A payment authorization form streamlines the process of granting permission to debit funds from a customer's account securely. Examples of these forms typically include details such as payment amount, frequency, and authorization signature to ensure clear consent. Using standardized templates helps businesses maintain compliance and protect against unauthorized transactions.

Payment Authorization Form Sample PDF Viewer

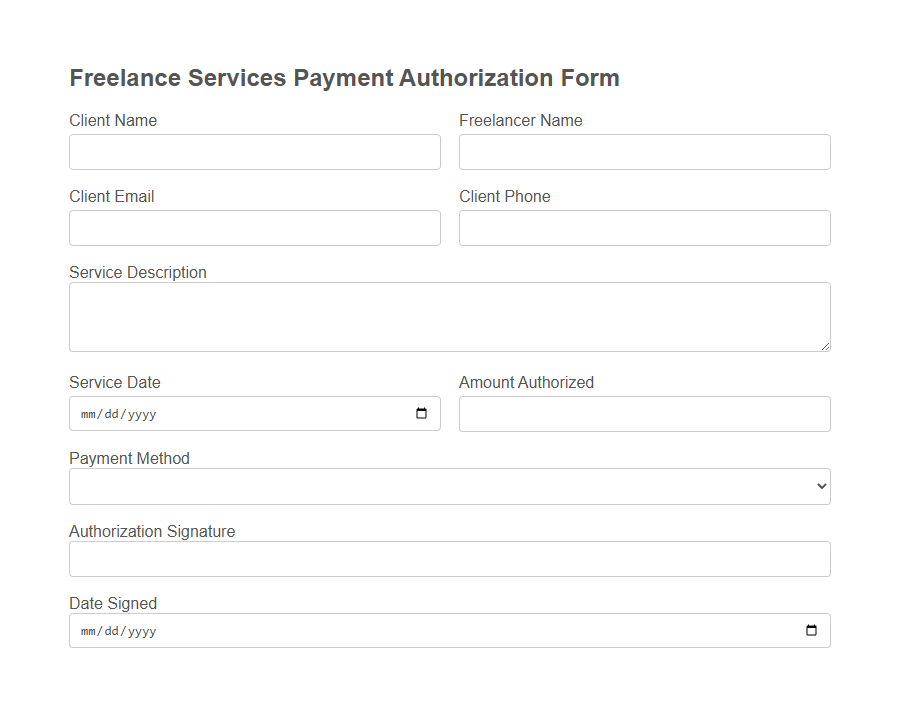

Image example of Payment Authorization Form:

Payment Authorization Form Samples

Freelance Services Payment Authorization Form - PDF - HTML

Recurring Subscription Payment Authorization Template - PDF - HTML

Medical Billing Payment Authorization Form - PDF - HTML

Event Registration Payment Authorization Form - PDF - HTML

Rental Property Payment Authorization Template - PDF - HTML

Membership Dues Payment Authorization Form - PDF - HTML

Tuition Fee Payment Authorization Template - PDF - HTML

Utility Bill Payment Authorization Form - PDF - HTML

Gym Membership Payment Authorization Template - PDF - HTML

Charitable Donation Payment Authorization Form - PDF - HTML

E-commerce One-time Purchase Payment Authorization - PDF - HTML

Homeowners Association (HOA) Payment Authorization Form - PDF - HTML

Vendor Services Payment Authorization Template - PDF - HTML

What is a Payment Authorization Form?

A Payment Authorization Form is a document that allows a business to collect payments directly from a customer's bank account or credit card.

This form grants permission to charge the specified amount for goods or services, ensuring secure and authorized transactions. It helps protect both parties by clearly outlining payment details and consent.

Importance of Payment Authorization Forms

Payment authorization forms play a crucial role in ensuring secure and verified transactions between parties. They help prevent fraud and provide a clear record of consent for payments.

- Enhances security - These forms verify the identity of the payer and safeguard against unauthorized transactions.

- Provides legal protection - They serve as documented evidence of consent, protecting both the payer and payee in disputes.

- Streamlines processing - Payment authorization forms facilitate quicker approval and smoother transaction management for businesses.

Key Elements in a Payment Authorization Form

What are the key elements in a Payment Authorization Form? A Payment Authorization Form must include the payer's full name and contact information to verify identity. It also requires detailed payment information, such as the payment amount, method, and date of authorization.

Why is a signature important on a Payment Authorization Form? The signature provides legal consent and confirms the payer's approval of the transaction. Without a valid signature, the authorization may be considered invalid or fraudulent.

How does including transaction details benefit a Payment Authorization Form? Specifying transaction details, such as invoice numbers or service descriptions, ensures clarity on what the payment covers. This reduces errors and disputes between the payer and payee.

What role does the payment method play in a Payment Authorization Form? Clearly stating the payment method--credit card, debit card, or bank transfer--helps process the transaction correctly. It also facilitates compliance with financial regulations and security standards.

Why is contact information necessary in a Payment Authorization Form? Contact details allow the merchant or service provider to reach the payer for verification or in case of issues. This element enhances communication and supports transaction transparency.

Types of Payment Authorization Forms

Payment Authorization Forms are used to grant permission for financial transactions, ensuring accuracy and security in processing payments. These forms help businesses and individuals manage payments through various methods while maintaining proper consent and documentation.

Common types of Payment Authorization Forms include credit card authorization, electronic funds transfer (EFT) authorization, and recurring payment authorization. Each type serves a specific payment method, allowing for streamlined and authorized financial operations.

How Payment Authorization Forms Work

Payment Authorization Forms allow businesses to obtain consent from customers to charge their bank account or credit card for a specified amount. The form captures essential payment details and authorizes recurring or one-time payments securely. This process ensures transparency, reduces payment disputes, and streamlines transaction processing.

Benefits of Using Payment Authorization Forms

Payment Authorization Forms streamline the transaction process by providing clear consent from customers, reducing the risk of unauthorized charges. They enhance security and compliance with financial regulations, protecting both businesses and clients. This form also simplifies record-keeping and dispute resolution, ensuring transparent and efficient payment management.

Common Mistakes to Avoid

Payment Authorization Forms are essential for securing consent before processing transactions. Avoiding common errors ensures smooth payment processing and prevents delays.

- Incomplete Information - Missing details like card number or expiration date can cause payment rejections.

- Unsigned Forms - Without a proper signature, the authorization is invalid and cannot be processed.

- Incorrect Amounts - Specifying wrong payment amounts leads to transaction disputes and customer dissatisfaction.

Legal Considerations and Compliance

Payment Authorization Forms must adhere to strict legal guidelines to ensure secure and lawful processing of transactions.

- Consumer Consent - The form must clearly obtain explicit permission from the customer to authorize charges, protecting against unauthorized payments.

- Data Privacy Compliance - It should comply with data protection laws such as GDPR or CCPA to safeguard personal and financial information.

- Record Retention - Businesses are required to retain authorization forms for a specified period to support audits and dispute resolutions.

Proper legal adherence in Payment Authorization Forms minimizes risk and builds customer trust.

Tips for Creating Secure Payment Authorization Forms

Creating a secure payment authorization form is essential to protect sensitive financial information and prevent fraud.

Use strong encryption methods to safeguard data during transmission and storage. Clearly explain the purpose of the form and how the information will be used to build trust with users.