Suspicious activity reporting forms play a crucial role in identifying and preventing financial crimes such as money laundering and fraud. These forms require detailed and accurate descriptions of unusual transactions or behaviors that may indicate illicit activities. Providing clear examples helps organizations and individuals recognize red flags and ensures compliance with regulatory requirements.

Suspicious Activity Reporting Form Sample PDF Viewer

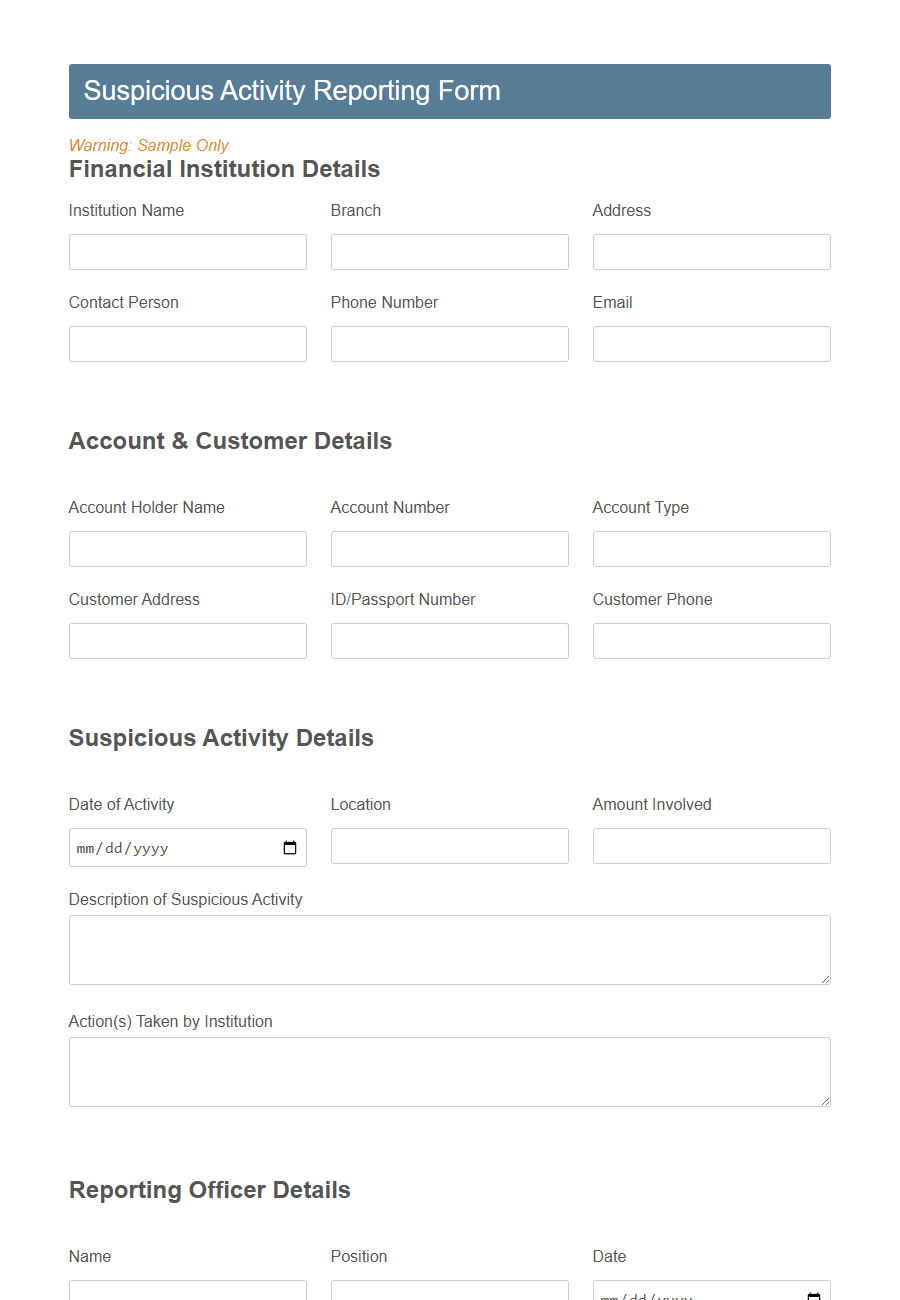

Image example of Suspicious Activity Reporting Form:

Suspicious Activity Reporting Form Samples

Suspicious Activity Reporting Form for Financial Institutions - PDF - HTML

Workplace Suspicious Behavior Incident Report Template - PDF - HTML

Healthcare Facility Suspicious Activity Reporting Form - PDF - HTML

School Campus Suspicious Activity Report Template - PDF - HTML

Real Estate/Property Suspicious Activity Notification Form - PDF - HTML

Public Transport Suspicious Passenger Activity Report - PDF - HTML

Hotel Guest Suspicious Behavior Reporting Template - PDF - HTML

Retail Store Suspicious Transaction Reporting Form - PDF - HTML

Online Banking Suspicious Login Activity Form - PDF - HTML

Suspicious Package Detection Report Template - PDF - HTML

Community Watch Suspicious Activity Log Sheet - PDF - HTML

Suspicious Email/Phishing Activity Report Template - PDF - HTML

Government Agency Suspicious Activity Intake Form - PDF - HTML

Introduction to Suspicious Activity Reporting Forms

What is the purpose of a Suspicious Activity Reporting Form? A Suspicious Activity Reporting Form is designed to identify and document unusual or potentially illegal activities. It helps organizations and authorities detect and prevent fraud, money laundering, and other financial crimes.

Importance of Suspicious Activity Reporting

Suspicious Activity Reporting forms play a crucial role in identifying and preventing illegal activities.

These forms enable organizations to document and communicate unusual or potentially harmful behavior promptly. Timely reporting helps authorities take necessary action to protect public safety and maintain regulatory compliance.

Key Components of a Suspicious Activity Reporting Form

A Suspicious Activity Reporting Form is essential for documenting unusual or potentially illegal activities. It helps organizations comply with legal requirements and supports investigations.

- Reporter Information - Captures the identity and contact details of the individual submitting the report for follow-up purposes.

- Details of Suspicious Activity - Describes the nature, date, time, and location of the suspicious behavior or transaction involved.

- Subject Information - Includes information about the person or entity involved, such as name, account number, and any relevant identifying details.

Who Should Use the Reporting Form

The Suspicious Activity Reporting Form is designed for individuals and organizations to report unusual or potentially illegal activities. It ensures timely communication with relevant authorities to prevent fraud and criminal behavior.

- Financial Institutions - Banks, credit unions, and other financial entities should use the form to report suspicious transactions that may involve money laundering or fraud.

- Employees and Employees of Regulated Entities - Personnel within organizations must report activities that seem unusual or violate regulatory compliance to maintain organizational integrity.

- Compliance Officers - Professionals responsible for regulatory adherence must file reports when detecting suspicious behavior to support legal investigations.

The form is essential for those tasked with monitoring and preventing illegal or unethical activities within their organizations or industries.

Types of Activities That Warrant Reporting

Suspicious Activity Reporting Forms are used to document behaviors that may indicate financial crimes such as money laundering or fraud. Activities warranting reporting include unusual transactions that lack a clear business purpose or appear inconsistent with a customer's known patterns. Other reportable activities involve attempts to evade regulatory requirements or transactions involving high-risk jurisdictions.

Step-by-Step Guide to Filling Out the Form

The Suspicious Activity Reporting Form is a critical document used to report unusual or potentially illegal activities. Accurate completion of this form ensures that authorities can investigate and respond effectively.

Begin by carefully filling in your personal and contact information to establish the source of the report.

Describe the suspicious activity in detail, including dates, times, locations, and any involved parties to provide a clear context. Avoid vague statements and stick to factual observations.

Specify any supporting evidence or documentation that can corroborate your report. Attach relevant files or records if the form allows.

Review the filled form thoroughly to ensure all required fields are completed and information is accurate. Submit the form according to the instructions provided, whether electronically or in person.

Common Mistakes to Avoid When Reporting

Filing a Suspicious Activity Reporting Form requires accuracy and attention to detail to ensure effective investigation. Avoid common mistakes that can delay or complicate the review process.

- Incomplete Information - Failing to provide all relevant details can hinder law enforcement's ability to assess the report properly.

- Submitting Unverified Suspicion - Reporting without a reasonable basis may lead to unnecessary investigations and wasted resources.

- Ignoring Deadlines - Missing the required submission timeframe can result in non-compliance and potential penalties.

Legal and Compliance Considerations

Suspicious Activity Reporting (SAR) forms are critical tools used by organizations to report potential illegal or suspicious activities to relevant authorities.

Legal frameworks require entities to file SARs to comply with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations. Failing to submit accurate and timely SARs can result in significant legal penalties and reputational damage.

Compliance considerations mandate that organizations establish robust internal controls and employee training programs to identify and report suspicious activities effectively. Properly documenting and protecting the confidentiality of SAR filings is essential to avoid legal repercussions and ensure regulatory adherence.

Confidentiality and Data Protection Measures

The Suspicious Activity Reporting Form is designed to ensure the highest level of confidentiality for all submitted information. Advanced data protection measures, including encryption and restricted access, safeguard sensitive details from unauthorized disclosure. Compliance with relevant privacy laws guarantees that personal data is handled securely and responsibly throughout the reporting process.