A retail cash handling log form is essential for accurately tracking daily cash transactions and ensuring accountability in store operations. This log helps prevent discrepancies by documenting cash inflows and outflows systematically. Using detailed examples can guide employees in maintaining consistent and error-free records.

Retail Cash Handling Log Form Sample PDF Viewer

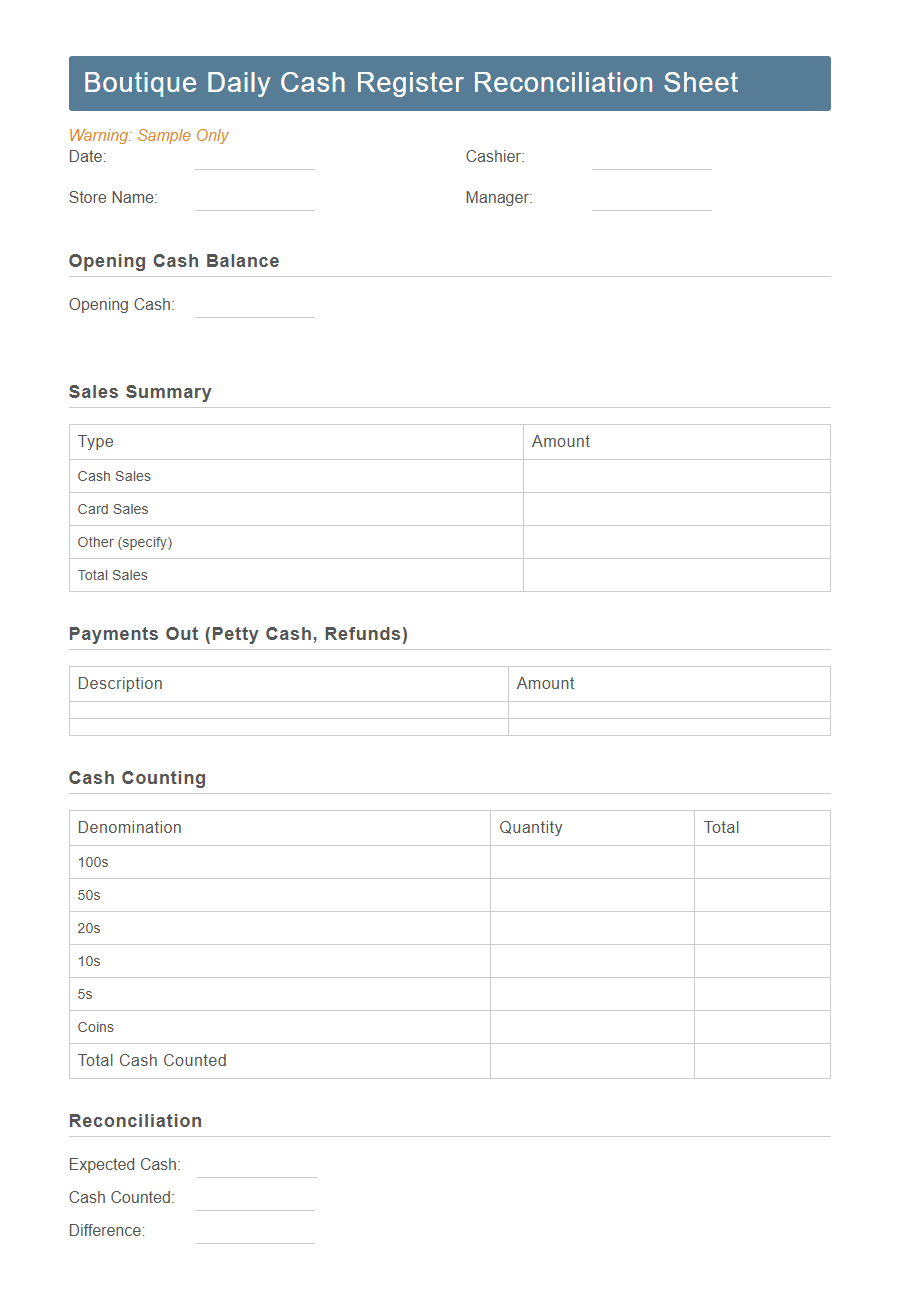

Image example of Retail Cash Handling Log Form:

Retail Cash Handling Log Form Samples

Boutique Daily Cash Register Reconciliation Sheet - PDF - HTML

Mall Kiosk Petty Cash Tracking Template - PDF - HTML

Small Neighborhood Grocery Cash Drop Log - PDF - HTML

Specialty Wine Shop Deposit Register Form - PDF - HTML

Artisan Craft Pop-Up Vendor Cash Log - PDF - HTML

Coffee Stand Shift Change Cash Summary Sheet - PDF - HTML

Flower Shop Till Audit Checklist Template - PDF - HTML

Consignment Store Cash Payout Record - PDF - HTML

Bookstore Refund & Cash Correction Slip - PDF - HTML

Farmers Market Stall Cash Ledger - PDF - HTML

Mobile Retail Truck Cash Bag Tracker - PDF - HTML

Thrift Store End-of-Day Cash Count Form - PDF - HTML

Souvenir Stand Event Cash Log - PDF - HTML

Local Bakery Deposit Bag Inventory Sheet - PDF - HTML

Independent Pharmacy Cash Float Monitoring Form - PDF - HTML

Introduction to Retail Cash Handling Log Forms

A Retail Cash Handling Log Form is a critical document used to track cash transactions in retail environments. It ensures accuracy and accountability during cash handling processes.

- Transaction Tracking - Records each cash inflow and outflow to maintain accurate financial records.

- Accountability - Helps assign responsibility to employees handling cash, reducing errors and theft risks.

- Audit Facilitation - Provides a clear, organized log for auditing and financial reviews, supporting business compliance.

Importance of Accurate Cash Handling Records

Maintaining accurate cash handling records is essential for preventing discrepancies and ensuring financial accountability. A retail cash handling log form provides a structured way to track all cash transactions, reducing errors and potential fraud. Consistent documentation builds trust among staff and supports efficient audits and financial reporting.

Key Components of a Cash Handling Log Form

A Retail Cash Handling Log Form captures detailed records of cash transactions to ensure accuracy and accountability in daily operations. It typically includes essential information such as date, time, cashier name, transaction amount, and payment method.

Accurate documentation of cash inflows and outflows helps prevent discrepancies and supports financial audits.

Step-by-Step Guide to Using a Cash Log Form

A Retail Cash Handling Log Form helps track all cash transactions accurately throughout the day. Begin by recording the opening cash balance and noting every cash receipt and payment systematically. End the process by calculating the closing balance and verifying it against the physical cash on hand to ensure accuracy.

Best Practices for Secure Cash Management

Effective cash management is crucial for retail operations to prevent losses and ensure accountability. A well-maintained Retail Cash Handling Log Form supports secure and accurate tracking of all cash transactions.

- Consistent Record-Keeping - Maintain detailed entries for each cash transaction to enable clear tracking and reconciliation.

- Restricted Access - Limit access to the cash handling log and cash drawers to authorized personnel only to reduce risk of theft.

- Regular Audits - Conduct frequent reviews of cash logs and physical cash counts to detect discrepancies promptly.

Common Mistakes in Cash Logging and How to Avoid Them

Accurate cash handling logs are crucial for maintaining retail financial integrity. Common mistakes in cash logging can lead to discrepancies and financial losses.

- Incorrect Amount Entries - Recording wrong cash amounts often causes balance errors and complicates audits.

- Omitting Transaction Details - Failing to note transaction specifics reduces traceability and accountability.

- Delayed Log Updates - Postponing cash log entries increases the risk of miscounts and theft.

Consistent training and systematic checks help prevent errors and improve cash handling accuracy.

Digital vs. Paper Cash Handling Forms

A Retail Cash Handling Log Form is essential for accurate tracking of daily cash transactions in stores.

Digital cash handling forms streamline data entry and reduce human errors compared to traditional paper forms. They enable real-time updates and easy access to financial records, enhancing overall cash management efficiency.

Compliance and Audit Requirements for Retail Cash Logs

Retail cash handling log forms are essential tools for maintaining accurate records of daily cash transactions.

These logs ensure compliance with internal controls and regulatory requirements by documenting every cash movement systematically. Properly maintained cash handling logs facilitate efficient audits and help detect discrepancies early.

Tips for Training Staff on Cash Log Procedures

How can you effectively train staff on using the Retail Cash Handling Log Form? Begin by offering clear, step-by-step instructions to ensure every employee understands the importance of accurate cash logging. Provide hands-on practice sessions to build confidence and reduce errors during real transactions.