A loan agreement request form template simplifies the process of documenting loan terms between parties, ensuring clarity and legal protection. This template includes essential elements such as loan amount, interest rate, repayment schedule, and borrower-lender details. Using structured examples helps users customize and accurately complete their loan agreements for various financial situations.

Loan Agreement Request Form Template Sample PDF Viewer

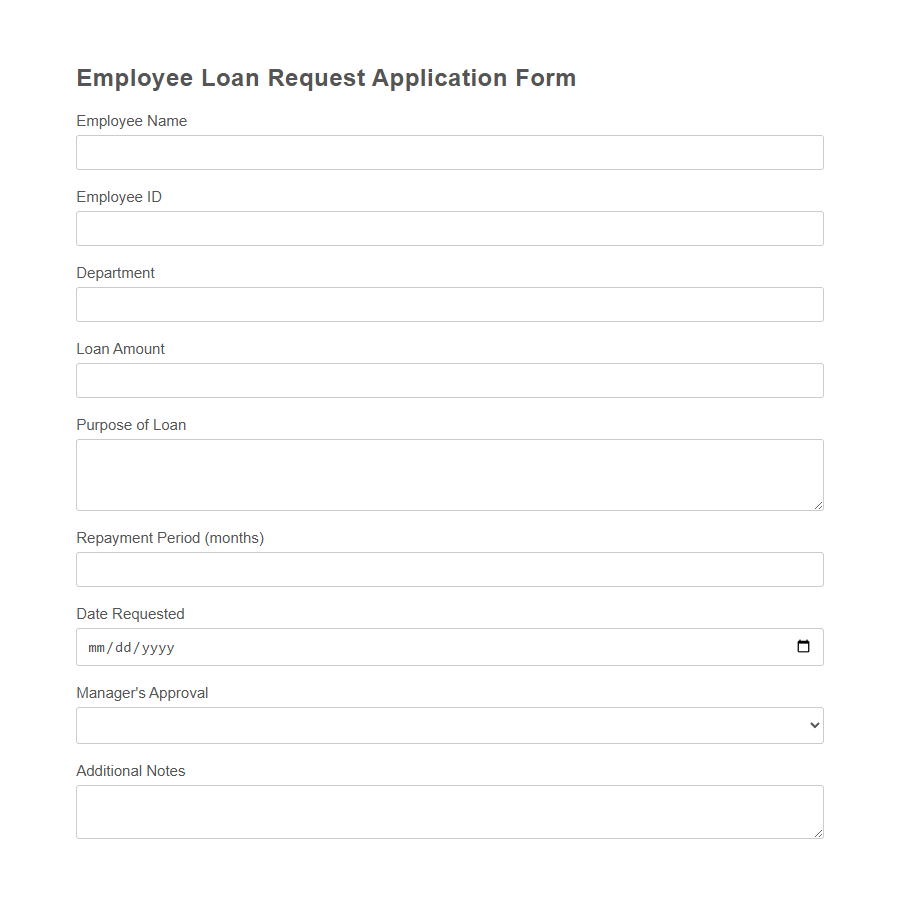

Image example of Loan Agreement Request Form Template:

Loan Agreement Request Form Template Samples

Employee Loan Request Application - PDF - HTML

Small Business Microloan Agreement Template - PDF - HTML

Peer-to-Peer Lending Request - PDF - HTML

Auto Title Loan Request - PDF - HTML

Start-up Seed Loan Application Template - PDF - HTML

Education Loan Agreement Request Template - PDF - HTML

Medical Emergency Loan Request - PDF - HTML

Farming Equipment Microloan Request Template - PDF - HTML

Freelance Project Loan Request Template - PDF - HTML

Home Renovation Microloan Agreement Template - PDF - HTML

Minority-Owned Business Microloan Request Template - PDF - HTML

Short-Term Bridge Loan Application Template - PDF - HTML

Student Laptop Loan Request - PDF - HTML

Inventory Financing Microloan Request Template - PDF - HTML

Nonprofit Event Loan Agreement Request Template - PDF - HTML

Introduction to Loan Agreement Request Form Template

A Loan Agreement Request Form Template streamlines the process of initiating a loan agreement between parties. This template ensures all necessary information is collected in a clear and organized manner.

- Purpose - It helps standardize loan requests to avoid misunderstandings and errors.

- Content - The template includes borrower details, loan amount, repayment terms, and conditions.

- Efficiency - Using the form speeds up the approval process by providing all required data upfront.

Importance of a Loan Agreement Request Form

A Loan Agreement Request Form is essential for formalizing loan terms between parties.

It clearly outlines the amount, repayment schedule, and obligations, reducing the risk of misunderstandings or disputes. This document ensures that both lender and borrower have a mutual understanding and legal protection throughout the loan process.

Key Components of the Template

A Loan Agreement Request Form Template includes essential details such as the borrower's and lender's information, loan amount, and repayment terms. It outlines the purpose of the loan, interest rate, and duration to ensure clear understanding between parties. The template also features sections for signatures and date to formalize the agreement and maintain legal validity.

How to Customize Your Loan Agreement Request Form

Customize your Loan Agreement Request Form by including specific loan details such as the amount, interest rate, and repayment schedule. Tailor the form fields to capture essential borrower information like name, contact details, and credit history. Ensure the form reflects your organization's policies and legal requirements for a clear and enforceable agreement.

Essential Information to Include

What essential information should be included in a Loan Agreement Request Form Template? The template must clearly state the borrower's and lender's full names and contact details. It should also specify the loan amount, purpose, and repayment terms to ensure mutual understanding.

Why is it important to detail the loan amount and repayment schedule in the form? Specifying these elements helps prevent disputes by outlining clear expectations for both parties. Accurate repayment dates and installment amounts provide a structured timeline for loan settlement.

How does including collateral details benefit a loan agreement request? Listing collateral secures the loan by providing assets that can be claimed if the borrower defaults. This information adds a layer of protection for the lender's investment.

What role does stating interest rates play in the loan agreement template? Clearly mentioning interest rates ensures transparency and helps both parties calculate total repayment costs. It also aligns the agreement with legal financial standards.

Should borrower and lender signatures be part of the Loan Agreement Request Form? Signatures confirm that both parties have read, understood, and agreed to the terms outlined. This makes the document legally binding and enforceable in court if necessary.

Legal Considerations and Compliance

A Loan Agreement Request Form Template must be crafted to ensure all legal obligations between the lender and borrower are clearly defined and understood. This helps prevent disputes by outlining loan terms, repayment schedules, interest rates, and consequences of default in compliance with applicable laws.

Ensuring the form adheres to local regulatory requirements and includes necessary disclosures is critical for enforceability and legal protection.

Tips for Completing the Request Form

Completing a Loan Agreement Request Form accurately helps ensure smooth processing and faster approval. Paying close attention to each section reduces errors and prevents delays.

- Provide accurate personal information - Double-check your name, address, and contact details to avoid miscommunication.

- Specify loan details clearly - Include the exact loan amount, purpose, and repayment terms to clarify your request.

- Review terms and conditions - Understand all clauses before signing to ensure you agree with the agreement requirements.

Common Mistakes to Avoid

Loan Agreement Request Form Templates help streamline the lending process by clearly outlining terms and borrower information.

Common mistakes include incomplete borrower details and unclear loan terms, which can lead to misunderstandings or legal disputes. Ensuring all sections are accurately filled avoids delays and protects both parties involved.