Business insurance coverage application form templates streamline the process of securing protection tailored to various business needs. These templates include sections for risk assessment, coverage options, and client information, ensuring comprehensive and accurate submissions. Utilizing a well-structured template enhances clarity and efficiency for both applicants and insurance providers.

Business Insurance Coverage Application Form Template Sample PDF Viewer

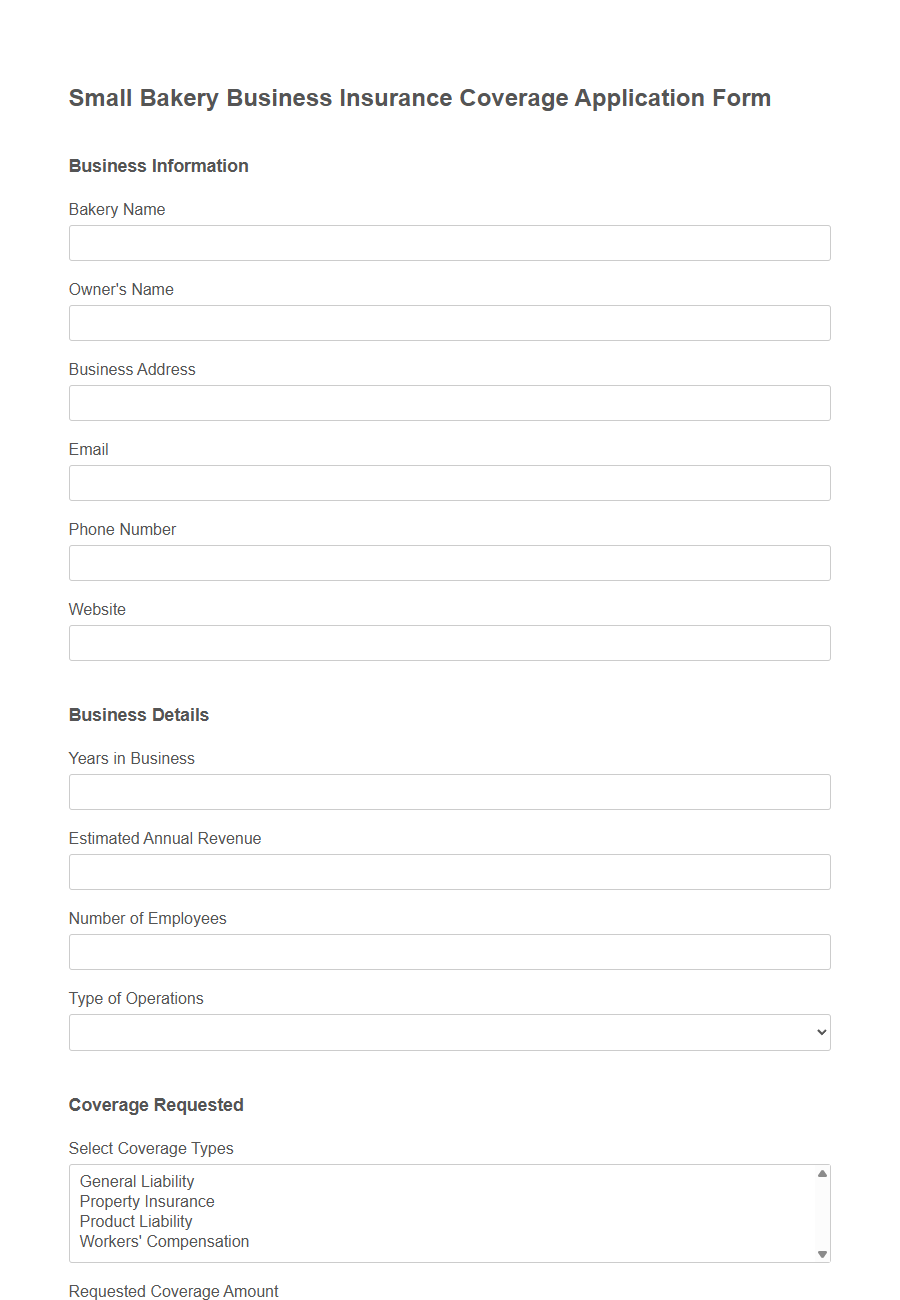

Image example of Business Insurance Coverage Application Form Template:

Business Insurance Coverage Application Form Template Samples

Small Bakery Business Insurance Coverage Application - PDF - HTML

Independent Fitness Trainer Liability Insurance Application - PDF - HTML

Freelance Graphic Designer Professional Liability Insurance - PDF - HTML

Mobile Pet Groomer Business Insurance Application Template - PDF - HTML

E-commerce Store Cyber Liability Insurance Application Template - PDF - HTML

Home-Based Daycare Business Insurance Application - PDF - HTML

Event Photographer Equipment Insurance Application Template - PDF - HTML

Food Truck General Liability Insurance Application - PDF - HTML

Solo Yoga Instructor Insurance Coverage Application Template - PDF - HTML

Residential Cleaning Services Business Insurance Application - PDF - HTML

Craft Fair Vendor Liability Insurance Application - PDF - HTML

Lawn Care and Landscaping Business Insurance Application Template - PDF - HTML

Mobile App Developer Errors & Omissions Insurance Application Template - PDF - HTML

Notary Public Professional Liability Insurance Application - PDF - HTML

Specialty Coffee Cart Business Insurance Application - PDF - HTML

Introduction to Business Insurance Coverage Application Forms

Business insurance coverage application forms are essential documents used to request protection against various risks that companies may face.

These forms gather critical information about the business, its operations, and the types of coverage needed. Completing the form accurately ensures that the insurer can assess risk properly and provide appropriate policy options.

Importance of a Well-Structured Application Template

A well-structured Business Insurance Coverage Application Form Template ensures accurate data collection and reduces the risk of errors during the underwriting process. Clear and organized templates facilitate quicker processing, saving time for both the insurer and the applicant.

Efficient application forms help businesses secure the appropriate coverage by capturing all essential information upfront.

Key Sections in a Business Insurance Application Form

What are the key sections in a business insurance coverage application form? The application form typically includes sections such as Business Details, Coverage Requirements, and Risk Assessment. These sections help insurers evaluate the specific needs and risks associated with the business.

Why is the Business Details section important in a business insurance application? This section collects essential information about the business, including its name, address, industry, and contact information. Accurate details ensure the insurer can tailor coverage to the business's unique profile.

What information is typically requested in the Coverage Requirements section? Applicants specify the types of insurance coverage they need, such as property, liability, or workers' compensation. Clarifying coverage needs helps in creating a policy that effectively protects the business.

How does the Risk Assessment section contribute to the application process? This section gathers information about potential hazards, past claims, and safety measures in place. Understanding risk factors allows insurers to determine appropriate premiums and coverage limits.

Why must owners provide Details of Employees in the application form? Information about the number of employees and their roles assists insurers in assessing liability and workers' compensation needs. This data influences the scope and cost of the insurance policy.

What role does the Financial Information section play in the insurance application? Financial details like revenue and profitability provide insight into the business's stability and risk exposure. Insurers use this information to ensure the coverage aligns with the business's financial situation.

How does the Signatures and Declarations section affect the application? This section confirms that the information provided is accurate and that the applicant agrees to the terms of coverage. It serves as a legal acknowledgment necessary for processing the insurance policy.

Essential Business Information Fields

The Business Insurance Coverage Application Form Template is designed to collect vital information for accurate risk assessment and policy issuance. Essential business information fields ensure that insurers have a clear understanding of the company's operations and needs.

- Business Name - Identifies the legal entity applying for coverage to avoid any confusion during the underwriting process.

- Business Address - Provides the physical location of the business, which impacts risk evaluation based on geographic factors.

- Type of Business - Describes the industry or sector to assess specific risks related to business activities accurately.

Required Coverage Details and Options

A Business Insurance Coverage Application Form Template collects essential information to tailor policies to specific business needs.

It includes fields for required coverage details such as general liability, property insurance, and workers' compensation. Applicants can select coverage options that best protect their business against potential risks and liabilities.

Employee and Payroll Data Collection

Collecting accurate employee and payroll data is essential for a comprehensive business insurance coverage application form template. This ensures proper risk assessment and premium calculation tailored to the business's workforce.

- Employee Details - Collect full names, job titles, and employment status to identify coverage eligibility.

- Payroll Information - Record total payroll amounts and pay periods for accurate premium determination.

- Compliance Verification - Verify that all employee data complies with legal employment standards to avoid coverage issues.

Risk Assessment and Disclosure Questions

Business Insurance Coverage Application Form templates include detailed Risk Assessment and Disclosure Questions to identify potential vulnerabilities. These questions help insurers evaluate the likelihood of claims and set appropriate coverage limits. Accurate responses ensure businesses receive tailored protection suited to their specific risks.

Document Uploads and Supporting Evidence

Business Insurance Coverage Application Forms require thorough Document Uploads and Supporting Evidence to ensure accurate risk assessment and policy underwriting.

- Document Uploads - Applicants must provide essential files such as financial records, licenses, and existing insurance policies to validate business operations.

- Supporting Evidence - Evidence like safety protocols, employee training certificates, and property appraisals helps demonstrate risk management practices.

- Compliance Verification - Uploaded documents are reviewed to confirm adherence to industry regulations and eligibility criteria for coverage.

Properly submitted documents and supporting evidence streamline the approval process and facilitate tailored insurance solutions.

Applicant Declarations and Signature

The Business Insurance Coverage Application Form includes a crucial section for Applicant Declarations, where the applicant confirms the accuracy and completeness of the information provided. This section ensures that the insurer receives truthful and reliable data to assess coverage eligibility and risks effectively. The form also requires the applicant's signature, which legally binds them to the terms and conditions outlined, affirming their commitment to the application details.