A direct deposit authorization form is essential for securely setting up electronic fund transfers between an employer or payer and a recipient's bank account. It captures critical banking details and authorizes the organization to deposit payments directly, ensuring accuracy and timeliness. Examples of these forms highlight the necessary components and variations across different institutions and use cases.

Direct Deposit Authorization Form Sample PDF Viewer

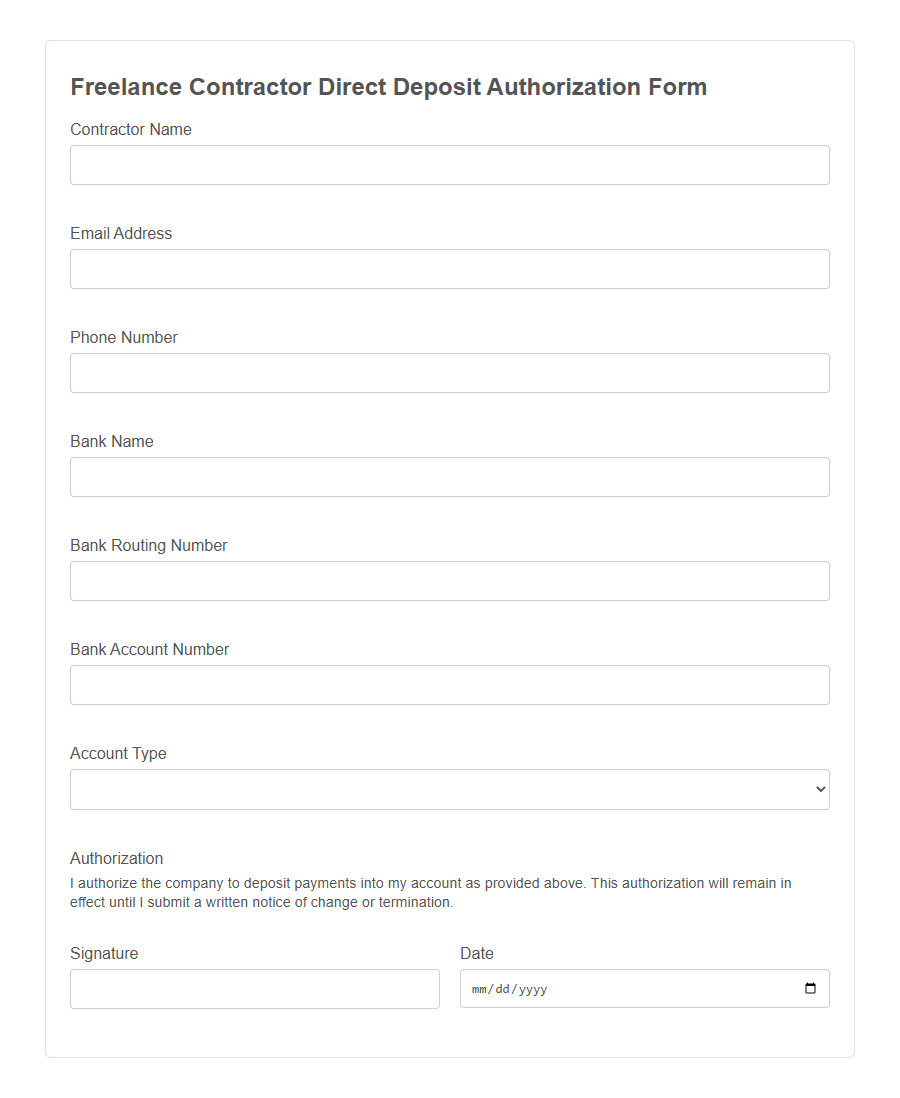

Image example of Direct Deposit Authorization Form:

Direct Deposit Authorization Form Samples

Freelance Contractor Direct Deposit Authorization Form - PDF - HTML

Employee Payroll Direct Deposit Authorization Form - PDF - HTML

Vendor Payment Direct Deposit Authorization Form - PDF - HTML

Landlord Rent Collection Direct Deposit Authorization Form - PDF - HTML

Child Support Recipient Direct Deposit Authorization Form - PDF - HTML

Social Security Benefit Direct Deposit Authorization Form - PDF - HTML

Insurance Claim Payout Direct Deposit Authorization Form - PDF - HTML

Scholarship Fund Direct Deposit Authorization Form - PDF - HTML

Loan Disbursement Direct Deposit Authorization Form - PDF - HTML

Parent-to-Student Allowance Direct Deposit Authorization Form - PDF - HTML

Membership Dues Direct Deposit Authorization Form - PDF - HTML

Utility Refund Direct Deposit Authorization Form - PDF - HTML

Affiliate Marketing Payment Direct Deposit Authorization Form - PDF - HTML

Nonprofit Grant Distribution Direct Deposit Authorization Form - PDF - HTML

Real Estate Commission Direct Deposit Authorization Form - PDF - HTML

What is a Direct Deposit Authorization Form?

A Direct Deposit Authorization Form is a document that allows an individual to give permission for their paycheck or other funds to be electronically deposited into their bank account.

It typically includes personal information, bank account details, and the account holder's signature to authorize the transfer. Employers or payers use this form to ensure accurate and timely direct deposits, eliminating the need for paper checks.

Key Components of a Direct Deposit Authorization Form

A Direct Deposit Authorization Form is essential for setting up electronic payments directly into a bank account. It ensures accurate and timely transfer of funds between the payer and the payee.

- Personal Information - Captures the individual's name, address, and contact details to verify the identity of the account holder.

- Bank Account Details - Includes the bank's name, routing number, and account number to direct funds to the correct financial institution.

- Authorization Statement - Grants permission for the payer to deposit funds electronically and for the bank to accept these deposits.

This form streamlines payment processes, increasing security and convenience for both employers and employees.

Benefits of Using Direct Deposit Authorization Forms

Using a Direct Deposit Authorization Form ensures employees receive their payments quickly and securely, eliminating the need for paper checks. It reduces the risk of lost or stolen checks and simplifies payroll processing for employers. This method provides convenience, saving time and effort for both employees and employers by automating the deposit of funds directly into bank accounts.

How to Fill Out a Direct Deposit Authorization Form

Filling out a Direct Deposit Authorization Form ensures your payments are securely deposited into your bank account. Properly completing each section avoids delays and errors in payment processing.

- Provide personal information - Enter your full name, address, and contact details exactly as they appear on your identification documents.

- Input bank account details - Write your bank's name, account number, and routing number clearly to direct funds accurately.

- Sign and date the form - Authorize the transaction by signing and dating the form to validate your consent for direct deposit.

Common Mistakes to Avoid

Direct Deposit Authorization Forms are essential for ensuring timely and accurate payment transfers.

Common mistakes include entering incorrect bank account numbers or forgetting to sign the form, which can delay the deposit process. Double-checking all information and submitting the form promptly helps avoid these issues.

Security Considerations and Data Protection

Direct Deposit Authorization Forms require sensitive personal and financial information, making data protection a top priority. Ensuring secure collection, transmission, and storage of this data helps prevent unauthorized access and fraud.

Implementing encryption and strict access controls safeguards the information throughout the entire process.

Who Needs a Direct Deposit Authorization Form?

A Direct Deposit Authorization Form is necessary for anyone who wants their payments deposited directly into their bank account. This form ensures accurate and timely transfer of funds from an employer or other payer to the individual's bank.

- Employees - They need to submit this form to receive their salary or wages electronically instead of by paper check.

- Vendors and Contractors - This form is required to facilitate direct payment for services rendered without delays.

- Benefit Recipients - Individuals receiving social security, pension, or other government benefits use this form to authorize direct deposit payments securely.

Step-by-Step Guide to Submitting the Form

Begin by obtaining the Direct Deposit Authorization Form from your employer or financial institution. Fill out the form carefully, providing accurate bank account details such as your account number and routing number. Submit the completed form to the designated department or representative, ensuring you keep a copy for your records.

Frequently Asked Questions About Direct Deposit

What is a Direct Deposit Authorization Form? A Direct Deposit Authorization Form allows employers to deposit your paycheck directly into your bank account. It streamlines payment processing and ensures timely access to your funds.

How do I complete a Direct Deposit Authorization Form? You need to provide your bank account number, routing number, and a voided check or bank document. Make sure all information is accurate to avoid payment delays.

Is it safe to use direct deposit? Yes, direct deposit is a secure method of payment that reduces the risk of lost or stolen checks. Financial institutions use encryption and security protocols to protect your information.

Can I change my bank account after submitting the form? Yes, you can update your direct deposit information by completing a new authorization form. Notify your employer or payroll department promptly to prevent payment interruptions.

How long does it take for direct deposit to start? It typically takes one to two pay cycles for direct deposit to become effective. Timing depends on your employer's payroll schedule and bank processing times.

What if I don't have a bank account? Some employers offer alternative payment options like pay cards or paper checks. Check with your payroll department to explore available choices.

Can I split my direct deposit into multiple accounts? Many employers allow splitting payments between checking and savings accounts. Verify with your employer if this option is supported and submit the necessary details.