Import/export compliance forms play a crucial role in facilitating smooth international trade by ensuring adherence to legal and regulatory requirements. These forms help businesses avoid penalties, delays, and disruptions by clearly documenting necessary information such as product classifications, licensing details, and shipment declarations. Understanding various examples of compliance forms enables companies to streamline their processes and maintain global trade integrity.

Import/Export Compliance Form Sample PDF Viewer

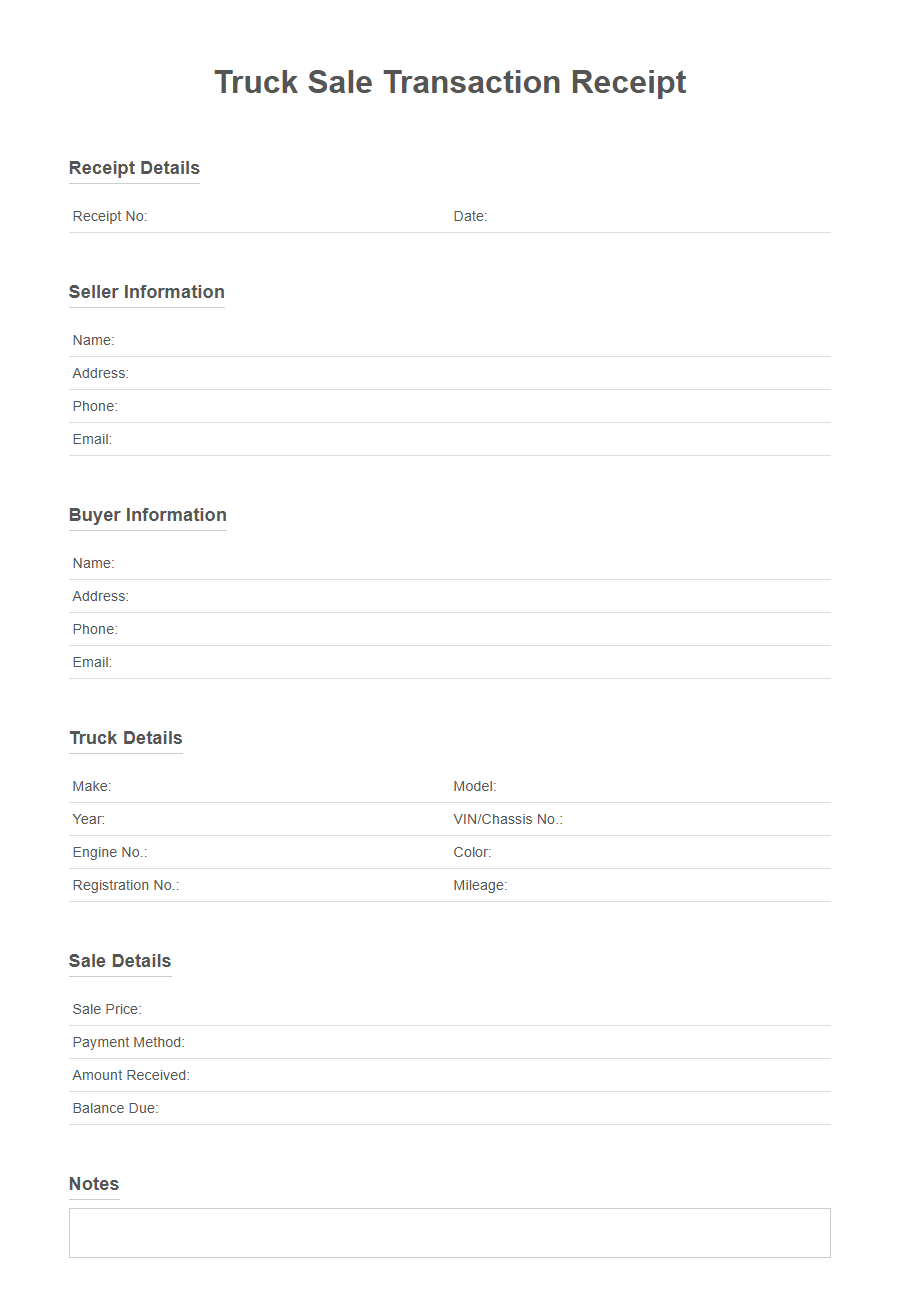

Image example of Import/Export Compliance Form:

Import/Export Compliance Form Samples

Import/Export Customs Declaration - PDF - HTML

Import/Export License Application Template - PDF - HTML

Restricted Goods Screening Checklist Template - PDF - HTML

Import/Export Shipment Pre-Compliance Checklist - PDF - HTML

Certificate of Origin Compliance Template - PDF - HTML

Import/Export Documentation Control Log - PDF - HTML

Importer Security Filing (ISF) Data Sheet Template - PDF - HTML

Product Classification Compliance Form - PDF - HTML

Export Control Classification Number (ECCN) Worksheet - PDF - HTML

Denied Party Screening Form - PDF - HTML

Import/Export Transaction Risk Assessment Template - PDF - HTML

Trade Compliance Audit Checklist - PDF - HTML

Free Trade Agreement (FTA) Compliance Statement Template - PDF - HTML

Import/Export Recordkeeping Acknowledgement Form - PDF - HTML

Introduction to Import/Export Compliance Forms

What is an Import/Export Compliance Form? This form is a crucial document used to ensure that goods being imported or exported meet all legal and regulatory requirements. It helps businesses avoid penalties by verifying adherence to international trade laws.

Importance of Compliance in International Trade

Import/Export Compliance Forms are essential tools ensuring businesses adhere to international trade regulations, preventing legal penalties. Maintaining compliance safeguards a company's reputation and enables smooth cross-border transactions.

- Legal Protection - Proper compliance minimizes the risk of fines and sanctions imposed by regulatory authorities.

- Operational Efficiency - Accurate documentation accelerates customs clearance and reduces shipment delays.

- Market Access - Compliance with trade laws helps maintain eligibility for global trade agreements and partnerships.

Key Regulatory Authorities and Standards

Import/Export Compliance Forms are essential for adhering to regulations set by key authorities such as the U.S. Customs and Border Protection (CBP) and the International Trade Administration (ITA). These forms ensure compliance with standards like the International Traffic in Arms Regulations (ITAR) and the Export Administration Regulations (EAR). Proper use of these forms helps businesses avoid penalties, streamline cross-border transactions, and maintain legal trade practices.

Essential Elements of Import/Export Compliance Forms

Import/Export Compliance Forms are critical documents ensuring adherence to international trade regulations.

These forms contain essential elements that verify the legality and accuracy of goods being shipped across borders. Proper completion helps prevent delays, fines, and legal issues in global trade operations.

Step-by-Step Guide to Completing the Forms

Begin by carefully reading all instructions on the Import/Export Compliance Form to understand the required information. Enter accurate details such as product descriptions, quantities, and relevant codes to ensure compliance with regulations. Review the form thoroughly before submission to avoid errors and expedite the approval process.

Common Mistakes and How to Avoid Them

Import/Export Compliance Forms are crucial for smooth international trade but often contain avoidable errors. Recognizing common mistakes helps businesses maintain compliance and prevent costly delays or fines.

- Incorrect or Incomplete Information - Missing or inaccurate details on the form can lead to shipment holds and fines.

- Misclassification of Goods - Using the wrong tariff codes causes incorrect duties and compliance issues.

- Failure to Update Regulatory Changes - Ignoring recent changes in trade regulations results in non-compliance and shipment rejection.

Documentation Required for Compliance

Proper documentation is essential for maintaining import/export compliance and avoiding legal issues. Accurate records ensure smooth customs clearance and adherence to international trade regulations.

- Commercial Invoice - Details the transaction between buyer and seller, listing goods and values.

- Packing List - Specifies the contents and packaging of each shipment for verification purposes.

- Export/Import Licenses - Official authorizations required for controlled or restricted goods.

Ensuring all required documents are complete and accurate facilitates timely processing and regulatory compliance.

Digital Solutions for Import/Export Compliance

Digital solutions for import/export compliance streamline the management of regulatory requirements and documentation. These technologies enhance accuracy, reduce processing time, and ensure adherence to international trade laws.

Automated import/export compliance forms enable companies to quickly verify product classifications, duties, and licensing needs, minimizing the risk of costly errors. Integrating these digital tools with enterprise systems improves data consistency and facilitates real-time reporting for better decision-making.

Penalties for Non-Compliance

Import/Export Compliance Forms are critical for ensuring that all shipments meet legal and regulatory requirements. Failure to comply with these regulations can result in severe financial penalties and legal consequences for businesses.

Non-compliance may lead to fines, shipment delays, and damage to company reputation.