Cost allocation forms are essential tools used by businesses to distribute expenses accurately across different departments, projects, or cost centers. These forms help ensure transparency in budgeting and facilitate precise financial reporting by clearly specifying how costs are assigned. Effective cost allocation supports better decision-making and enhances overall financial management within an organization.

Cost Allocation Form Sample PDF Viewer

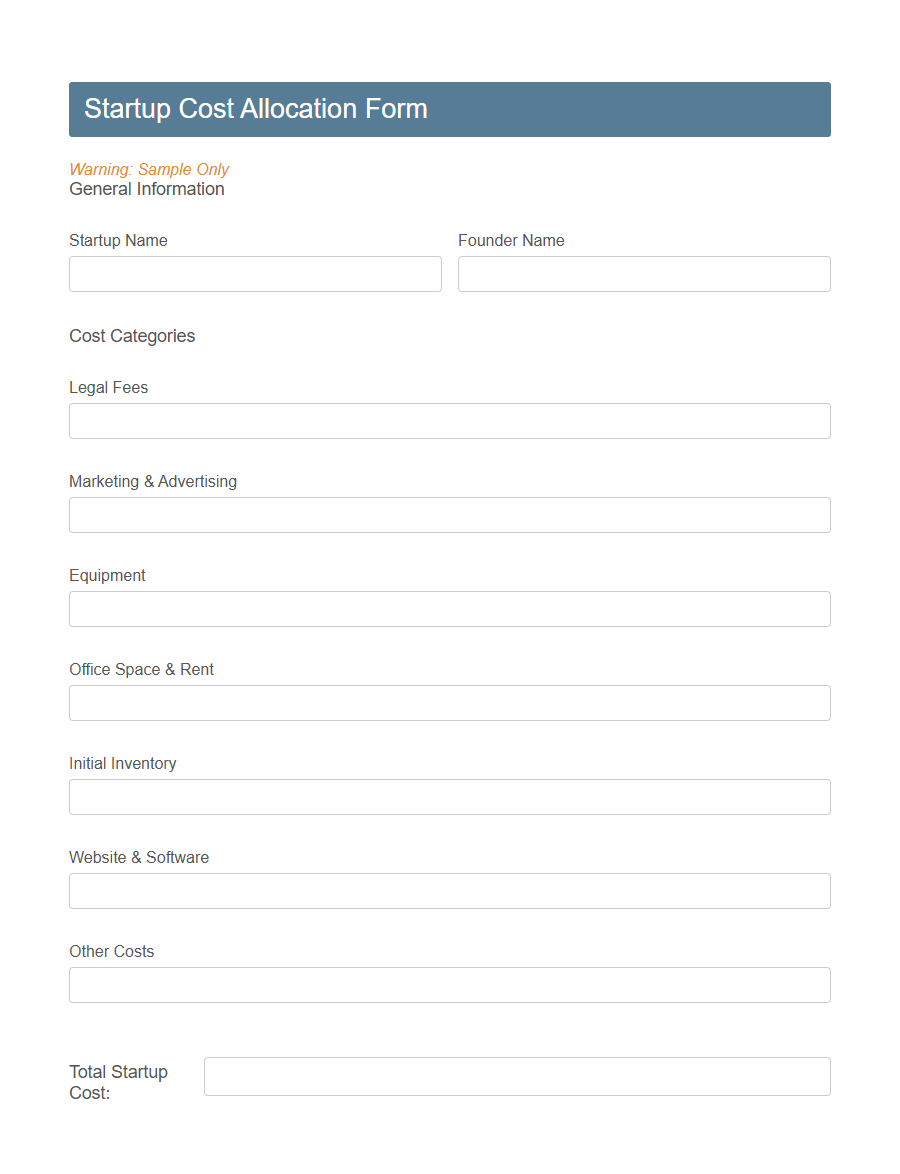

Image example of Cost Allocation Form:

Cost Allocation Form Samples

Startup Cost Allocation - PDF - HTML

Project-Based Cost Allocation Form - PDF - HTML

Nonprofit Grant Cost Allocation Form - PDF - HTML

IT Department Cost Allocation Template - PDF - HTML

Healthcare Cost Allocation Worksheet - PDF - HTML

Marketing Campaign Cost Allocation Form - PDF - HTML

Research & Development Cost Allocation Template - PDF - HTML

Event Expense Allocation Form - PDF - HTML

Office Rent Cost Allocation Sheet - PDF - HTML

Shared Services Cost Allocation Template - PDF - HTML

Public Sector Cost Allocation Form - PDF - HTML

Construction Project Cost Allocation Worksheet - PDF - HTML

SaaS Subscription Cost Allocation Form - PDF - HTML

Introduction to Cost Allocation Forms

Cost Allocation Forms are essential tools used by organizations to systematically distribute expenses across various departments or projects. These forms help ensure transparency and accuracy in financial reporting by clearly documenting how costs are assigned. Understanding and properly utilizing Cost Allocation Forms is crucial for effective budgeting and resource management.

Key Components of a Cost Allocation Form

A Cost Allocation Form details the distribution of expenses across various departments or projects within an organization. Key components include cost centers, allocation bases, and the total amount to be allocated. These elements ensure accurate financial tracking and resource management.

Purpose and Importance of Cost Allocation

Cost Allocation Forms serve to systematically assign expenses to specific departments or projects, ensuring accurate financial reporting. This process aids organizations in tracking resource usage and managing budgets effectively.

Understanding cost allocation is crucial for making informed decisions and optimizing operational efficiency.

Types of Costs Allocated

Cost allocation forms categorize expenses to accurately distribute costs across departments or projects.

These forms typically allocate direct costs, which are easily traceable to a specific cost object, and indirect costs, which support multiple functions and require a systematic allocation method. Understanding the types of costs allocated helps organizations manage budgets and improve financial accountability.

Step-by-Step Process for Completing the Form

Completing a Cost Allocation Form requires careful attention to detail and accurate data entry to ensure proper distribution of expenses. Following a systematic approach helps maintain transparency and accountability in financial reporting.

- Identify Cost Centers - List all departments or projects that will share the costs.

- Gather Expense Data - Collect all relevant invoices, receipts, and financial records.

- Allocate Costs - Distribute the total expenses to each cost center based on a predefined method such as usage or headcount.

Common Challenges in Cost Allocation

Cost allocation forms are essential tools for distributing expenses accurately across departments or projects. They help organizations ensure financial accountability and transparency.

- Complexity in Identifying Cost Drivers - Determining the appropriate basis for allocating costs can be difficult and may lead to inaccurate distributions.

- Data Collection Challenges - Gathering accurate and timely data for cost allocation requires significant effort and coordination across teams.

- Resistance from Departments - Departments may dispute allocated costs, leading to conflicts and delays in the approval process.

Overcoming these challenges is critical for effective cost management and financial reporting.

Best Practices for Accurate Cost Allocation

Accurate cost allocation is essential for effective financial management and decision-making within any organization.

Clear guidelines should be established to define cost centers and allocation bases. Using consistent and transparent methods enhances reliability and supports better budgeting and forecasting.

Compliance and Regulatory Considerations

What are the key compliance and regulatory considerations in a cost allocation form? Cost allocation forms must adhere to strict regulatory guidelines to ensure transparency and accuracy in financial reporting. Proper documentation helps organizations avoid legal penalties and maintain audit readiness.

Tools and Software for Cost Allocation

Cost allocation forms are essential for accurately distributing expenses across departments or projects, ensuring financial transparency and accountability. Utilizing specialized tools and software enhances the precision and efficiency of this process.

- Automated Cost Allocation Systems - These systems streamline the distribution of costs by automatically assigning expenses based on predefined rules and criteria.

- Cloud-Based Financial Software - Such software offers real-time collaboration and data access, facilitating accurate and up-to-date cost allocation across teams.

- Data Analytics Tools - Analytics tools help identify spending patterns and optimize cost allocation strategies by providing deep insights into financial data.