A payroll change notification form template streamlines the communication of updates to employee payroll information, ensuring accuracy and compliance. This document typically includes adjustments such as salary revisions, tax withholding changes, or benefits modifications. Using clear examples helps organizations standardize the process and reduce errors in payroll management.

Payroll Change Notification Form Template Sample PDF Viewer

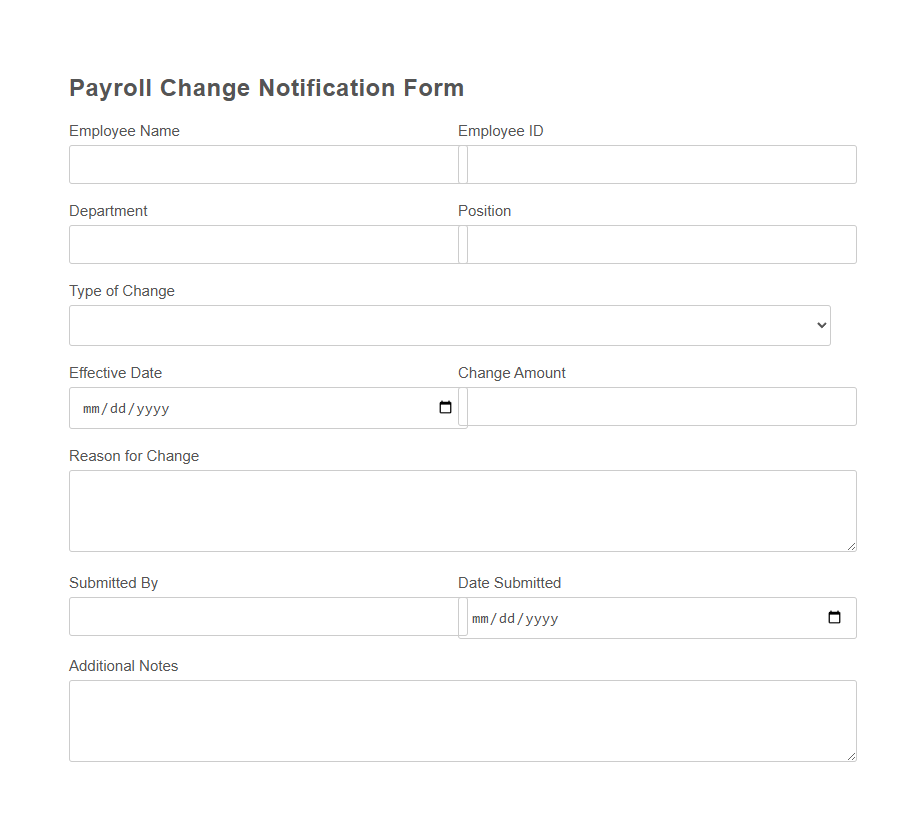

Image example of Payroll Change Notification Form Template:

Payroll Change Notification Form Template Samples

Payroll Change Notification - PDF - HTML

Employee Salary Adjustment Notification Template - PDF - HTML

Promotion Payroll Update - PDF - HTML

Deduction Adjustment Notification - PDF - HTML

Overtime Pay Change Request Template - PDF - HTML

Employee Status Change Payroll Form - PDF - HTML

Payroll Direct Deposit Change - PDF - HTML

Pay Grade Change Notification Template - PDF - HTML

Bonus Payment Notification - PDF - HTML

Payroll Retroactive Adjustment - PDF - HTML

Tax Withholding Change Request Template - PDF - HTML

Shift Differential Pay Change Form - PDF - HTML

Payroll Position Change Notification Template - PDF - HTML

Termination Payroll Adjustment Form - PDF - HTML

Commission Structure Change Notification Template - PDF - HTML

Introduction to Payroll Change Notification Form Templates

A Payroll Change Notification Form Template is a structured document used to record and communicate modifications in employee payroll information.

This form ensures that payroll adjustments such as salary changes, deductions, or tax withholdings are accurately updated and documented. Using a standardized template helps maintain consistency and reduces errors in payroll processing.

Importance of Payroll Change Notification in HR Processes

Payroll Change Notification Forms are essential in maintaining accurate employee compensation records. They streamline communication between HR and payroll teams, ensuring timely updates on salary adjustments or role changes.

- Enhances Accuracy - The form minimizes errors by providing clear documentation of payroll changes.

- Ensures Compliance - It helps organizations adhere to legal and tax regulations related to employee compensation.

- Improves Record Keeping - The structured template keeps all payroll modifications organized for future reference.

Key Components of a Payroll Change Notification Form

A Payroll Change Notification Form Template is essential for documenting updates in employee payroll information accurately. It ensures timely and organized communication between employees and the payroll department.

- Employee Information - Captures basic details such as name, employee ID, and department to identify the individual accurately.

- Change Details - Specifies the type of payroll change, including salary adjustments, tax withholdings, or direct deposit updates.

- Effective Date - Indicates the date when the payroll change should take effect to ensure proper implementation.

- Approval Signatures - Includes authorization from the relevant manager or HR representative to validate the change.

Payroll Change Notification Forms help maintain payroll accuracy and compliance by documenting essential updates systematically.

Common Types of Payroll Changes Requiring Notification

The Payroll Change Notification Form Template helps organizations efficiently document and communicate alterations in employee payroll details. It ensures timely updates to payroll systems, maintaining accurate payment records and compliance.

- Salary Adjustments - These involve increases, decreases, or corrections to an employee's base pay that must be reported promptly.

- Position or Department Changes - Shifts in job roles or departments often affect payroll classification and require formal notification.

- Benefit Deductions Updates - Modifications to health insurance, retirement contributions, or other deductions need to be clearly communicated to payroll processing teams.

Step-by-Step Guide to Completing the Form

What is the first step in completing the Payroll Change Notification Form Template? Begin by carefully reviewing the employee's current payroll information to ensure accuracy. Enter the employee's full name and identification number as the initial details.

How do you specify the type of payroll change? Select the appropriate change category such as salary adjustment, tax withholding, or benefit modification. Accurate selection ensures the correct processing of the payroll update.

What details are required for a salary adjustment? Input the new salary amount along with the effective date of the change. This information triggers the payroll system to calculate the updated payments correctly.

How should tax withholding changes be recorded? Provide the revised withholding allowances or exemptions along with any necessary documentation. This guarantees compliance with tax regulations and precise paycheck deductions.

What is important when updating benefits information? Clearly list the new or modified benefits and any associated enrollment or termination dates. Proper documentation helps maintain accurate employee benefit records.

Who needs to review and approve the completed form? The form must be reviewed by the employee's supervisor or the HR department for verification. Their signature confirms the legitimacy of the payroll change request.

What should you do after obtaining approvals on the form? Submit the completed and signed form to the payroll department promptly. Timely submission prevents delays in processing the payroll adjustment.

How can you ensure the form is correctly filed? Keep a copy of the completed Payroll Change Notification Form for employee records and future reference. Organized record-keeping supports audits and resolves potential discrepancies.

Best Practices for Payroll Change Documentation

A Payroll Change Notification Form Template ensures accurate and consistent documentation of employee payroll updates, minimizing errors and compliance risks. Best practices include clearly specifying the nature of the change, effective dates, and obtaining necessary approvals before processing. Maintaining a standardized form supports smooth communication between HR, payroll, and finance departments while providing a reliable audit trail.

Digital vs. Paper Payroll Change Notification Templates

Choosing between digital and paper Payroll Change Notification Form templates impacts efficiency and accuracy in payroll management.

Digital templates streamline the update process by enabling quick, error-reducing submissions and easy record-keeping. Paper templates often slow down processing and increase the risk of manual errors but are still preferred in organizations with limited digital infrastructure.

Ensuring Compliance with Payroll Change Forms

A Payroll Change Notification Form Template simplifies the process of updating employee payroll information while ensuring accuracy and accountability. Properly designed forms help organizations comply with legal and regulatory requirements, minimizing errors and reducing the risk of audits.

Using standardized payroll change forms guarantees that all necessary details are captured consistently, supporting transparent record-keeping and timely payroll adjustments.

Integrating Payroll Change Forms with HR Systems

Integrating Payroll Change Notification Form templates with HR systems streamlines data accuracy and reduces manual entry errors. This seamless connection ensures real-time updates to employee payroll records, enhancing compliance and reporting efficiency. Automating payroll changes within HR platforms saves time and supports consistent communication across departments.