Mileage reimbursement forms help employees accurately report and claim vehicle expenses for work-related travel. These forms typically include fields for date, purpose, starting and ending locations, miles driven, and reimbursement rate. Using clear examples ensures proper documentation and smooth processing of mileage claims.

Mileage Reimbursement Form Sample PDF Viewer

Image example of Mileage Reimbursement Form:

Mileage Reimbursement Form Samples

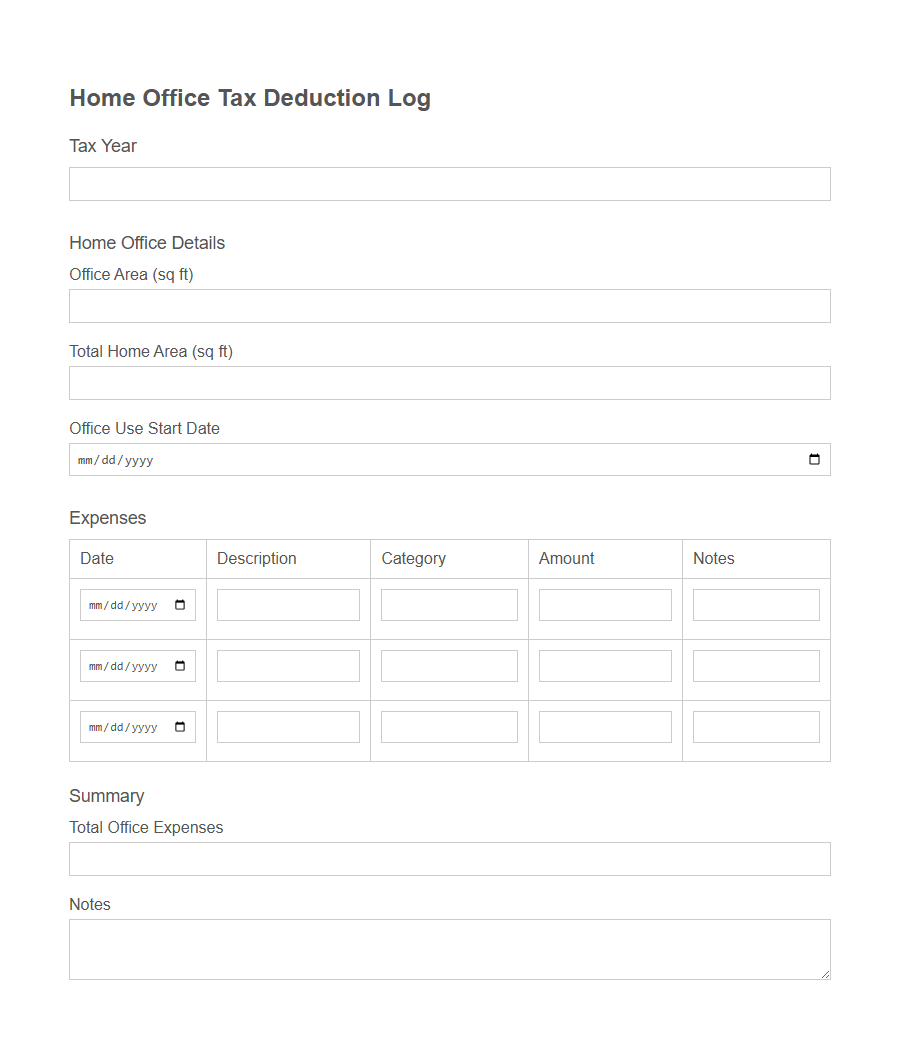

Home Office Tax Deduction Log - PDF - HTML

Employee Travel Expense Report Template - PDF - HTML

Delivery Driver Mileage Tracking Sheet - PDF - HTML

Freelance Contractor Mileage Log - PDF - HTML

Real Estate Agent Client Visit Mileage Sheet - PDF - HTML

Nonprofit Volunteer Mileage Reimbursement Form - PDF - HTML

Ride-Share Driver Daily Mileage Record - PDF - HTML

Field Technician Mileage and Expense Tracker - PDF - HTML

Medical Sales Representative Mileage Report - PDF - HTML

Personal Vehicle Use Authorization Form - PDF - HTML

Mobile Healthcare Provider Mileage Log - PDF - HTML

Construction Site Visit Mileage Sheet - PDF - HTML

Insurance Adjuster Mileage Log Template - PDF - HTML

Counseling Session Mileage Claim Form - PDF - HTML

Teacher Field Trip Transportation Mileage Report - PDF - HTML

What Is a Mileage Reimbursement Form?

A Mileage Reimbursement Form is a document used to claim compensation for travel expenses incurred using a personal vehicle for work-related purposes.

This form records details such as the miles driven, date of travel, purpose of the trip, and the reimbursement rate. It helps organizations accurately track and reimburse employees for business travel costs.

Importance of Tracking Mileage Expenses

Tracking mileage expenses accurately is essential for proper reimbursement and financial record keeping. Using a Mileage Reimbursement Form ensures employees are fairly compensated for business travel costs.

- Ensures Accurate Reimbursement - Detailed mileage tracking helps calculate precise reimbursements based on the distance traveled for work-related activities.

- Facilitates Tax Deductions - Maintaining a documented record of mileage supports tax claims and compliance with IRS guidelines.

- Improves Budget Management - Monitoring mileage expenses helps organizations control travel costs and allocate resources effectively.

Consistent use of a Mileage Reimbursement Form promotes transparency and accountability in managing travel expenses.

Key Components of a Mileage Reimbursement Form

A Mileage Reimbursement Form is essential for documenting travel expenses incurred during work-related trips. It ensures accurate tracking and timely reimbursement of mileage costs for employees.

Key components include the date of travel, starting and ending locations, total miles driven, purpose of the trip, and the employee's signature.

Who Should Use a Mileage Reimbursement Form?

A Mileage Reimbursement Form is essential for employees who use their personal vehicles for work-related travel and seek to recover their fuel and maintenance expenses. This form ensures accurate tracking and proper compensation for business miles driven.

- Employees Who Drive for Work Purposes - These individuals use their personal cars for business errands, client meetings, or site visits and need to document mileage for reimbursement.

- Freelancers and Contractors - Independent workers often travel to various locations and require a formal method to claim travel expenses from clients or agencies.

- Managers and Field Staff - Professionals responsible for overseeing operations or conducting fieldwork frequently incur travel costs deserving reimbursement through an official form.

How to Accurately Complete a Mileage Reimbursement Form

Completing a mileage reimbursement form accurately ensures that employees receive the correct compensation for their travel expenses. Proper documentation helps maintain clear financial records and supports expense verification.

- Record the Date and Purpose - Note the specific date of the trip and clearly describe the reason for the travel to provide context for the reimbursement request.

- Calculate Mileage Precisely - Use a reliable method such as a GPS tracker or odometer readings to determine the exact miles traveled during the business trip.

- Attach Supporting Documentation - Include relevant receipts, maps, or logs to verify the mileage claimed and facilitate the approval process.

Common Errors to Avoid in Mileage Reporting

Common errors to avoid in mileage reporting include failing to accurately record start and end locations, which can lead to incorrect distance calculations. Another frequent mistake is neglecting to submit receipts or supporting documentation, making it difficult to verify the reimbursement claim. Lastly, using inconsistent or incorrect mileage rates can result in improper reimbursement amounts and potential budget discrepancies.

IRS Guidelines for Mileage Reimbursement

What are the IRS guidelines for mileage reimbursement? The IRS sets a standard mileage rate that businesses must use to calculate deductible vehicle expenses. This rate is updated annually and helps ensure consistent and fair reimbursement practices.

How should mileage be documented according to IRS rules? Businesses and employees must keep accurate records of the date, purpose, and miles driven for each trip. This documentation is essential to support mileage reimbursement claims and comply with IRS requirements.

Can personal vehicle use be reimbursed under IRS rules? Yes, the IRS allows reimbursement for business use of personal vehicles at the standard mileage rate. Personal use miles are excluded from reimbursement to avoid tax implications.

What happens if reimbursement exceeds the IRS standard mileage rate? Excess reimbursement over the IRS rate is generally considered taxable income to the employee. Employers must report the excess amount as wages on the employee's tax return.

Are there exceptions to using the standard mileage rate? The IRS permits actual expense reimbursement if properly substantiated and consistently applied by the business. However, this method requires detailed records of all vehicle expenses including gas, maintenance, and insurance.

Benefits of Using a Standardized Form

Using a standardized mileage reimbursement form ensures accurate and consistent mileage tracking for all employees. It simplifies the approval process by providing clear and uniform documentation. This efficiency reduces errors and accelerates reimbursement payments, benefiting both staff and finance departments.

Digital Tools for Mileage Tracking and Reimbursement

Mileage reimbursement forms are essential for accurately documenting travel expenses for business purposes.

Digital tools for mileage tracking and reimbursement simplify the process by automatically recording distances traveled using GPS technology. These tools reduce errors, save time, and ensure employees receive timely and precise reimbursements.