Check request forms streamline the process of obtaining authorization for payments by providing clear documentation of expenses. These forms typically include details such as payee information, payment amount, and approval signatures to ensure accuracy and accountability. Examples of check request forms demonstrate various formats tailored to different organizational needs and financial practices.

Check Request Form Sample PDF Viewer

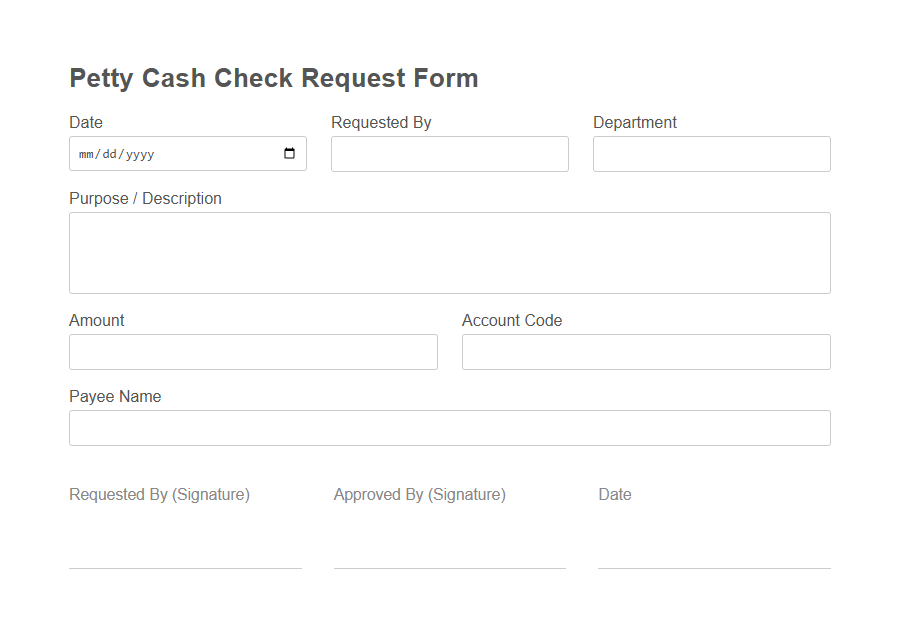

Image example of Check Request Form:

Check Request Form Samples

Petty Cash Check Request Form - PDF - HTML

Vendor Payment Check Request Template - PDF - HTML

Employee Reimbursement Check Request Form - PDF - HTML

Nonprofit Grant Disbursement Check Request - PDF - HTML

Lease Security Deposit Refund Check Request - PDF - HTML

Medical Expense Check Request Template - PDF - HTML

Event Fund Advance Check Request Form - PDF - HTML

School Field Trip Check Request - PDF - HTML

Utility Refund Check Request Template - PDF - HTML

Construction Project Payment Check Request - PDF - HTML

Insurance Claim Check Request Form - PDF - HTML

Travel Expense Check Request Template - PDF - HTML

Membership Fee Refund Check Request - PDF - HTML

Donation Disbursement Check Request - PDF - HTML

Freelance Contractor Payment Check Request Form - PDF - HTML

Understanding the Purpose of a Check Request Form

A Check Request Form is a document used to initiate the process of issuing a payment from an organization. It ensures proper authorization and documentation for expenses that require payment through a check.

The form helps maintain financial accuracy and accountability within the organization.

Key Components of a Check Request Form

A Check Request Form is essential for authorizing payments within an organization. It ensures accuracy and accountability in financial transactions.

- Requester Information - Includes the name and department of the person initiating the request to maintain accountability.

- Payment Details - Specifies the amount, payee, and reason for the payment to ensure correct processing.

- Approval Signatures - Requires signatures from authorized personnel to validate and authorize the expense.

When to Use a Check Request Form

A Check Request Form is used to formally request a payment or reimbursement when an invoice or direct payment is not applicable. It ensures proper documentation and approval for financial transactions within an organization.

- Vendor Payments - Use the form to request payment for services or goods received without a standard invoice.

- Employee Reimbursements - Submit a check request to recover out-of-pocket expenses incurred during business activities.

- Miscellaneous Expenses - Use the form for any approved expenses that require payment but do not have a purchase order or invoice.

Using a Check Request Form helps maintain accurate financial records and authorizes timely payments.

Step-by-Step Guide to Completing a Check Request Form

To complete a Check Request Form, start by filling in the payee's name and address accurately. Specify the amount requested and provide a clear description of the purpose for the payment. Finally, attach all relevant receipts or supporting documents and obtain the necessary approvals before submitting the form.

Required Supporting Documentation

The Check Request Form requires specific supporting documentation to ensure proper processing and approval.

Required documents typically include original invoices, receipts, or contracts that correspond to the payment request. These documents must be attached to the form to verify the legitimacy of the expense and comply with company policies.

Common Mistakes to Avoid

Filling out the Check Request Form inaccurately can lead to payment delays and processing errors. Common mistakes include missing signatures, incorrect payee information, and incomplete details about the expense. Ensuring all sections are thoroughly and correctly completed helps streamline the approval process and avoid unnecessary follow-ups.

Approval Workflow and Authorization Process

A Check Request Form streamlines the process of obtaining funds by documenting payment needs.

The Approval Workflow ensures that each request is reviewed and authorized by the appropriate personnel before payment is processed. This step reduces errors and prevents unauthorized expenditures.

The Authorization Process verifies the legitimacy and budget compliance of the request through designated approvers. It establishes control measures that maintain financial accountability within the organization.

Digital vs. Paper Check Request Forms

Check request forms streamline the payment approval process, with digital versions offering enhanced efficiency over traditional paper forms. Choosing between digital and paper depends on organizational needs for speed, accuracy, and record-keeping.

- Digital Check Request Forms - Enable faster processing and reduce errors through automated data entry and validation.

- Paper Check Request Forms - Require manual handling, which can increase processing time and the risk of lost documents.

- Record Management - Digital forms allow for easy storage and retrieval of records, improving audit trails compared to physical files.

Best Practices for Efficient Processing

How can organizations ensure the efficient processing of check request forms? Clear guidelines and accurate information on the form minimize delays and errors. Prompt approvals and thorough documentation support smooth financial workflows.