A Vehicle Insurance Change of Details Form Template streamlines the process of updating personal or vehicle information with your insurer. This essential document ensures accuracy in your insurance records, reducing the risk of claim disputes. Using standardized templates allows policyholders to make changes efficiently and maintain continuous coverage.

Vehicle Insurance Change of Details Form Template Sample PDF Viewer

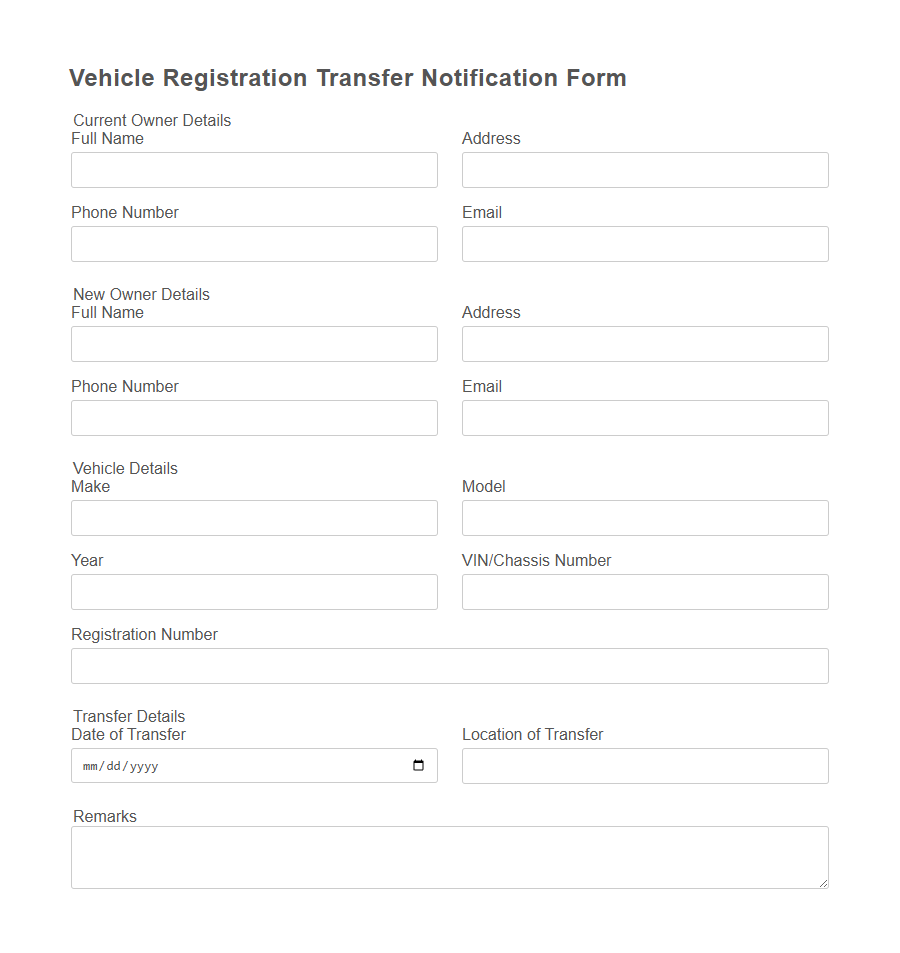

Image example of Vehicle Insurance Change of Details Form Template:

Vehicle Insurance Change of Details Form Template Samples

Vehicle Registration Transfer Notification - PDF - HTML

Vehicle Insurance Cancellation Request - PDF - HTML

Vehicle Owner Address Update - PDF - HTML

Vehicle Insurance Nominee Change - PDF - HTML

Vehicle Usage Modification Declaration - PDF - HTML

Insured Vehicle Modification Approval Request Template - PDF - HTML

Vehicle Policy Endorsement Request - PDF - HTML

Motor Insurance Personal Information Correction - PDF - HTML

Vehicle Insurance Policy Transfer - PDF - HTML

Change of Vehicle Use Category - PDF - HTML

Vehicle Insurance Beneficiary Addition - PDF - HTML

Insured Vehicle Engine/Chassis Number Update - PDF - HTML

Vehicle Insurance Mobile/Email Update - PDF - HTML

Introduction to Vehicle Insurance Change of Details

Vehicle Insurance Change of Details Form Template is designed to help policyholders update their insurance information quickly and accurately. It ensures that any changes, such as address, vehicle use, or driver details, are properly recorded with the insurer. Keeping insurance details up to date is essential for maintaining valid coverage and avoiding claim issues.

Importance of Updating Insurance Information

Updating your vehicle insurance details promptly ensures continuous and accurate coverage.

Accurate insurance information reflects your current circumstances, reducing the risk of claim denial. Failing to update details can lead to gaps in coverage and potential legal issues.

Common Reasons for Changing Policy Details

Updating your vehicle insurance details is essential to ensure your policy remains accurate and valid. Using a Vehicle Insurance Change of Details Form Template simplifies this process.

- Change of Address - Updating your residential address is crucial for correspondence and accurate risk assessment.

- New Vehicle Information - Adding a new vehicle or updating details like registration ensures your coverage matches your current assets.

- Modification to Drivers - Updating the list of authorized drivers reflects who is permitted to operate the insured vehicle.

Submitting these changes promptly helps avoid disputes and ensures continuous protection under your insurance policy.

Key Sections in a Change of Details Form

The Vehicle Insurance Change of Details Form Template is designed to update policy information efficiently.

Key sections in this form include personal details, vehicle information, and the specifics of the changes requested. Accurate completion of these sections ensures the insurance provider can process updates without delay.

Required Documents for Submission

Submitting a Vehicle Insurance Change of Details Form requires specific documents to ensure the update is processed correctly. Proper documentation helps verify the changes and maintain accurate insurance records.

- Completed Change of Details Form - This form must be filled out accurately to specify the details being updated on the insurance policy.

- Proof of Identity - Submit a valid government-issued ID to verify the policyholder's identity during the change request.

- Current Insurance Policy Document - Provide the existing insurance certificate or policy document to confirm the active coverage linked to the details being changed.

Step-by-Step Guide to Completing the Form

Completing a Vehicle Insurance Change of Details Form is essential when updating personal or vehicle information with your insurance provider. This step-by-step guide ensures your changes are accurately recorded to maintain continuous coverage.

Begin by filling out your policy number and personal details to verify your identity and policy.

Next, specify the changes required, such as address updates, vehicle modifications, or changes in the driver's information. Provide accurate and complete details to avoid processing delays.

Review the information you have entered for correctness and completeness.

Sign and date the form to confirm authorization of the changes, then submit it according to your insurer's instructions, either online, by mail, or in person.

Digital vs. Paper Form: Pros and Cons

What are the advantages and disadvantages of using a digital Vehicle Insurance Change of Details form compared to a paper form? Digital forms offer faster processing and easy accessibility, allowing users to submit changes from anywhere at any time. However, they may require internet access and can pose security risks if not properly encrypted.

How do paper forms compare to digital forms for updating vehicle insurance details? Paper forms provide a tangible record and may feel more secure to some users, but they are slower to process and require physical handling and mailing. This can lead to delays and increased chances of errors or lost documents.

Common Mistakes to Avoid When Updating Details

When updating your vehicle insurance details, ensure all information is accurate to avoid claim rejections. Avoid submitting incomplete forms, as missing details can delay the processing of your update. Double-check that you notify your insurer promptly to maintain continuous coverage without lapses.

Processing Time and What to Expect

Filling out a Vehicle Insurance Change of Details Form template helps ensure your insurance records remain accurate and up to date. Processing times can vary depending on the insurer but generally take a few business days to complete.

- Submission Review - The insurance company reviews the submitted form to verify the changes requested.

- Verification Process - Additional information or documentation may be requested to confirm the accuracy of the updated details.

- Confirmation and Update - Once approved, the insurer updates your policy and sends you a confirmation of the changes.