Insurance subrogation form templates streamline the process of recovering costs from third parties responsible for a loss. These templates ensure accurate documentation and facilitate efficient communication between insurers and claimants. Clear and well-structured forms help expedite settlements and reduce administrative delays.

Insurance Subrogation Form Template Sample PDF Viewer

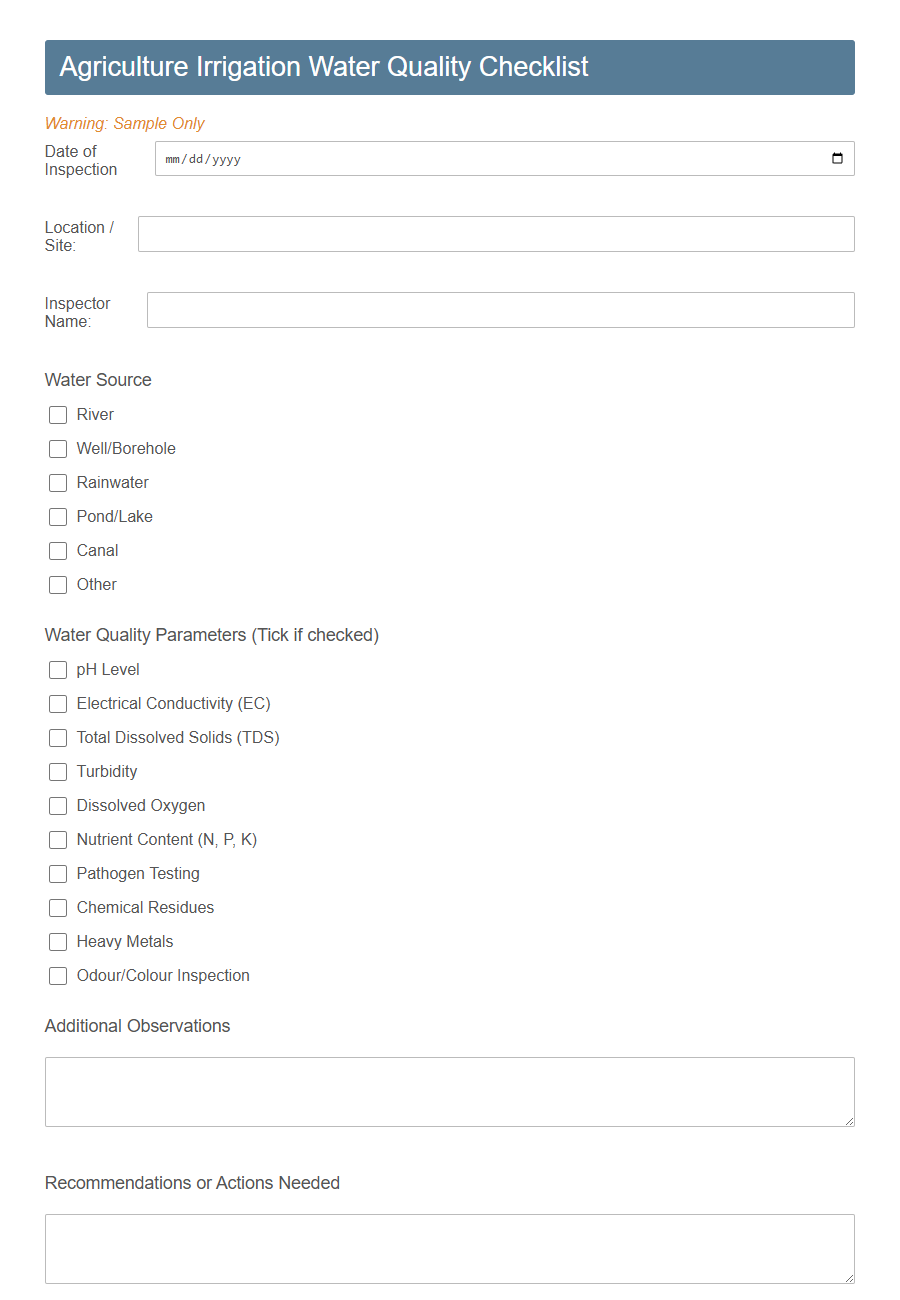

Image example of Insurance Subrogation Form Template:

Insurance Subrogation Form Template Samples

Automobile Accident Subrogation Claim - PDF - HTML

Property Damage Subrogation Request Template - PDF - HTML

Health Insurance Subrogation Notice Letter Template - PDF - HTML

Workers’ Compensation Subrogation Agreement Template - PDF - HTML

Fire Loss Subrogation Claim - PDF - HTML

Water Damage Subrogation Reporting Template - PDF - HTML

Liability Insurance Subrogation Demand Letter Template - PDF - HTML

Product Liability Subrogation - PDF - HTML

Commercial Property Subrogation Claim Template - PDF - HTML

Medical Payments Subrogation Recovery - PDF - HTML

Subrogation Authorization and Assignment Template - PDF - HTML

Flood Insurance Subrogation Notification Template - PDF - HTML

Theft Claim Subrogation - PDF - HTML

Construction Defect Subrogation Reporting Template - PDF - HTML

Understanding Insurance Subrogation

What is insurance subrogation? Insurance subrogation is the process where an insurance company seeks reimbursement from a third party responsible for a loss after paying a claim to the insured. It helps insurers recover costs and keeps premiums lower for policyholders.

Why is an insurance subrogation form important? This form documents the insurer's right to pursue the third party for payment and outlines the details of the claim. It ensures clear communication and legal protection for both the insurer and the insured during the recovery process.

Importance of Subrogation in Insurance Claims

Insurance subrogation is a critical process that helps insurers recover costs from third parties responsible for a loss. Using an Insurance Subrogation Form Template streamlines this process by clearly documenting the claim details and parties involved.

- Cost Recovery - Subrogation allows insurance companies to reclaim expenses, reducing financial losses after paying a claim.

- Legal Clarity - A standardized form ensures all necessary information is properly captured, supporting legal and administrative procedures.

- Claim Efficiency - Using a template accelerates the subrogation process, facilitating faster resolution and better resource management.

What Is an Insurance Subrogation Form?

An insurance subrogation form is a document used by an insurance company to recover costs from a third party responsible for a loss. This form allows the insurer to pursue reimbursement after paying the policyholder's claim.

The form outlines the insurer's right to subrogate and provides necessary details to support the recovery process.

Key Components of a Subrogation Form Template

An Insurance Subrogation Form Template is essential for documenting the transfer of claim rights after an insurer pays a loss. It outlines the responsibilities and rights involved in recovering costs from a third party.

- Claim Information - Captures details about the original insurance claim, including claim number and date of loss.

- Parties Involved - Identifies the insured, insurer, and third party responsible for the loss or damage.

- Assignment of Rights - Documents the insurer's legal right to pursue recovery from the responsible third party on behalf of the insured.

How to Use an Insurance Subrogation Form Template

An Insurance Subrogation Form Template helps streamline the process of recovering costs from a third party responsible for a loss. Using this template ensures all necessary information is clearly documented for effective claim handling.

- Gather Incident Details - Collect all relevant information about the accident or loss to accurately complete the form.

- Fill Out Policyholder Information - Enter the insured party's details to link the claim to the correct policyholder.

- Submit to Insurance Provider - Send the completed form to your insurance company to initiate the subrogation claim process.

Following these steps helps maximize the efficiency and success of subrogation efforts using the template.

Benefits of Using Standardized Subrogation Forms

Using a standardized insurance subrogation form template streamlines the claims recovery process efficiently.

Standardized forms ensure consistency and accuracy, reducing errors and delays in subrogation claims. They simplify communication between insurers and third parties, accelerating the resolution of claims and improving overall workflow.

Common Mistakes to Avoid in Subrogation Forms

Insurance subrogation form templates must be filled out accurately to ensure proper claim processing and recovery. Common mistakes to avoid include incomplete information, incorrect policy details, and missing signatures, which can delay or invalidate the subrogation process. Carefully reviewing the form and verifying all data before submission helps prevent costly errors and expedites reimbursement.

Legal Considerations for Insurance Subrogation

Insurance subrogation forms must clearly outline the legal rights and obligations of both the insurer and the insured to ensure compliance with state and federal laws. Proper documentation within the form helps establish a claimant's right to recover losses from third parties responsible for damages. Including detailed clauses about consent, assignment of rights, and dispute resolution minimizes the risk of legal challenges during the subrogation process.

Customizing Subrogation Form Templates for Your Needs

A well-designed Insurance Subrogation Form Template streamlines the recovery process after a claim payout.

Customizing subrogation form templates ensures that all necessary details specific to your case are accurately captured. Tailoring sections like claimant information, claim details, and payment recovery terms enhances clarity and efficiency.