Zakat, an essential pillar of Islam, mandates charitable giving to support those in need. Examples of eligible recipients include the poor, widows, orphans, and those burdened by debt. Proper submission of zakat ensures its effective distribution to uplift and empower vulnerable communities.

Zakat (Charitable Giving) Submission Form Sample PDF Viewer

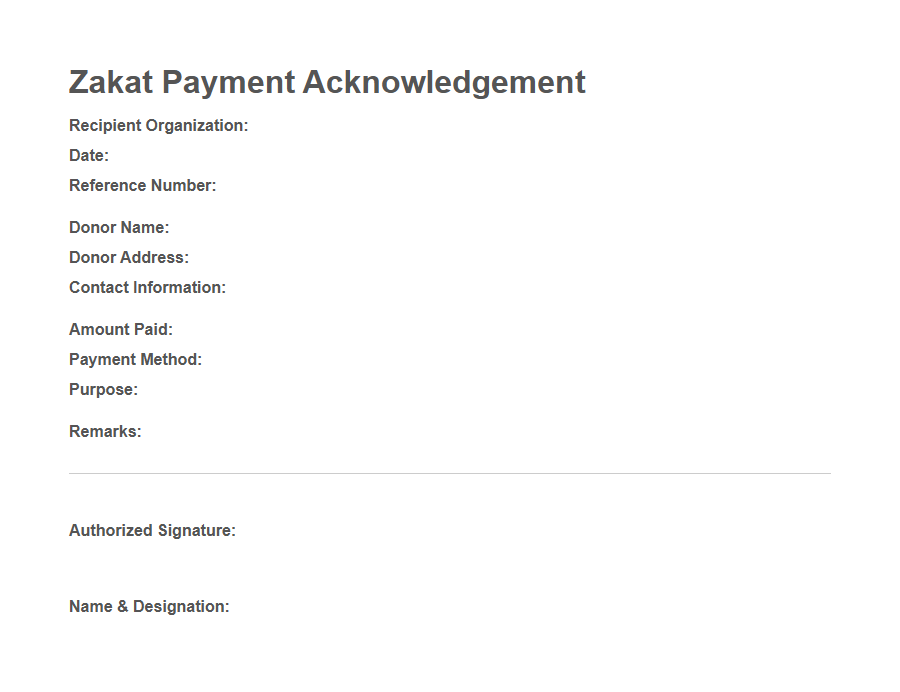

Image example of Zakat (Charitable Giving) Submission Form:

Zakat (Charitable Giving) Submission Form Samples

Zakat Payment Acknowledgement Template - PDF - HTML

Zakat Calculation Worksheet Template - PDF - HTML

Zakat Distribution Record Form - PDF - HTML

Zakat Recipient Eligibility Verification Template - PDF - HTML

Annual Zakat Contribution Statement - PDF - HTML

Zakat Refund Request Application - PDF - HTML

Zakat Payment Authorization Letter - PDF - HTML

Zakat Deduction from Salary Consent Form - PDF - HTML

Zakat Project Proposal Submission Form - PDF - HTML

Zakat Asset Declaration Template - PDF - HTML

Emergency Zakat Assistance Request Form - PDF - HTML

Zakat Sponsorship Agreement Template - PDF - HTML

Zakat Compliance Self-Assessment Checklist - PDF - HTML

Understanding Zakat: The Pillar of Charitable Giving

Zakat is a fundamental pillar of Islam that mandates charitable giving to support those in need. Understanding its purpose and calculation helps ensure this religious duty is fulfilled correctly and meaningfully.

- Obligation of Zakat - Muslims who meet the financial criteria are required to give a portion of their wealth annually to help the less fortunate.

- Calculation Principles - Zakat is typically 2.5% of accumulated wealth, including savings and investments, calculated with precision to meet religious guidelines.

- Purpose of Zakat - Beyond charity, Zakat promotes social equity by redistributing wealth and alleviating poverty within the community.

Importance of a Zakat Submission Form

A Zakat submission form ensures accurate calculation and collection of charitable donations, promoting transparency and trust. It simplifies the process for donors by providing clear guidelines and structured input fields. Such a form helps organizations manage funds effectively, ensuring timely distribution to those in need.

Key Components of a Zakat Submission Form

A Zakat submission form is designed to facilitate the organized and transparent collection of charitable donations according to Islamic principles.

The key components of a Zakat submission form typically include the donor's personal information, details of the Zakat amount, and the intended recipient category. These elements ensure accurate record-keeping and proper allocation of funds to those eligible under Islamic law.

Eligibility Criteria for Zakat Recipients

Zakat submission forms require clear identification of eligible recipients to ensure proper distribution of funds. Understanding the criteria helps in supporting those truly in need according to Islamic principles.

- Poverty - Recipients must be those who lack sufficient means to meet basic living expenses and support themselves.

- Debt Relief - Individuals burdened by debts that hinder their financial stability are eligible for zakat assistance.

- Dependents - Those financially responsible for dependents without adequate resources qualify for zakat aid.

Step-by-Step Guide to Completing the Zakat Form

What is the first step in completing the Zakat submission form? Begin by carefully reading the instructions provided to understand the requirements. Ensure you have all necessary personal and financial information ready before starting.

How should you enter your personal details on the form? Fill in your full name, contact information, and identification number accurately. Double-check for any spelling errors to avoid processing delays.

What financial information is needed next on the form? Report your total savings, investments, and assets subject to Zakat. Calculate their current value to ensure the correct amount is declared.

How do you determine the amount of Zakat due? Use the prescribed Nisab threshold to identify if your wealth qualifies for Zakat. Apply the 2.5% rate on the eligible amount to find the payable sum.

What should be done when selecting a recipient for your Zakat? Choose from approved charitable organizations or specify individuals in need. Verify the legitimacy of the chosen receiver to ensure your contribution reaches the intended beneficiaries.

How can you confirm all provided information is correct? Review every section of the form carefully before submission. Correct any mistakes to prevent rejection or delays in processing.

What is the final step in submitting the Zakat form? Submit the completed form through the designated online portal or physical office. Keep a copy of the submission receipt for your records and future reference.

Required Documentation for Zakat Submission

Submitting a Zakat (Charitable Giving) form requires specific documentation to ensure accurate and transparent processing. Essential documents typically include proof of income, asset statements, and identification details.

Providing complete and verifiable records helps facilitate a smooth submission and timely distribution of Zakat funds.

Digital vs. Paper Zakat Forms: Pros and Cons

Zakat submission forms are essential for facilitating charitable giving, with both digital and paper formats offering distinct advantages and challenges. Choosing the right format can impact ease of use, accessibility, and record-keeping efficiency.

- Digital forms offer convenience - Users can submit Zakat quickly from any device with internet access, reducing time and effort.

- Paper forms provide tangible proof - Physical documents allow donors to keep a clear, hard-copy record for personal and official use.

- Digital forms enhance accuracy - Built-in validation features minimize errors and ensure complete submissions.

- Paper forms may limit accessibility - They require physical delivery or mailing, which can delay processing and restrict reach.

- Digital forms support eco-friendly practices - Reducing paper use helps lower environmental impact during the submission process.

- Paper forms can be preferred by less tech-savvy individuals - They provide familiarity and ease of use for those who are not comfortable with digital tools.

Careful consideration of these factors helps organizations optimize Zakat collection methods to suit diverse donor preferences.

Ensuring the Security and Privacy of Donor Information

The Zakat Submission Form is designed with advanced security measures to protect donor information from unauthorized access. Personal and financial data are encrypted to ensure confidentiality throughout the donation process. Strict privacy policies are in place to guarantee that donor details are never shared without explicit consent.

Common Mistakes to Avoid in Zakat Submission

Submitting your Zakat (Charitable Giving) should be done carefully to ensure your contribution reaches those in need correctly.

Common mistakes include incorrect calculation of the payable amount and missing the proper submission deadline. Ensuring accurate details and timely submission prevents delays and complications in the distribution process.