A health insurance claim form template simplifies the process of submitting medical expenses for reimbursement. This list provides various examples to help individuals accurately complete their claims and avoid common errors. Using the right template ensures faster processing and timely payments from insurance providers.

Health Insurance Claim Form Template Sample PDF Viewer

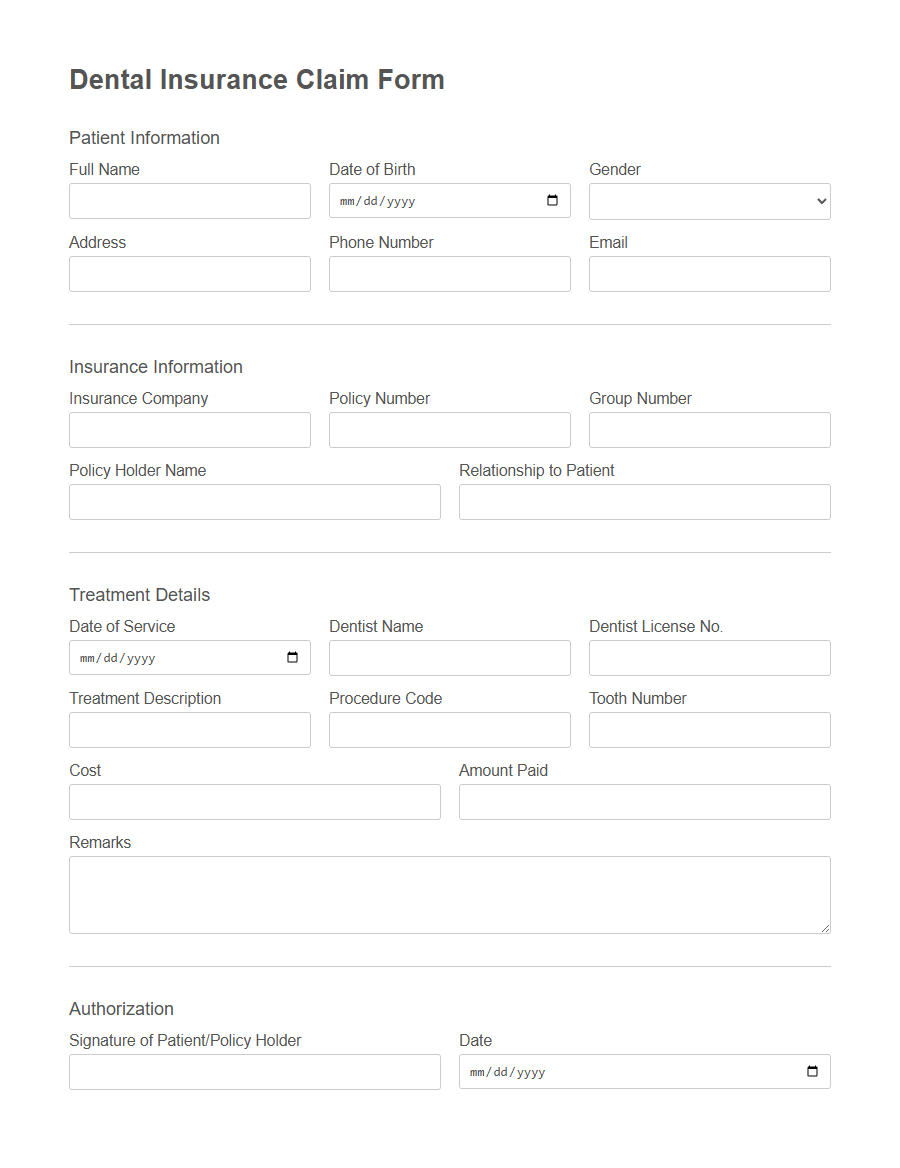

Image example of Health Insurance Claim Form Template:

Health Insurance Claim Form Template Samples

Dental Insurance Claim - PDF - HTML

Vision Insurance Reimbursement - PDF - HTML

Out-of-Network Health Claim Template - PDF - HTML

International Medical Treatment Claim Form - PDF - HTML

Mental Health Therapy Reimbursement Form - PDF - HTML

Prescription Drug Reimbursement Claim Template - PDF - HTML

Accident & Injury Medical Claim Form - PDF - HTML

Maternity Expenses Claim Template - PDF - HTML

Telemedicine Consultation Claim Form - PDF - HTML

Ambulance Services Health Claim Template - PDF - HTML

COVID-19 Hospitalization Claim Form - PDF - HTML

Alternative Medicine Insurance Claim Template - PDF - HTML

Pre-authorization Request Form for Surgery - PDF - HTML

What Is a Health Insurance Claim Form Template?

A Health Insurance Claim Form Template is a standardized document used to request reimbursement or direct payment for medical expenses from an insurance provider.

It simplifies the process of submitting health insurance claims by providing predefined fields for essential information such as patient details, treatment specifics, and payment information. Using a template ensures accuracy and speeds up the approval and settlement process for medical claims.

Key Sections in a Health Insurance Claim Form

What are the key sections in a health insurance claim form? The form typically includes personal information, policy details, and medical treatment information. Accurate completion of these sections ensures timely processing and reimbursement.

Which section captures the patient's personal details? This section requires the insured's name, date of birth, contact information, and policy number. Correct personal data helps in verifying the identity and policy coverage.

What information is needed in the policy details section? It includes the insurance provider's name, policy number, and coverage dates. This section confirms the validity and extent of the insurance coverage.

How is the medical treatment information documented? It requires details such as diagnosis, treatment dates, hospital or clinic name, and billing amounts. Precise documentation helps in evaluating the claim legitimacy and calculating reimbursement.

Why is the declaration and signature section important? The insured must sign to confirm the accuracy of the provided information and consent to claim processing. This section legally authorizes the insurance company to proceed with the claim.

Benefits of Using a Claim Form Template

Using a health insurance claim form template simplifies the submission process by providing a clear and organized structure for all necessary information. This reduces the likelihood of errors and speeds up the approval time for claims.

A standardized template ensures that policyholders include all required details, preventing delays caused by incomplete forms.

How to Fill Out a Health Insurance Claim Form

Filling out a health insurance claim form accurately is essential for timely reimbursement of medical expenses.

Begin by carefully reading the instructions provided on the form to understand the required information. Ensure you fill in all personal details, including policy number, insured name, and contact information, without any errors.

Common Mistakes to Avoid on Claim Forms

Filling out a health insurance claim form accurately is essential to ensure timely approval and reimbursement. Avoiding common mistakes can prevent delays and denials in the claim process.

- Incomplete Information - Missing details such as policy number, patient information, or treatment dates can lead to claim rejection.

- Incorrect Coding - Using wrong medical codes or service descriptions can cause confusion and delay claim processing.

- Missing Signatures - Failing to sign the form where required results in invalid claims and processing setbacks.

Choosing the Right Template for Your Needs

Choosing the right health insurance claim form template simplifies the submission process and ensures accuracy. Selecting a template that aligns with your specific insurance provider's requirements can save time and reduce errors.

- Understand your insurance policy - Know what information your insurer requires before selecting a template.

- Look for clarity and simplicity - Choose templates that are easy to read and fill out to avoid mistakes.

- Check compatibility - Ensure the template format is accepted by your insurance company, whether digital or paper-based.

Using a well-suited health insurance claim form template enhances the likelihood of prompt claim approval and reimbursement.

Digital vs. Paper Health Insurance Claim Forms

Health insurance claim form templates are essential for submitting medical expense claims accurately. Digital health insurance claim forms streamline the process by allowing faster submission, easier data entry, and reduced errors. Paper forms, while still in use, often involve longer processing times and higher chances of mistakes due to manual handling.

Essential Attachments and Supporting Documents

A Health Insurance Claim Form Template requires specific essential attachments to ensure the claim is processed smoothly and without delays. Providing accurate supporting documents verifies the treatment received and validates the claim.

- Medical Bills and Receipts - These documents provide proof of the expenses incurred during medical treatment and are crucial for reimbursement.

- Doctor's Prescription and Reports - These validate the necessity of the treatment and support the claim's authenticity.

- Insurance Policy and Identification Documents - These confirm the claimant's eligibility and help in verifying the coverage details under the health insurance plan.

Tips for a Successful Health Insurance Claim Submission

Ensure all personal and policy information is accurate and clearly filled out to avoid processing delays. Attach all required documents such as bills, prescriptions, and doctor's notes to support your claim. Review the form thoroughly before submission to catch any errors or omissions that could lead to rejection.