A credit card authorization form is essential for businesses to securely obtain payment approval from customers. This document outlines the cardholder's information and consent, reducing the risk of fraudulent transactions. Various examples demonstrate how to effectively customize these forms for different business needs.

Credit Card Authorization Form Sample PDF Viewer

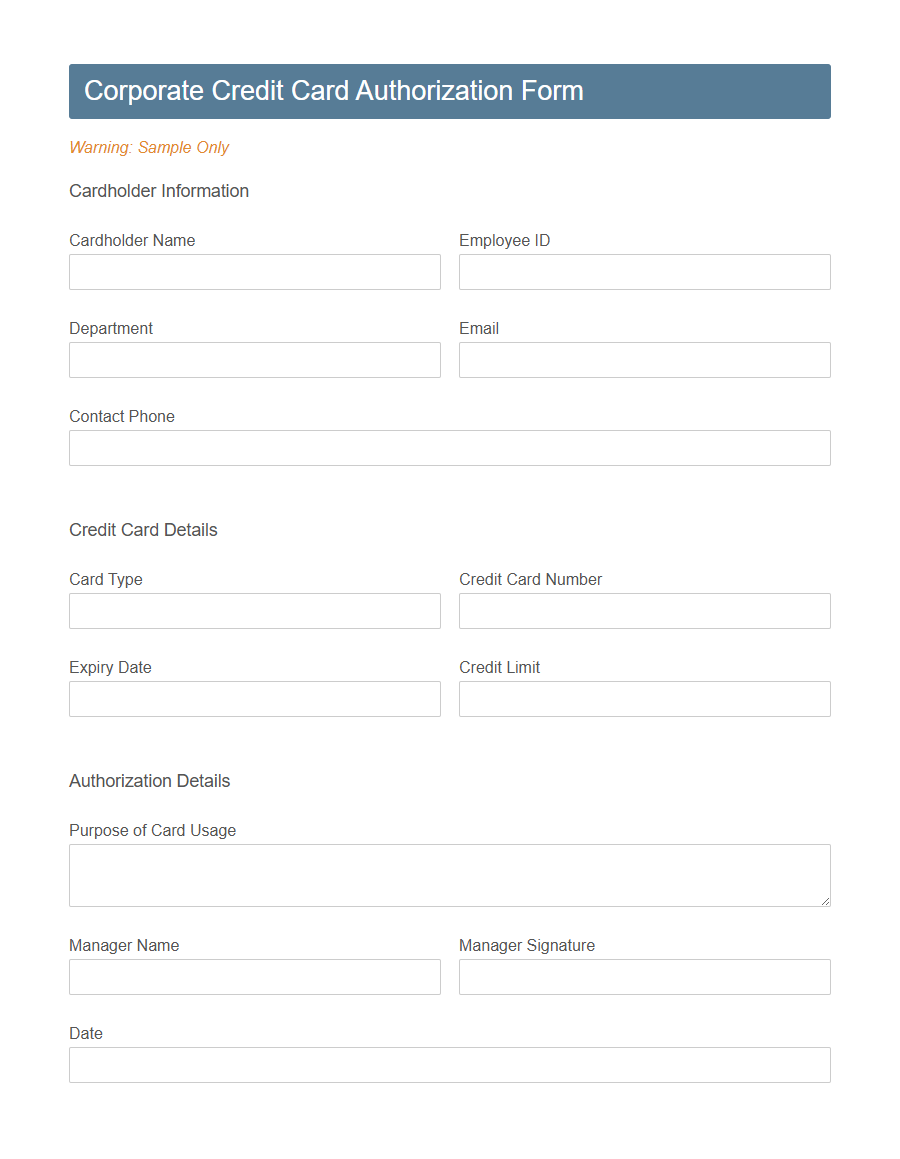

Image example of Credit Card Authorization Form:

Credit Card Authorization Form Samples

Corporate Credit Card Authorization Form - PDF - HTML

Recurring Payment Credit Card Authorization Template - PDF - HTML

Hotel Guest Credit Card Authorization Form - PDF - HTML

Medical Services Credit Card Authorization Template - PDF - HTML

Rental Property Credit Card Authorization Form - PDF - HTML

Online Subscription Credit Card Authorization Form - PDF - HTML

One-Time Event Credit Card Authorization Template - PDF - HTML

Car Rental Credit Card Authorization Form - PDF - HTML

Law Firm Retainer Credit Card Authorization Template - PDF - HTML

Membership Dues Credit Card Authorization Form - PDF - HTML

Utility Bill Payment Credit Card Authorization Template - PDF - HTML

Tuition Payment Credit Card Authorization Form - PDF - HTML

Gym Membership Credit Card Authorization Template - PDF - HTML

Travel Agency Payment Credit Card Authorization Form - PDF - HTML

Introduction to Credit Card Authorization Forms

A Credit Card Authorization Form is a document that grants permission to a business or individual to charge a specified amount to a customer's credit card. This form helps ensure secure and authorized transactions by verifying the cardholder's consent in advance. Its use is common in industries requiring remote payments or recurring billing.

Importance of Credit Card Authorization Forms

Credit card authorization forms are essential documents that ensure secure and authorized use of a card for transactions.

They protect both the merchant and the cardholder by verifying consent and reducing the risk of fraud. Without such forms, businesses may face financial losses and legal disputes due to unauthorized charges.

Key Components of a Credit Card Authorization Form

A Credit Card Authorization Form includes essential details such as the cardholder's name, card number, expiration date, and CVV code to verify the card's validity. It also contains the transaction amount and purpose to specify the payment being authorized. The form must have the cardholder's signature and date to confirm consent and prevent unauthorized use.

Types of Credit Card Authorization Forms

A Credit Card Authorization Form is a document that allows merchants to charge a customer's credit card for a specific amount or transaction. These forms help protect both the customer and the business by providing clear consent for payment processing.

- Single-Transaction Authorization - This form grants permission to charge the credit card for one specific purchase or payment only.

- Recurring Payment Authorization - This type allows ongoing, automatic charges at regular intervals for subscriptions or installment plans.

- Pre-Authorization Form - Used to reserve funds on a credit card temporarily before the final sale amount is confirmed.

Choosing the correct type of Credit Card Authorization Form ensures secure and efficient payment processing tailored to the business needs.

How Credit Card Authorization Forms Work

A Credit Card Authorization Form allows businesses to obtain permission from cardholders to charge their credit cards. This form ensures security and compliance in payment processing by confirming the cardholder's consent.

- Customer Information Collection - The form collects essential details like the cardholder's name, card number, expiration date, and billing address to verify the identity.

- Authorization Granting - The cardholder provides explicit consent for the merchant to charge a specified amount on the credit card.

- Transaction Processing - Once authorized, the merchant processes the payment securely while retaining the form as proof of consent for future reference.

Steps to Fill Out a Credit Card Authorization Form

Filling out a credit card authorization form ensures secure payment processing and protects both the merchant and cardholder. Proper completion of the form helps prevent fraud and facilitates smooth transactions.

- Provide Cardholder Information - Enter the cardholder's full name and contact details as they appear on the credit card.

- Fill in Credit Card Details - Include the card number, expiration date, CVV code, and billing address accurately.

- Sign and Date the Form - The cardholder must sign and date the form to authorize the payment and confirm consent.

Legal Considerations and Compliance

What legal considerations must be addressed when using a Credit Card Authorization Form? Compliance with payment card industry standards and data protection laws is essential to avoid legal penalties. Properly obtaining and storing authorization helps protect both the business and the cardholder from fraud and unauthorized charges.

Common Mistakes to Avoid

Credit Card Authorization Forms are essential for secure transactions but often contain errors that can cause delays or disputes. Common mistakes include incomplete information and missing signatures, which invalidate the form.

Double-check all fields and ensure the cardholder's authorization is clearly documented to avoid processing issues.

Tips for Secure Credit Card Authorization

Credit card authorization forms require careful handling to ensure security and prevent fraud.

Always verify the identity of the person providing credit card information and confirm the details with the card issuer when possible.

Keep authorization forms stored securely to protect sensitive data from unauthorized access.

Use encrypted digital forms rather than paper copies to minimize the risk of information theft or loss.

Limit the amount of information collected on credit card authorization forms to only what is necessary.

Avoid storing full credit card numbers and CVV codes unless absolutely required, complying with PCI DSS standards to enhance security.

Implement clear policies for who can access and process credit card authorization forms.

Regularly train employees on secure handling practices to maintain confidentiality and prevent data breaches.