A property insurance claim form template simplifies the process of documenting damages and losses for a claim. This template ensures all necessary details are accurately recorded to facilitate a smoother approval process. Using examples helps policyholders understand how to complete their forms effectively and avoid common mistakes.

Property Insurance Claim Form Template Sample PDF Viewer

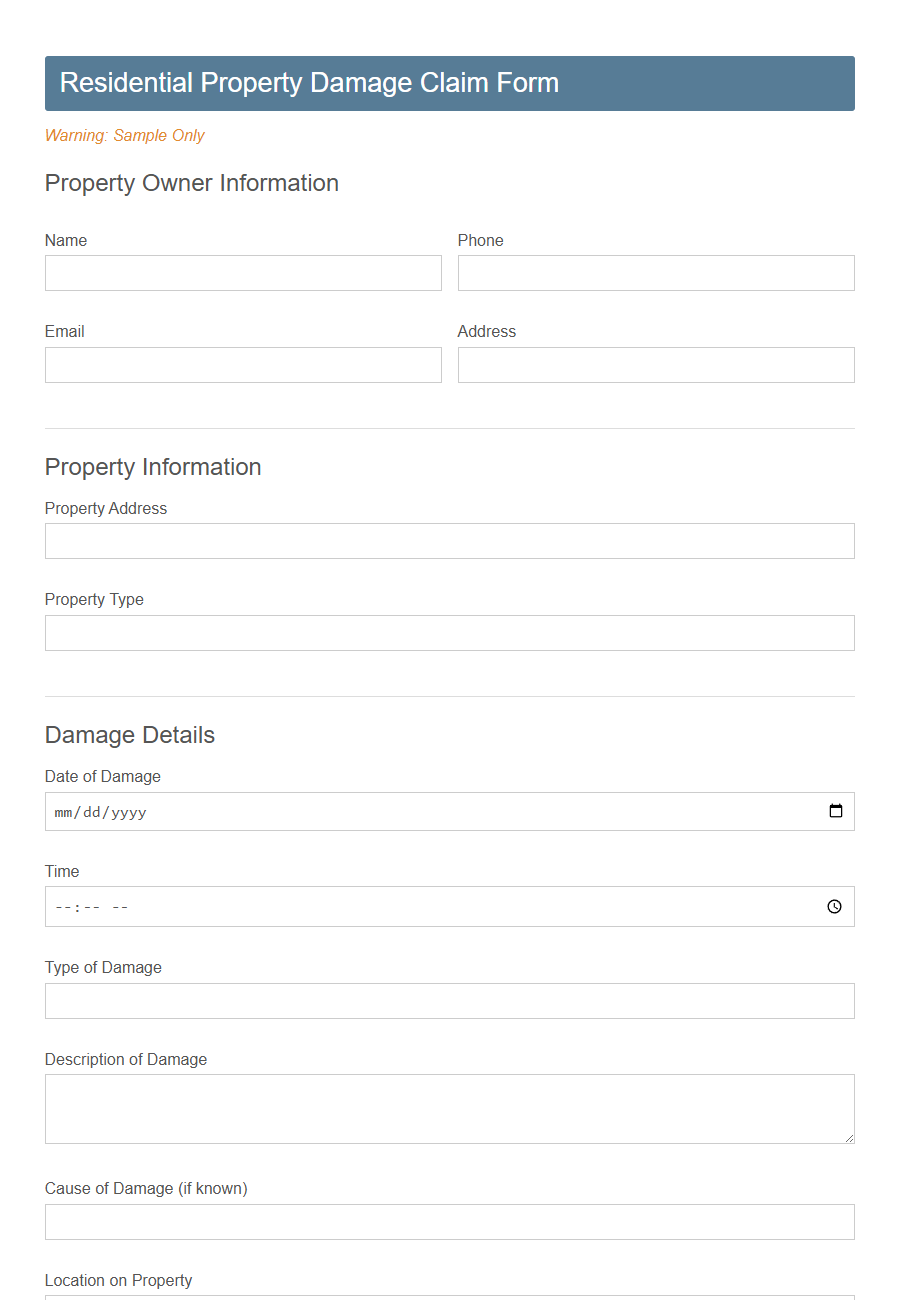

Image example of Property Insurance Claim Form Template:

Property Insurance Claim Form Template Samples

Residential Property Damage Claim - PDF - HTML

Commercial Property Insurance Claim Template - PDF - HTML

Rental Property Loss Claim Template - PDF - HTML

Natural Disaster Property Claim - PDF - HTML

Fire Damage Property Insurance Claim Template - PDF - HTML

Water Damage Property Claim - PDF - HTML

Vandalism Property Insurance Claim Template - PDF - HTML

Theft Property Claim - PDF - HTML

Flood Property Insurance Claim - PDF - HTML

Landlord Property Insurance Claim Template - PDF - HTML

Condo Association Property Claim - PDF - HTML

Business Interruption Property Claim Template - PDF - HTML

Vacant Property Insurance Claim Template - PDF - HTML

Introduction to Property Insurance Claim Form Templates

Property insurance claim form templates provide a structured way to report damages or losses to your insured property. These templates streamline the filing process, ensuring that all necessary information is accurately captured for a successful claim.

Using a well-designed template helps policyholders submit claims efficiently, reducing errors and processing time.

Importance of Using a Standardized Claim Form

Using a standardized property insurance claim form template ensures consistency and accuracy in the claims process. It helps streamline communication between policyholders and insurance companies, reducing delays and errors.

- Efficiency Improvement - Standardized forms simplify data collection, making it faster for both parties to complete and review claims.

- Legal Compliance - These templates align with industry regulations, ensuring all necessary information is properly documented and preventing claim denials.

- Clear Communication - Uniform claim forms minimize misunderstandings by providing a structured format that guides policyholders in submitting complete and relevant information.

Employing a standardized property insurance claim form template maximizes claim processing efficiency and accuracy for all involved.

Key Sections of a Property Insurance Claim Form

A Property Insurance Claim Form Template typically includes key sections such as Policyholder Information, where the claimant provides personal and contact details. It also contains a Description of Loss or Damage section, requiring a detailed account of the incident and affected property. Finally, the form includes a Supporting Documents area, prompting the submission of evidence like photos, repair estimates, and police reports to validate the claim.

Essential Information to Include in the Template

A Property Insurance Claim Form Template must capture all critical details to ensure a smooth and efficient claims process. Including essential information helps both the insurer and the claimant accurately document the incident and property damage.

- Claimant Information - This section collects the policyholder's name, contact details, and policy number for identification and communication purposes.

- Property Details - Describes the insured property location, type, and any relevant characteristics necessary to assess the claim accurately.

- Incident Description - Provides a thorough account of the event causing damage, including date, time, cause, and extent of the loss for proper evaluation.

Step-by-Step Guide to Filling Out the Claim Form

How do you begin filling out a Property Insurance Claim Form Template? Start by carefully reading the instructions provided on the form to understand each section clearly. Gather all necessary documents such as policy details, proof of loss, and incident reports before you start.

What personal information is required on the claim form? You need to provide your full name, contact details, and policy number accurately. This information helps the insurance company identify your account quickly and process your claim efficiently.

How should you describe the incident or damage? Provide a detailed and honest description of what happened, including the date and time of the incident. Include specific information about the location and type of damage sustained to support your claim.

What supporting documents should you attach to the claim form? Include photographs of the damage, repair estimates, police reports if applicable, and any receipts for temporary repairs. These documents serve as evidence to validate your claim and speed up the review process.

How do you finalize and submit the Property Insurance Claim Form? Review all entered information carefully to ensure accuracy and completeness before signing the form. Submit the completed form along with all supporting documents to your insurance provider via their preferred method, such as mail or online submission.

Common Mistakes to Avoid When Completing the Form

Filling out a property insurance claim form requires careful attention to detail.

Common mistakes include providing incomplete information and missing deadlines, which can delay the processing of your claim.

Many claimants forget to attach all necessary supporting documents.

Always double-check that photos, invoices, and repair estimates are included to avoid rejection or requests for additional information.

Incorrect policy numbers or personal details can cause confusion and slow down your claim.

Verify that every entry matches your insurance policy exactly before submitting the form.

Some individuals fail to describe the damages clearly and accurately.

Use specific and detailed descriptions to help the insurance adjuster understand the scope of the loss.

Submitting the claim form late is a frequent error that impacts eligibility for reimbursement.

Be aware of your insurer's deadline and submit claims promptly to ensure timely processing.

Not keeping copies of the completed claim form and related correspondence is a common oversight.

Maintain duplicates for your records to track the progress and protect yourself in case of disputes.

Tips for Submitting a Successful Claim

When filling out a Property Insurance Claim Form Template, ensure all information is accurate and detailed to avoid delays. Attach all necessary documents, such as photos of the damage and receipts, to strengthen your claim. Keep copies of the completed form and correspondence for your records and follow up promptly with your insurance company.

Digital vs. Paper Claim Form Templates: Pros and Cons

Choosing between digital and paper property insurance claim form templates depends on your specific needs and preferences.

Digital claim form templates offer faster processing and easier storage compared to traditional paper forms. They enable convenient online submission and reduce the risk of lost or damaged documents.

Paper claim form templates provide a tangible record that some users find more reassuring and easier to review without electronic devices.

However, paper forms can be slower to process, prone to physical damage, and require manual handling which may lead to errors. Digital forms streamline the workflow but rely on technology access and familiarity.

Customizing Your Property Insurance Claim Form Template

Customizing your property insurance claim form template ensures it captures all necessary details specific to your situation. Tailoring the form helps streamline the claims process and improves communication with your insurer.

- Include relevant property details - Adding specifics such as address, type of property, and ownership information makes the claim form comprehensive.

- Specify types of damages - Clearly listing categories like fire, theft, or water damage helps in accurate assessment and faster processing.

- Add space for supporting documentation - Providing sections for photos, receipts, and repair estimates strengthens your claim evidence.