Insurance reinstatement application form templates simplify the process of restoring a lapsed policy by providing a standardized format for submitting necessary information. These templates ensure accuracy and completeness, helping applicants meet insurer requirements efficiently. Using a well-structured form can expedite approval and minimize delays in coverage restoration.

Insurance Reinstatement Application Form Template Sample PDF Viewer

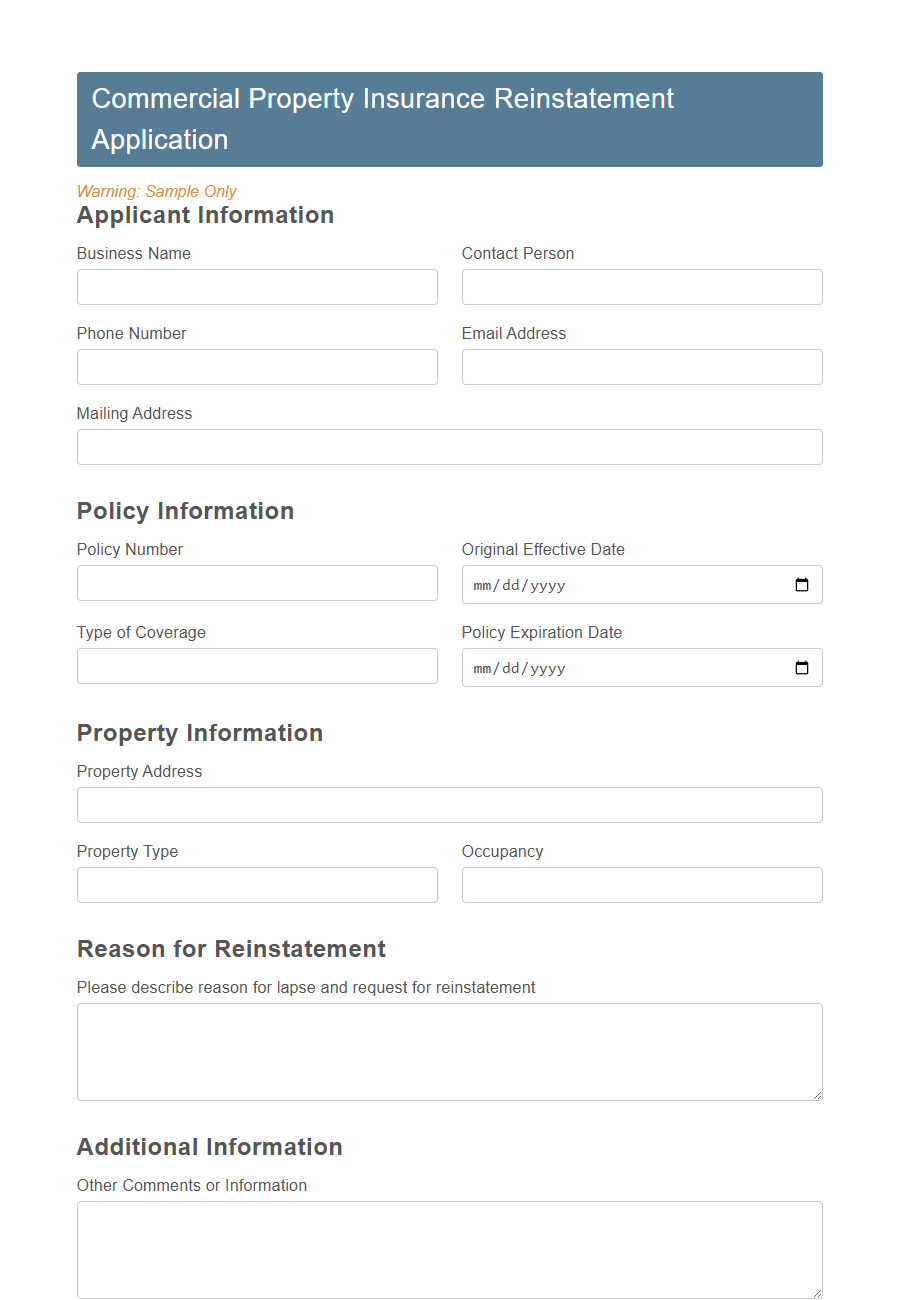

Image example of Insurance Reinstatement Application Form Template:

Insurance Reinstatement Application Form Template Samples

Commercial Property Insurance Reinstatement Application - PDF - HTML

Health Insurance Policy Reinstatement Request - PDF - HTML

Life Insurance Lapsed Policy Reinstatement - PDF - HTML

Auto Insurance Policy Reinstatement Application Template - PDF - HTML

Disability Insurance Reinstatement Application - PDF - HTML

Homeowners Insurance Reinstatement Request Template - PDF - HTML

Term Life Insurance Reinstatement Application - PDF - HTML

Group Insurance Reinstatement Application Template - PDF - HTML

Travel Insurance Lapse Reinstatement Request - PDF - HTML

Business Interruption Insurance Reinstatement - PDF - HTML

Pet Insurance Policy Reinstatement Application Template - PDF - HTML

Dental Insurance Reinstatement Request - PDF - HTML

Renters Insurance Reinstatement Application Template - PDF - HTML

Critical Illness Insurance Reinstatement - PDF - HTML

Mortgage Protection Insurance Reinstatement Application Template - PDF - HTML

Overview of Insurance Reinstatement

What is the purpose of an Insurance Reinstatement Application Form? This form is used to reactivate a lapsed insurance policy by providing necessary information and documentation. It helps the insurer assess the policyholder's eligibility to restore coverage under the original terms.

Importance of a Reinstatement Application Form

The Insurance Reinstatement Application Form is crucial for restoring coverage after a policy lapse. It ensures a smooth and official process to reactivate insurance protection without starting a new policy.

- Legal Documentation - The form provides a formal record required by insurers to verify the applicant's intent to reinstate the policy.

- Risk Assessment - Insurers use the form to reassess risk and determine eligibility for reinstatement based on current conditions.

- Policy Continuity - Filing the form helps maintain benefit continuity, preventing gaps in coverage that could expose the insured to risk.

Key Sections in the Reinstatement Form

The Insurance Reinstatement Application Form includes key sections such as personal information, policy details, and reasons for policy lapse. It requires the applicant to provide accurate data to facilitate the evaluation of eligibility for reinstatement. Medical history and payment information sections are also essential for verifying the applicant's current status and processing the reinstatement request.

Personal and Policyholder Information

The Insurance Reinstatement Application Form Template is designed to capture essential Personal and Policyholder Information accurately. This section ensures that all details such as name, contact information, and policy number are clearly documented for seamless processing.

Accurate Personal and Policyholder Information is crucial for verifying identity and reinstating the insurance policy without delays.

Details of Lapsed Insurance Policy

The Insurance Reinstatement Application Form Template includes a specific section for the Details of Lapsed Insurance Policy.

This section requires accurate information such as the policy number, original issue date, and reason for lapse. Providing these details ensures a smoother reinstatement process and helps the insurer verify the previous coverage.

Reasons for Policy Lapse

The Insurance Reinstatement Application Form Template helps policyholders restore coverage after a lapse. Reasons for policy lapse often include missed premium payments, changes in personal financial situations, or lack of awareness about payment deadlines. Understanding these causes is essential for completing the reinstatement process accurately and promptly.

Required Supporting Documentation

The Insurance Reinstatement Application Form Template requires specific supporting documentation to verify the applicant's eligibility and policy history. Proper submission of these documents ensures a smooth and timely reinstatement process.

- Proof of Identity - A government-issued ID such as a passport or driver's license must be included to confirm the applicant's identity.

- Previous Insurance Policy Details - Copies of the original policy documents or proof of prior coverage are needed to validate the reinstatement request.

- Payment Evidence - Receipts or bank statements must be provided to show payment of any outstanding premiums or fees.

Step-by-Step Application Process

The Insurance Reinstatement Application Form Template simplifies the process of restoring a lapsed insurance policy. It guides policyholders through a clear and organized step-by-step application process to ensure quick approval.

- Prepare Required Documents - Gather all necessary identification and policy information before starting the application.

- Complete the Application Form - Fill out the form accurately with personal details, policy number, and reason for reinstatement.

- Submit and Await Confirmation - Send the completed form to the insurer and wait for their review and approval notification.

Following these steps helps streamline the reinstatement process and restores coverage efficiently.

Common Mistakes to Avoid

Completing an Insurance Reinstatement Application Form requires careful attention to detail.

Common mistakes include providing inaccurate personal information or missing critical details such as policy numbers. These errors can delay the reinstatement process or result in application rejection.