Proof of insurance verification form templates streamline the process of confirming coverage by providing standardized documentation. These templates typically include essential details such as policy number, insured party information, and effective dates. Utilizing clear examples helps organizations ensure accurate and efficient verification, reducing administrative errors and delays.

Proof of Insurance Verification Form Template Sample PDF Viewer

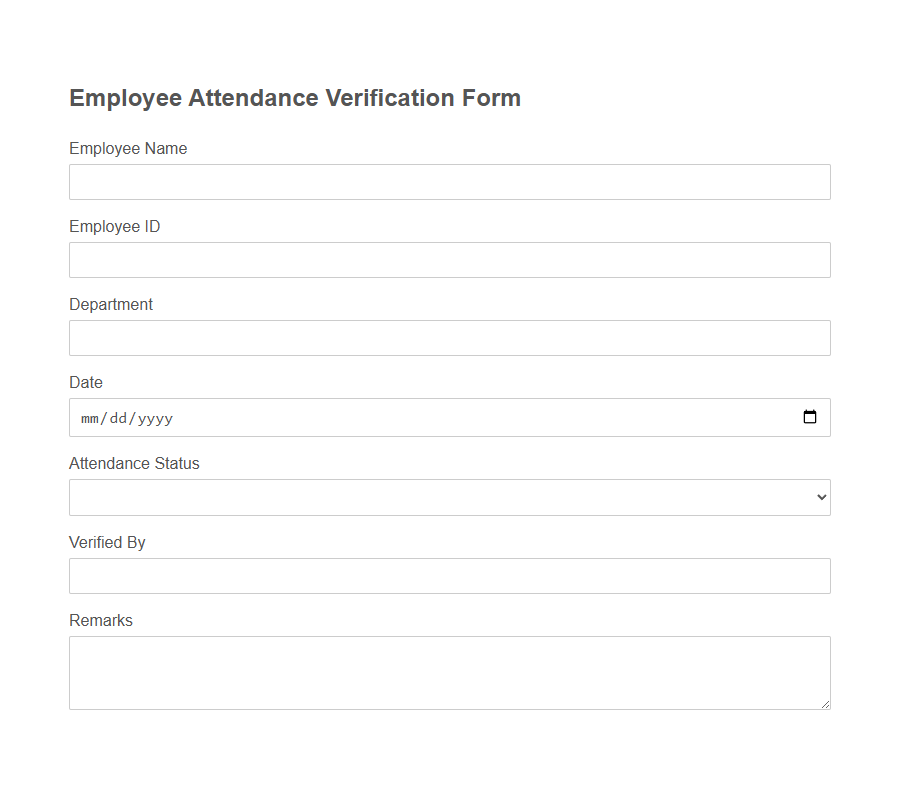

Image example of Proof of Insurance Verification Form Template:

Proof of Insurance Verification Form Template Samples

Employee Attendance Verification - PDF - HTML

Tenant Rental Payment Proof Template - PDF - HTML

Vehicle Maintenance Log Verification - PDF - HTML

Freelance Work Completion Proof Template - PDF - HTML

Internship Hours Verification Sheet Template - PDF - HTML

Student Enrollment Verification Letter Template - PDF - HTML

Contractor License Proof Submission Template - PDF - HTML

Medical Treatment Receipt Verification Template - PDF - HTML

Charity Donation Proof - PDF - HTML

Parental Consent Proof - PDF - HTML

Remote Work Location Proof Template - PDF - HTML

Business Address Verification - PDF - HTML

Identity Proof Submission - PDF - HTML

Introduction to Proof of Insurance Verification Forms

What is the purpose of a Proof of Insurance Verification Form? This form serves to confirm that an individual or entity holds an active insurance policy. It ensures that all parties involved have verified coverage before proceeding with related activities.

Purpose and Importance of Insurance Verification

Proof of Insurance Verification Form templates serve to confirm that an individual or entity holds active insurance coverage. This verification process helps prevent financial risks by ensuring compliance with legal and contractual requirements.

- Legal Compliance - Insurance verification ensures that all parties meet mandated regulatory requirements to avoid penalties.

- Risk Management - Confirming insurance protects businesses and individuals from potential financial losses due to unforeseen events.

- Trust Building - Providing proof of insurance fosters confidence and transparency between service providers and clients.

Key Elements of a Proof of Insurance Verification Form

A Proof of Insurance Verification Form serves as a critical document to confirm an individual's or entity's insurance coverage status.

It ensures that the insured meets the necessary legal or contractual insurance requirements, providing peace of mind to all parties involved.

Key elements of a Proof of Insurance Verification Form include the insured's personal or business information, detailing the name, address, and contact details.

Accurate identification helps verify the coverage belongs to the correct party, preventing any misunderstandings or fraudulent claims.

Another essential component is the insurance policy details, such as the policy number, type of coverage, and effective dates.

This section outlines the scope and duration of coverage, confirming that the insurance is current and valid.

The form must also include the insurer's information, including the company name, contact information, and the agent or representative's details.

This enables confirmation with the insurance provider directly if verification or clarification is needed.

Signature fields for the insured party and, where applicable, the insurance agent or authorized representative, are key.

Signatures authenticate the form, certifying the truthfulness and accuracy of the information provided.

Terms and conditions or disclaimers sometimes accompany the verification form.

These clarify the responsibilities of each party and any limitations related to the insurance coverage or verification process.

Types of Insurance Covered by Verification Forms

Proof of Insurance Verification Form templates typically cover various types of insurance such as auto, health, and homeowners insurance. These forms are designed to confirm the validity and coverage details required by employers, landlords, or government agencies. Verification ensures that the insurance policy meets the necessary criteria for protection and compliance.

How to Use an Insurance Verification Form Template

An Insurance Verification Form Template simplifies the process of confirming insurance coverage quickly and accurately. It ensures all necessary information is collected in a standardized format for easy review.

- Gather Required Information - Collect personal details, insurance policy numbers, and coverage dates before filling out the form.

- Complete the Form Accurately - Enter all relevant data clearly to avoid delays or errors during verification.

- Submit for Verification - Send the completed form to the insurance provider or relevant agency for confirmation of coverage.

Customizing Your Proof of Insurance Verification Template

Customizing your Proof of Insurance Verification Form Template ensures it meets the specific requirements of your business or organization. You can include fields for policy numbers, coverage dates, and insurer contact information to streamline the verification process. Tailoring the template helps improve accuracy and efficiency when validating insurance coverage.

Legal Requirements for Insurance Verification Forms

Proof of Insurance Verification Forms are essential documents that confirm a policyholder's insurance coverage meets legal standards.

These forms must comply with specific legal requirements to ensure validity and protect all parties involved. They typically include policy details, coverage limits, and effective dates to provide clear evidence of insurance status.

Common Mistakes to Avoid in Insurance Verification

Proof of Insurance Verification Form templates are essential for confirming coverage but often contain errors that delay processing. Common mistakes include incorrect policy numbers and missing signature fields, which can invalidate the document.

Ensuring accuracy and completeness helps avoid unnecessary delays in insurance verification.

Benefits of Digital Insurance Verification Templates

Proof of Insurance Verification Form Templates streamline the process of confirming insurance coverage efficiently and accurately. Utilizing digital templates enhances accessibility and minimizes errors in record-keeping.

- Saves Time - Digital templates enable quick data entry and instant retrieval, reducing administrative workload.

- Enhances Accuracy - Automated fields and validation help prevent common mistakes during insurance verification.

- Improves Accessibility - Cloud-based storage allows easy access to verification forms from any device at any time.

Adopting digital insurance verification templates modernizes workflow and supports secure, reliable insurance documentation management.