An insurance change of beneficiary form allows policyholders to update the designated recipient of their policy benefits. This crucial document ensures that death benefits are directed according to the policyholder's current wishes. Examples of completed forms illustrate common scenarios and help clarify the process.

Insurance Change of Beneficiary Form Sample PDF Viewer

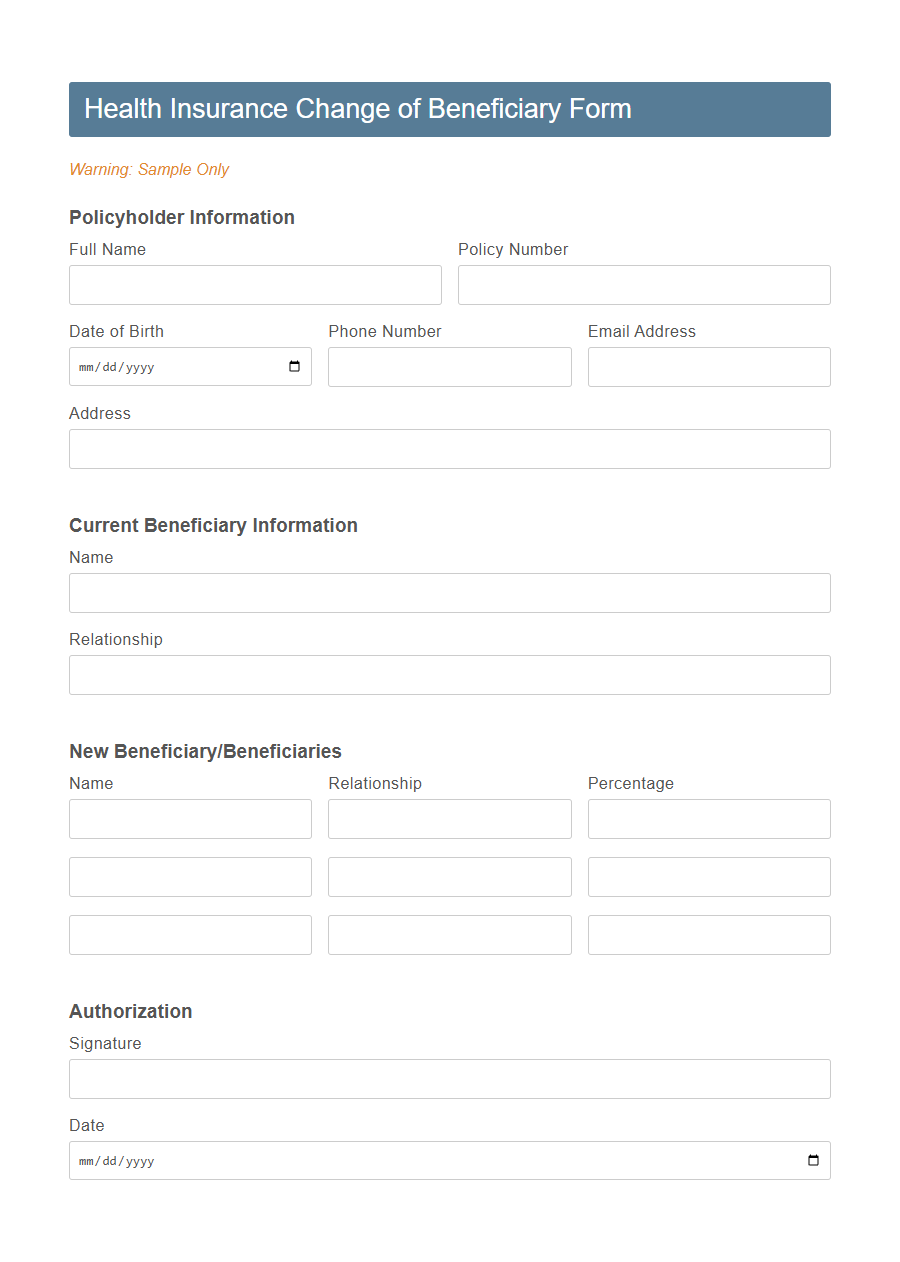

Image example of Insurance Change of Beneficiary Form:

Insurance Change of Beneficiary Form Samples

Health Insurance Change of Beneficiary Form - PDF - HTML

Life Insurance Change of Beneficiary Request - PDF - HTML

Auto Insurance Beneficiary Amendment Template - PDF - HTML

Group Life Policy Beneficiary Update Form - PDF - HTML

Accident Insurance Beneficiary Change Document - PDF - HTML

Term Life Insurance Beneficiary Designation Template - PDF - HTML

Annuity Policy Beneficiary Change Request - PDF - HTML

Critical Illness Insurance Beneficiary Form - PDF - HTML

Mortgage Protection Insurance Beneficiary Update - PDF - HTML

Travel Insurance Change of Beneficiary Form - PDF - HTML

Pension Plan Beneficiary Modification Template - PDF - HTML

Employer-Sponsored Life Insurance Beneficiary Change - PDF - HTML

Disability Insurance Beneficiary Designation Form - PDF - HTML

Child Life Insurance Beneficiary Change Document - PDF - HTML

Universal Life Insurance Beneficiary Amendment Form - PDF - HTML

Understanding the Insurance Change of Beneficiary Form

What is an Insurance Change of Beneficiary Form? This form allows policyholders to update or change the designated recipient of their insurance benefits. It ensures that the insurance payouts go to the correct individual or entity as intended by the policyholder.

Importance of Updating Your Beneficiary Information

Updating your insurance beneficiary information ensures your benefits are distributed according to your current wishes. Keeping this information accurate prevents legal complications and provides financial security for your loved ones.

- Reflects Life Changes - Changes such as marriage, divorce, or the birth of a child require beneficiary updates to align with your evolving personal circumstances.

- Prevents Payment Disputes - Accurate beneficiary designations help avoid conflicts or delays in benefit payments to the intended recipients.

- Maintains Financial Security - Ensuring the correct beneficiary is listed guarantees that your insurance proceeds support the people you care about most.

When Should You Change Your Beneficiary?

Changing the beneficiary on your insurance policy ensures your benefits go to the right person when circumstances shift.

You should change your beneficiary after major life events such as marriage, divorce, the birth of a child, or the death of a current beneficiary. Regularly reviewing and updating your beneficiary prevents legal complications and ensures your insurance proceeds are distributed according to your current wishes.

Step-by-Step Guide to Completing the Form

Begin by gathering your current insurance policy details and the new beneficiary information you wish to designate. Carefully fill out the form by entering your policy number, personal information, and the full name, relationship, and contact details of the new beneficiary. Review all entries for accuracy, sign and date the form, then submit it to your insurance provider for processing.

Required Documents for Beneficiary Changes

An Insurance Change of Beneficiary Form is essential for updating the designated recipient of an insurance policy's death benefits.

Submitting the form requires specific documents to ensure a valid and smooth beneficiary change process. These documents typically include a completed and signed change of beneficiary form, a valid identification proof of the policyholder, and any relevant supporting documents such as the original insurance policy or previous beneficiary designation.

Common Mistakes to Avoid on the Form

Filling out an Insurance Change of Beneficiary Form requires careful attention to detail to ensure your wishes are accurately reflected. Avoiding common mistakes can prevent delays and misunderstandings in the benefits distribution process.

- Incomplete or Incorrect Information - Providing missing or inaccurate details such as names, dates, or identification numbers can invalidate the form or cause processing delays.

- Not Signing the Form - Failing to sign and date the form nullifies the beneficiary change request and may default the benefits to the previous beneficiary.

- Ignoring Policy Requirements - Overlooking specific insurer instructions or required witnesses can result in the form being rejected or deemed invalid.

Legal Implications of Changing a Beneficiary

Changing the beneficiary on an insurance policy has significant legal implications that can affect the distribution of the policy's proceeds. It is essential to follow the proper procedure to ensure the change is legally valid and enforceable.

Failure to correctly update the beneficiary may lead to disputes or unintended inheritance consequences.

How to Submit the Change of Beneficiary Form

Submitting an Insurance Change of Beneficiary Form requires careful attention to the insurer's specific instructions. Proper submission ensures that your beneficiary updates are legally recognized and processed without delay.

- Obtain the correct form - Download the form from the insurance company's official website or request it via customer service.

- Complete the form accurately - Fill in all required fields with current information about the new beneficiary and your policy details.

- Submit the form correctly - Send the completed form through the insurer's preferred method, such as online submission, mail, or in-person delivery.

Following these steps guarantees your beneficiary change is recorded promptly and correctly.

What Happens After Submitting the Form?

After submitting the Insurance Change of Beneficiary Form, the insurance company reviews the request to ensure all information is complete and accurate. Once approved, the beneficiary designation is officially updated in the policy records. The policyholder will receive confirmation of the change, and future benefits will be paid according to the new beneficiary details.