Auto loan application form templates streamline the vehicle financing process by collecting essential borrower information efficiently. These templates typically include fields for personal details, employment status, income verification, and loan preferences. Utilizing a well-structured form ensures accuracy and speeds up approval timelines for both lenders and applicants.

Auto Loan Application Form Template Sample PDF Viewer

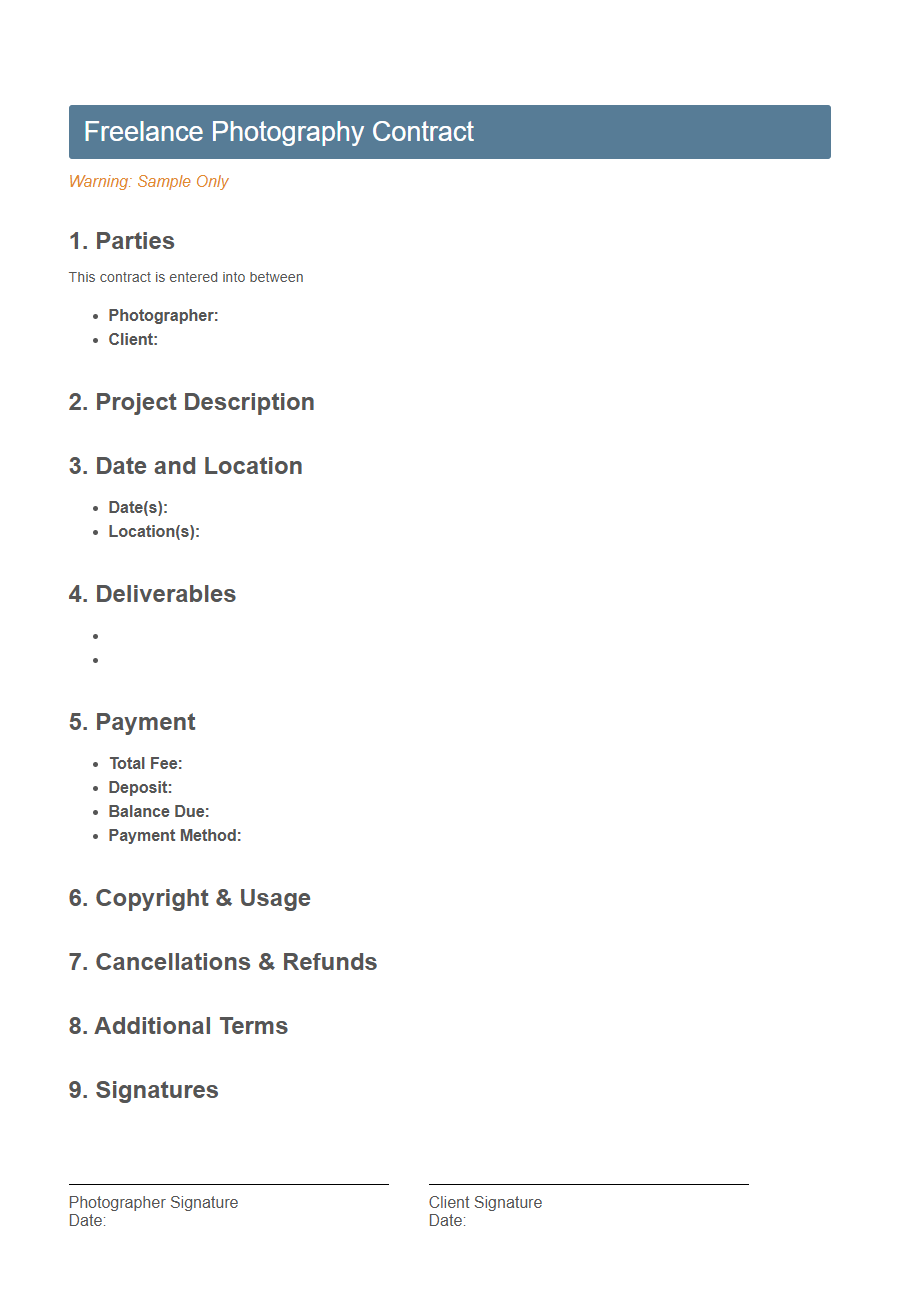

Image example of Auto Loan Application Form Template:

Auto Loan Application Form Template Samples

Freelance Photography Contract Template - PDF - HTML

Pet Adoption Application - PDF - HTML

Influencer Collaboration Proposal Template - PDF - HTML

Small Business Grant Application Template - PDF - HTML

Nonprofit Volunteer Waiver - PDF - HTML

Home Renovation Quotation Template - PDF - HTML

Mobile App Bug Report Template - PDF - HTML

Startup Pitch Deck Outline Template - PDF - HTML

Virtual Event Feedback Survey Template - PDF - HTML

Boutique Product Return Request Template - PDF - HTML

Social Media Takeover Agreement Template - PDF - HTML

Yoga Class Registration - PDF - HTML

Online Course Affiliate Agreement Template - PDF - HTML

Introduction to Auto Loan Application Forms

What is an auto loan application form and why is it important? An auto loan application form is a standardized document used by lenders to collect necessary information from borrowers seeking financing for a vehicle. This form helps streamline the approval process by gathering details such as personal information, employment history, and financial status.

Importance of Using a Structured Template

Using a structured auto loan application form template streamlines the loan approval process and reduces errors. It ensures consistency and completeness in collecting essential borrower information.

- Enhances Efficiency - A standardized template accelerates data entry and review by organizing information logically.

- Improves Accuracy - Clear fields minimize the risk of missing or incorrect details that can delay loan processing.

- Ensures Compliance - Structured forms help meet regulatory requirements by capturing all necessary information systematically.

A well-designed template is crucial for a smooth and reliable auto loan application experience for both lenders and borrowers.

Key Sections in an Auto Loan Application Form

An Auto Loan Application Form Template is designed to collect essential information needed to process a car loan efficiently. It streamlines the loan approval process by organizing key details in a structured way.

- Personal Information - Captures the applicant's full name, contact details, and identification to verify their identity.

- Employment and Income Details - Records the borrower's job status and monthly income to assess financial stability and repayment capacity.

- Loan Amount and Vehicle Information - Specifies the desired loan amount and details about the vehicle to be purchased, such as make, model, and price.

Personal Information Requirements

The Auto Loan Application Form Template requires detailed personal information to assess the applicant's eligibility accurately. This ensures lenders can verify identity and financial responsibility before approving the loan.

- Full Name - Essential for identity verification and official record keeping.

- Date of Birth - Used to confirm the applicant's age and eligibility for loan terms.

- Contact Information - Includes phone number and address for communication and background checks.

Vehicle Details and Specifications

The Vehicle Details and Specifications section of an Auto Loan Application Form Template gathers essential information about the car being financed.

This section typically includes fields for the make, model, year, VIN, mileage, and asking price of the vehicle. Providing accurate vehicle information helps lenders assess the loan risk and determine appropriate terms.

Applicant's Financial Information

The Applicant's Financial Information section in the Auto Loan Application Form Template gathers essential details about income, employment status, and monthly expenses. This information helps lenders assess the applicant's ability to repay the loan. Accurate and comprehensive financial data improves the chances of approval and ensures appropriate loan terms are offered.

Employment and Income Verification

The Auto Loan Application Form Template includes a dedicated section for Employment and Income Verification to ensure accurate assessment of the applicant's financial stability. Applicants are required to provide details such as employer name, job title, length of employment, and monthly income. This information helps lenders verify income sources and make informed decisions about loan approval and repayment capacity.

Authorization and Consent Clauses

The Authorization and Consent Clauses in an Auto Loan Application Form Template grant the lender permission to verify the applicant's information.

These clauses enable the lender to access credit reports, employment history, and financial records to assess loan eligibility. Applicants acknowledge their understanding and agreement to these terms by signing the form.

Tips for Customizing Your Loan Application Form

When customizing your auto loan application form template, ensure that all essential personal and financial information fields are clearly labeled for easy completion. Use a clean, organized layout to enhance readability and reduce errors during data entry.

Include specific questions relevant to your lending criteria to streamline the approval process and gather necessary information upfront.