An investment proposal submission form template streamlines the process of presenting business opportunities to potential investors. Including key elements such as project overview, financial projections, and risk assessment enhances clarity and professionalism. Utilizing well-crafted examples ensures completeness and improves the chances of securing funding.

Investment Proposal Submission Form Template Sample PDF Viewer

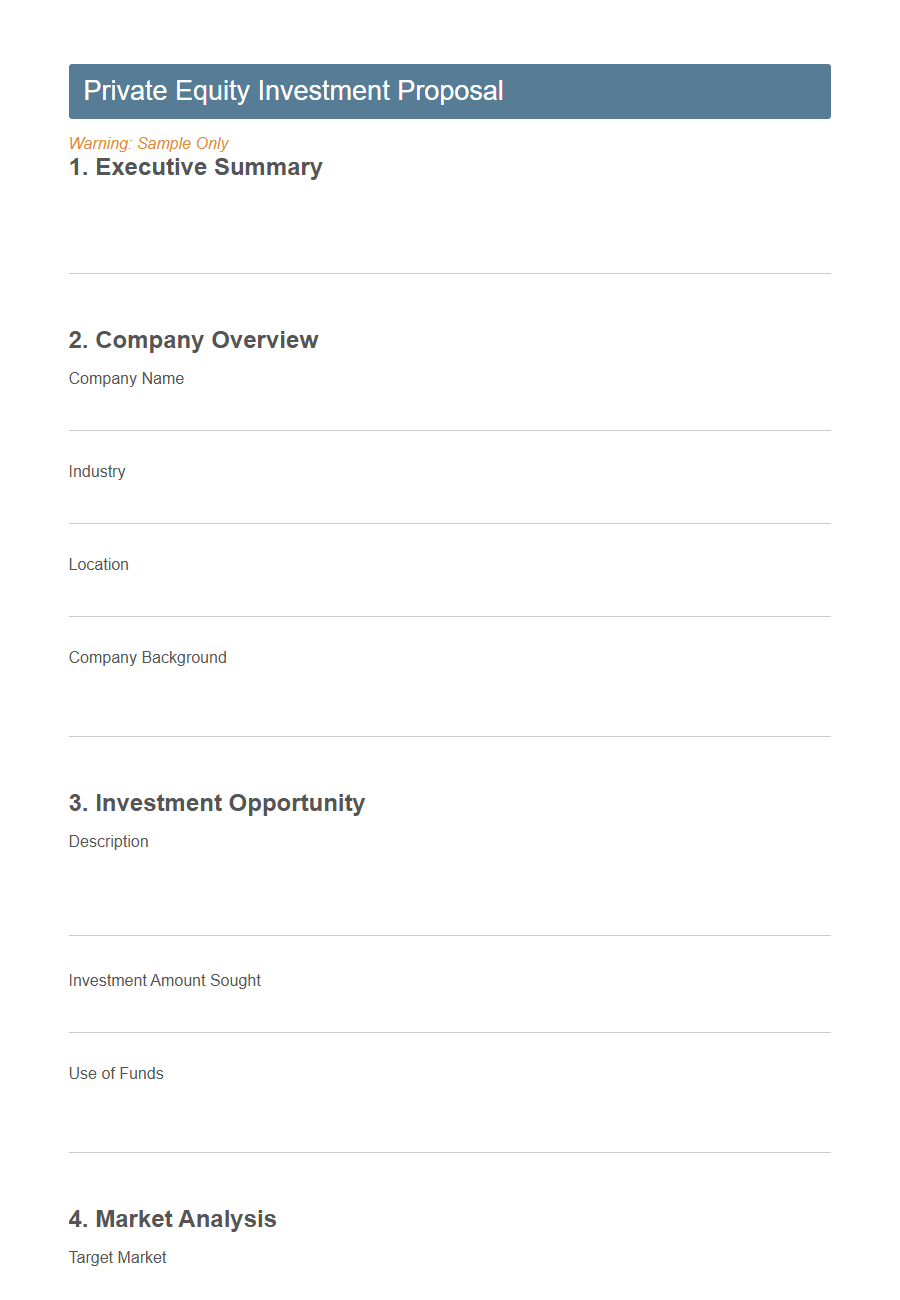

Image example of Investment Proposal Submission Form Template:

Investment Proposal Submission Form Template Samples

Private Equity Investment Proposal Template - PDF - HTML

Real Estate Investment Pitch Form - PDF - HTML

Early-Stage Startup Investment Submission Template - PDF - HTML

Angel Investor Project Application Form - PDF - HTML

Renewable Energy Project Investment Proposal Template - PDF - HTML

SaaS Investment Proposal Submission Form - PDF - HTML

Franchise Investment Opportunity Template - PDF - HTML

Impact Investing Project Proposal Form - PDF - HTML

Fintech Startup Investment Defense Template - PDF - HTML

Biotech Venture Capital Submission Form - PDF - HTML

Hospitality Business Investment Proposal Template - PDF - HTML

Mining Project Investment Application Form - PDF - HTML

Art Investment Project Submission Template - PDF - HTML

Introduction to Investment Proposal Submission Forms

An Investment Proposal Submission Form template is a structured document used to present investment ideas clearly and professionally. It helps streamline the evaluation process for potential investors or decision-makers.

- Purpose - Captures essential details of the investment opportunity to ensure thorough understanding.

- Clarity - Organizes information in a consistent format to facilitate easy comparison among proposals.

- Efficiency - Saves time by standardizing submissions and simplifying review procedures.

This form template is essential for communicating investment plans effectively and increasing the likelihood of approval.

Importance of a Well-Structured Submission Form

A well-structured Investment Proposal Submission Form ensures clear communication of key project details, facilitating informed decision-making by stakeholders. It streamlines the evaluation process by organizing information logically and comprehensively.

Clarity and organization in the submission form enhance the likelihood of approval and successful project funding.

Key Components of an Investment Proposal Template

An Investment Proposal Submission Form Template streamlines the process of presenting investment opportunities clearly and professionally.

The key components of the template include an executive summary that outlines the business idea and objectives concisely. It also features sections for financial projections, detailing expected revenue, expenses, and profitability to give investors a clear financial picture.

Essential Sections to Include in Your Form

An Investment Proposal Submission Form Template is a crucial tool for standardizing project evaluations.

The form should capture detailed investment objectives and a clear summary of the proposal. Including sections for financial projections and risk assessments facilitates informed decision-making.

Essential sections in your form begin with the proposer's contact information and company background.

These details ensure proper follow-up and context for the evaluation team. Including a dedicated space for the investment amount requested helps clarify funding needs upfront.

Another critical section is the project description, outlining the purpose, scope, and expected outcomes.

This area provides reviewers with a comprehensive understanding of the investment's potential impact. Concluding with an approval workflow or signature section formalizes the submission and review process.

Customizing the Template for Different Investments

Investment Proposal Submission Form Templates can be tailored to address the unique requirements of various investment types. Customizing these templates ensures relevant information is captured, streamlining the evaluation process.

- Industry-Specific Sections - Incorporate fields that reflect the distinct metrics and criteria pertinent to sectors like technology, real estate, or healthcare.

- Variable Risk Assessment - Adapt risk evaluation components to suit the risk profiles of different investment opportunities, enhancing accuracy in decision-making.

- Flexible Financial Projections - Modify financial forecast sections to align with the investment's time horizon and expected returns, providing clearer insights for investors.

Tips for Creating an Effective Submission Form

Design the investment proposal submission form template to be clear and concise, ensuring all necessary information is requested without overwhelming the user. Use structured sections and guided prompts to help applicants provide detailed and relevant data efficiently. Incorporate validation checks to reduce errors and streamline the review process for faster decision-making.

Common Mistakes to Avoid in Investment Proposal Forms

Investment proposal submission forms are crucial for clearly conveying project details and securing funding. Avoiding common mistakes in these forms improves the chances of approval and demonstrates professionalism.

- Incomplete Information - Omitting key project details or financial data can lead to confusion and rejection by investors.

- Unclear Objectives - Vague or poorly defined goals make it difficult for reviewers to understand the proposal's purpose and potential impact.

- Ignoring Formatting Guidelines - Not following the prescribed template can create a disorganized presentation that undermines the proposal's credibility.

Best Practices for Reviewing Submitted Proposals

How can you effectively review submitted investment proposals to ensure quality and alignment? Establish clear evaluation criteria before reviewing to maintain consistency and objectivity. Involve multiple reviewers to gain diverse perspectives and minimize bias.

What key factors should be prioritized during the assessment of investment proposals? Focus on the proposal's clarity, feasibility, financial projections, and alignment with strategic goals. Verify that all required documentation and supporting data are complete and accurate.

How important is documentation and record-keeping in the review process? Keeping detailed records of evaluations and feedback helps track decision-making and supports transparency. This practice also facilitates future audits and continuous improvement of the proposal process.