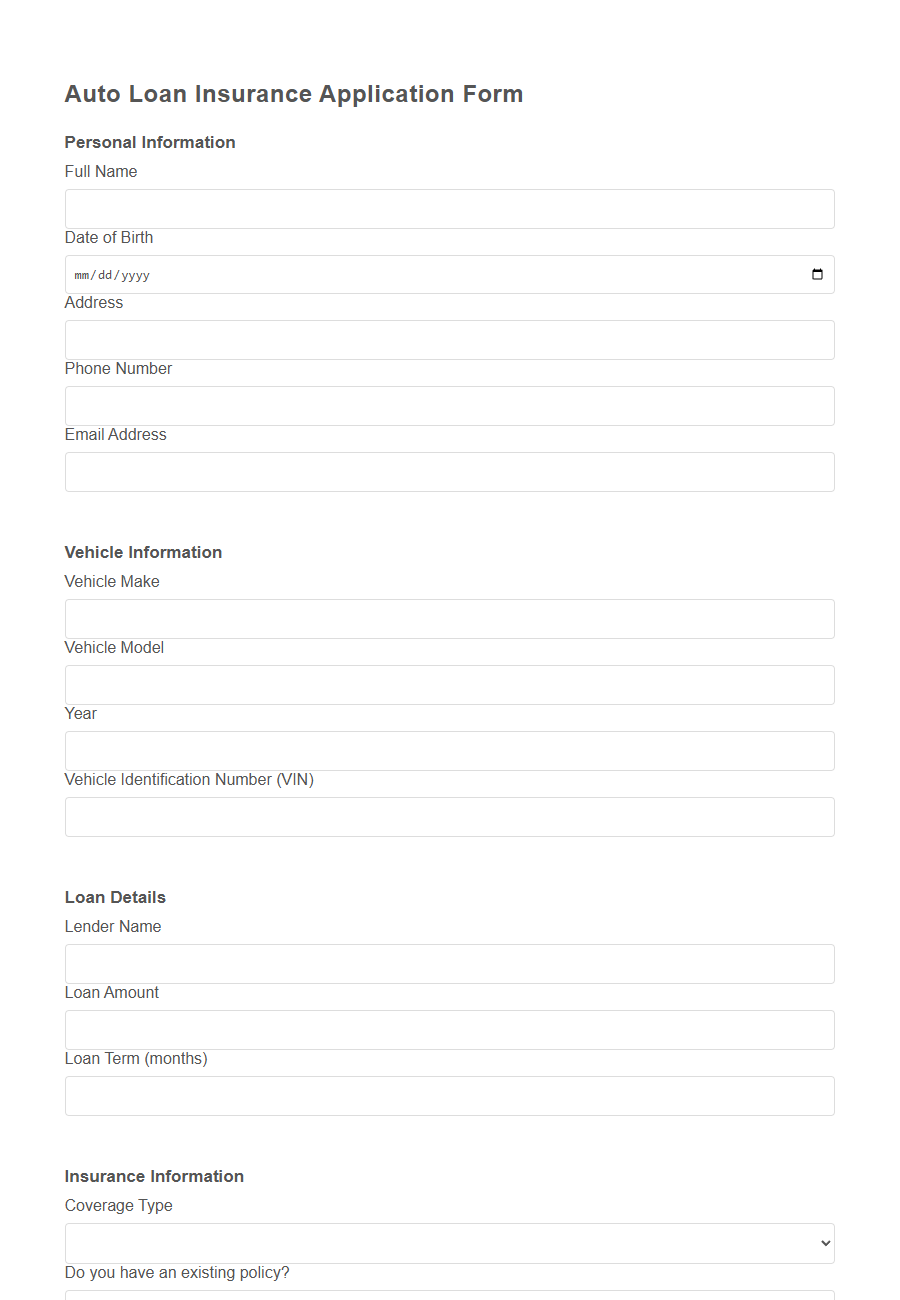

Image example of Mortgage Insurance Coverage Request Form Template:

Mortgage Insurance Coverage Request Form Template Samples

Auto Loan Insurance Application - PDF - HTML

Commercial Lease Insurance Verification - PDF - HTML

Homeowners Association Insurance Declaration - PDF - HTML

Small Business Equipment Insurance Claim - PDF - HTML

Travel Medical Expense Insurance Request - PDF - HTML

Event Liability Insurance Certificate Request Template - PDF - HTML

Health Practitioner Professional Liability Insurance Enrollment Form - PDF - HTML

Flood Zone Property Insurance Approval - PDF - HTML

Pet Liability Insurance Application - PDF - HTML

Cybersecurity Breach Insurance Claim Notification Form - PDF - HTML

Landlord Rent Guarantee Insurance Request - PDF - HTML

Vintage Car Agreed Value Insurance Coverage Form - PDF - HTML

Intellectual Property Infringement Insurance Request Form - PDF - HTML

Construction Site Builder’s Risk Insurance Application Template - PDF - HTML

Art Gallery Exhibition Insurance Coverage Request Form - PDF - HTML

Introduction to Mortgage Insurance Coverage Request Forms

A Mortgage Insurance Coverage Request Form is a standardized document used by borrowers to apply for mortgage insurance. This form facilitates the approval process by providing necessary details to the insurance provider.

- Purpose of the form - It serves as an official request to initiate or modify mortgage insurance coverage for a property loan.

- Information required - The form typically includes borrower details, loan information, and specifics about the property being insured.

- Importance in lending - Mortgage insurance protects lenders from potential loan defaults, making this form essential in securing financing.

Importance of a Mortgage Insurance Request Form

The Mortgage Insurance Coverage Request Form is essential for borrowers seeking to secure financial protection on their home loans. It ensures clear communication between the borrower, lender, and insurance provider regarding coverage details and requirements.

This form streamlines the approval process and safeguards both parties by documenting the mortgage insurance terms accurately.

Key Components of a Mortgage Insurance Coverage Form

The Mortgage Insurance Coverage Request Form is essential for initiating mortgage insurance coverage with a lender or insurer.

Key components of this form include personal and property details to accurately identify the borrower and the asset. It also requests loan information, such as loan amount and term, to assess the coverage requirements.

The form requires the borrower's declaration and signature to confirm the accuracy of the information provided. There is often a section detailing the type of insurance coverage requested, including coverage limits and premiums.

Additional sections may capture lender information and specific instructions for processing the insurance coverage request. This ensures that all parties involved have the necessary details to proceed efficiently.

How to Fill Out a Mortgage Insurance Request Form

Filling out a Mortgage Insurance Coverage Request Form requires attention to detail to ensure accuracy and prompt processing. Proper completion of the form helps secure the necessary mortgage insurance coverage without delays.

- Provide Personal Information - Enter your full name, contact details, and loan number exactly as they appear on your mortgage documents to avoid any processing errors.

- Specify Insurance Details - Clearly state the amount and type of mortgage insurance coverage you are requesting based on your lender's requirements.

- Review and Sign - Double-check all entries for accuracy before signing and dating the form to validate your request officially.

Eligibility Criteria for Mortgage Insurance Coverage

The Mortgage Insurance Coverage Request Form Template helps streamline the application process by clearly outlining eligibility requirements. Understanding these criteria ensures applicants provide necessary information for approval.

- Minimum Credit Score - Applicants must meet a specified credit score threshold to qualify for mortgage insurance coverage.

- Loan-to-Value Ratio - The requested mortgage insurance must comply with established loan-to-value (LTV) ratio limits set by the insurer.

- Property Type - Only eligible residential property types are accepted for mortgage insurance coverage requests.

Meeting all eligibility criteria on the form improves the chances of mortgage insurance approval and expedites processing.

Common Mistakes to Avoid on Request Forms

What are common mistakes to avoid on a Mortgage Insurance Coverage Request Form template? Leaving required fields blank can delay processing and lead to denial. Providing inaccurate information may cause coverage issues or application rejection.

How can overlooking document attachments affect your mortgage insurance request? Missing necessary supporting documents often results in incomplete submissions. This can slow down approval and complicate verification procedures.

Why is it important to double-check personal and property details on the form? Errors in names, addresses, or loan numbers create confusion and processing delays. Accurate details ensure smooth communication between all parties involved.

What happens if the form is not signed or dated correctly? An unsigned or undated form may be considered invalid and rejected by the insurer. Proper authorization is essential for legal compliance and approval.

How does using the wrong form version impact your mortgage insurance coverage request? Outdated templates might lack necessary updates or fields, causing incomplete submissions. Using the latest form ensures alignment with current insurer requirements.

Sample Mortgage Insurance Coverage Request Template

The Sample Mortgage Insurance Coverage Request Template provides a clear and concise format for borrowers to request mortgage insurance coverage. It includes essential sections for personal information, property details, and coverage amount to streamline the application process. This template helps ensure accuracy and completeness when submitting requests to insurance providers.

Customizing Your Mortgage Insurance Form for Your Needs

Customizing your Mortgage Insurance Coverage Request Form ensures it aligns perfectly with your specific needs and simplifies the application process.

Tailor the form fields to capture essential information relevant to your mortgage policy. This personalization helps streamline approvals and improves communication with your insurance provider.

Tips for Submitting a Successful Request Form

Ensure all required fields on the Mortgage Insurance Coverage Request Form Template are accurately completed to avoid delays. Attach all necessary supporting documents, such as proof of income and property details, to strengthen your submission. Review the form thoroughly before submitting to catch any errors or omissions that could impact approval.