A personal financial statement form provides a clear snapshot of an individual's financial health by detailing assets, liabilities, income, and expenses. It serves as a crucial tool for applying for loans, budgeting effectively, and managing personal finances with greater accuracy. Understanding the key components of this form can help individuals make informed financial decisions and track their economic progress.

Personal Financial Statement Form Sample PDF Viewer

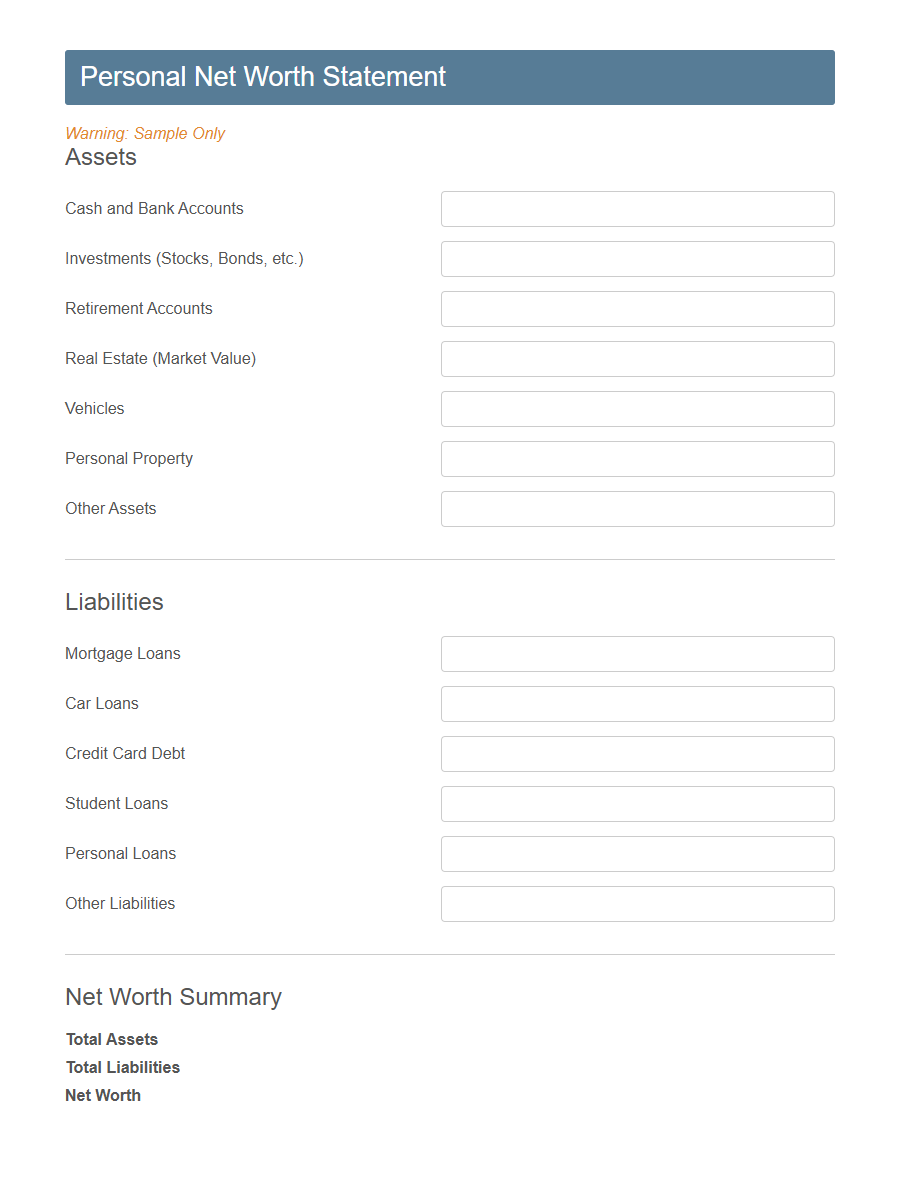

Image example of Personal Financial Statement Form:

Personal Financial Statement Form Samples

Personal Net Worth Statement Template - PDF - HTML

Monthly Budget Planner Template - PDF - HTML

Individual Income & Expense Report Template - PDF - HTML

Debt Reduction Worksheet Template - PDF - HTML

Assets & Liabilities Tracker Template - PDF - HTML

Personal Loan Application Financial Statement Template - PDF - HTML

Yearly Financial Summary Statement Template - PDF - HTML

Student Financial Statement Template - PDF - HTML

Freelancer Income Statement Template - PDF - HTML

Rental Property Owner Financial Statement Template - PDF - HTML

Retirement Savings Statement Template - PDF - HTML

Personal Balance Sheet Template - PDF - HTML

Divorce Financial Affidavit Template - PDF - HTML

Introduction to Personal Financial Statement Forms

What is a Personal Financial Statement Form? A Personal Financial Statement Form is a document that provides a detailed snapshot of an individual's financial condition. It lists assets, liabilities, income, and expenses to help assess financial health and creditworthiness.

Importance of Maintaining a Personal Financial Statement

A Personal Financial Statement is a crucial document that provides a clear snapshot of an individual's financial health.

Maintaining a Personal Financial Statement helps track assets, liabilities, income, and expenses accurately. It supports better financial decision-making and planning for future goals.

Key Components of a Personal Financial Statement

A Personal Financial Statement is a document that outlines an individual's financial position at a specific point in time.

The key components include assets, liabilities, income, and expenses. These elements help assess overall financial health and support loan or credit applications.

Types of Personal Financial Statement Forms

Personal Financial Statement Forms come in various types, each designed to capture a specific financial snapshot. Common forms include individual, joint, and business-owner versions, tailored to different financial assessment needs.

Individual forms detail personal assets, liabilities, income, and expenses.

Step-by-Step Guide to Filling Out the Form

Filling out a Personal Financial Statement Form requires careful attention to detail to accurately represent your financial status. This step-by-step guide will help you complete the form efficiently and correctly.

- Gather Financial Documents - Collect all necessary documents such as bank statements, investment accounts, loan balances, and income records before starting.

- Complete Personal Information - Enter your full name, address, contact details, and any other requested personal data precisely as it appears on your official records.

- List Assets and Liabilities - Detail all assets including cash, property, and investments, followed by listing liabilities like debts, loans, and credit balances accurately.

- Calculate Net Worth - Subtract total liabilities from total assets to determine your net worth, ensuring all entries are double-checked for accuracy.

- Review and Sign - Carefully review the filled form for completeness, then sign and date it to verify the information is truthful and complete.

Following these steps ensures your Personal Financial Statement Form is thorough and reliable for financial assessments or loan applications.

Common Mistakes to Avoid on Your Financial Statement

A Personal Financial Statement is a key document that outlines your assets, liabilities, income, and expenses to assess your financial health accurately. Understanding common mistakes can help you present a clear and precise financial picture.

- Inaccurate Asset Valuation - Overestimating or underestimating the value of assets can lead to misleading financial information and affect credit decisions.

- Omitting Liabilities - Failing to list all debts and obligations results in an incomplete statement that does not reflect your true financial status.

- Neglecting to Update Regularly - Using outdated information can cause errors in assessing your current financial position and hinder effective financial planning.

Benefits of Regularly Updating Your Financial Statement

Regularly updating your personal financial statement ensures accurate tracking of your assets and liabilities. This practice enhances financial decision-making and helps maintain a clear picture of your financial health.

- Improved Financial Accuracy - Consistently revised statements provide up-to-date information on your financial status, minimizing errors and outdated data.

- Enhanced Planning Ability - Frequent updates allow for better budgeting and goal setting based on current financial realities.

- Stronger Creditworthiness - Maintaining current records supports loan applications and credit assessments by reflecting your true financial capacity.

How Lenders Use Personal Financial Statements

Lenders use personal financial statements to evaluate an individual's overall financial health and ability to repay loans. These statements provide a detailed snapshot of assets, liabilities, income, and expenses, helping lenders assess risk. Accurate information on the form supports informed lending decisions and determines loan eligibility and terms.

Tools and Templates for Personal Financial Statement Forms

Personal Financial Statement Forms help individuals organize their assets, liabilities, income, and expenses in one clear document. Tools and templates for these forms provide structured layouts that simplify data entry and ensure all critical financial information is captured accurately. Using these resources can improve financial planning, loan applications, and overall money management by presenting a comprehensive snapshot of personal finances.