A mortgage pre-approval application form gathers essential financial information to assess a buyer's loan eligibility. Key details typically include income, employment history, credit score, and outstanding debts. Submitting an accurate form helps streamline the home buying process and increases chances of loan approval.

Mortgage Pre-Approval Application Form Sample PDF Viewer

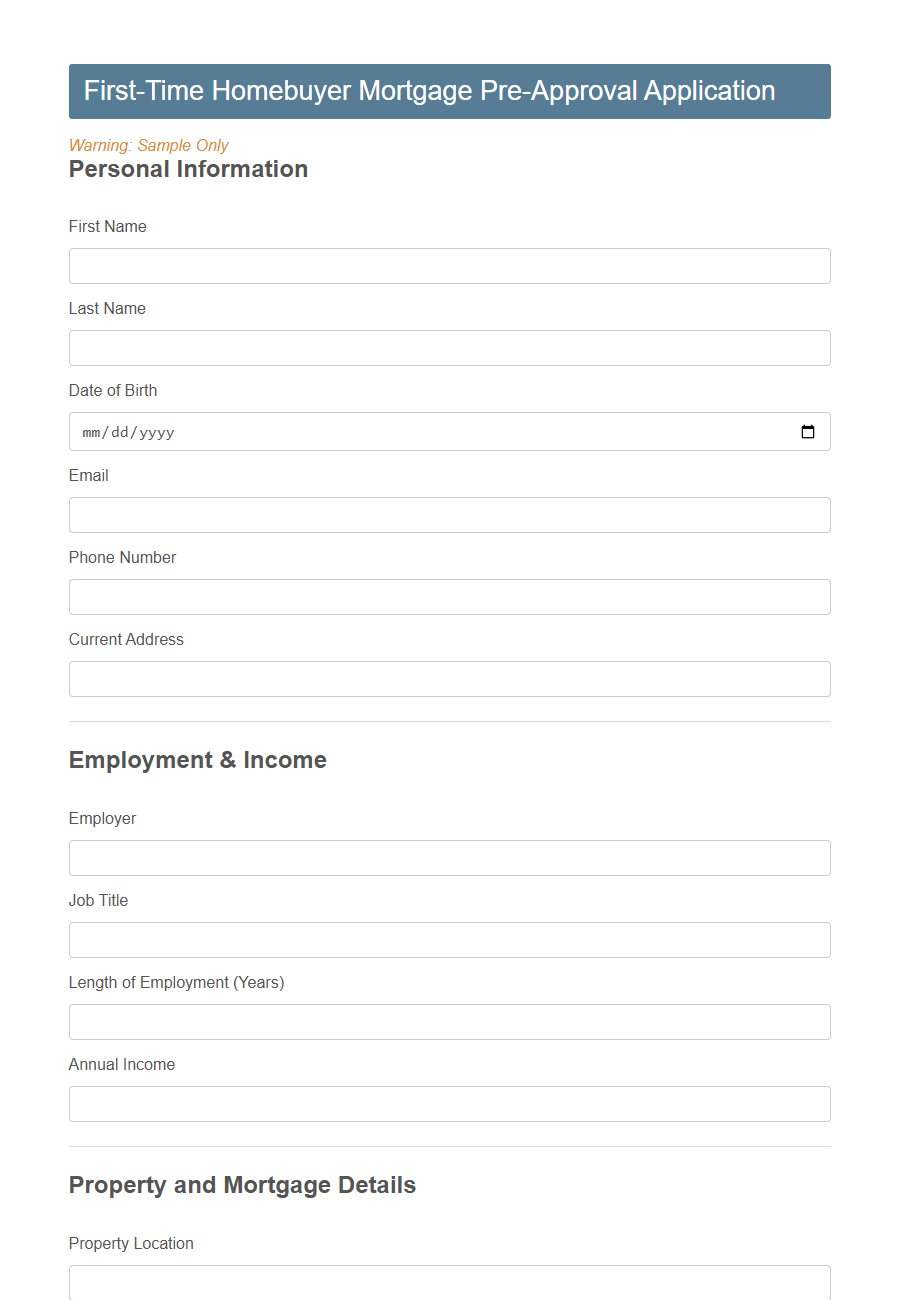

Image example of Mortgage Pre-Approval Application Form:

Mortgage Pre-Approval Application Form Samples

First-Time Homebuyer Mortgage Pre-Approval Application - PDF - HTML

Self-Employed Borrower Mortgage Pre-Approval Form - PDF - HTML

FHA Loan Pre-Approval Application Template - PDF - HTML

VA Loan Mortgage Pre-Approval Questionnaire - PDF - HTML

Jumbo Loan Pre-Approval Application Form - PDF - HTML

Investment Property Mortgage Pre-Approval Sheet - PDF - HTML

Physician Mortgage Loan Pre-Approval Template - PDF - HTML

Low-Income HUD Mortgage Pre-Approval Application - PDF - HTML

Non-Resident Alien Mortgage Pre-Approval Form - PDF - HTML

Condo Purchase Mortgage Pre-Approval Checklist - PDF - HTML

New Construction Home Mortgage Pre-Approval Form - PDF - HTML

Fixed-Rate Mortgage Pre-Approval Application - PDF - HTML

Adjustable-Rate Mortgage (ARM) Pre-Approval Sheet - PDF - HTML

Refinance Mortgage Pre-Approval Request Template - PDF - HTML

Introduction to Mortgage Pre-Approval

Mortgage pre-approval is a crucial first step in the home buying process that helps determine your borrowing capacity. It provides a clear understanding of your financial standing before you start house hunting.

- Pre-qualification vs Pre-approval - Pre-approval involves a thorough review of your financial documents, offering a more accurate estimate than pre-qualification.

- Credit Check - Lenders perform a credit check during pre-approval to assess your creditworthiness and loan eligibility.

- Benefits of Pre-approval - Having a pre-approval letter shows sellers that you are a serious buyer and strengthens your negotiation position.

Completing a mortgage pre-approval application form helps streamline the loan process and sets realistic expectations for homebuyers.

Importance of a Mortgage Pre-Approval Application Form

A Mortgage Pre-Approval Application Form is a critical step in the home buying process. It helps buyers understand their borrowing capacity and strengthens their position when making an offer.

- Defines borrowing limits - The form provides a clear estimate of how much a lender is willing to loan based on the applicant's financial information.

- Enhances credibility with sellers - Having a pre-approval shows sellers that the buyer is serious and financially prepared, making offers more competitive.

- Speeds up the loan process - Pre-approval accelerates final mortgage approval by verifying financial data early in the process.

Key Sections in the Application Form

The Mortgage Pre-Approval Application Form is essential for beginning the home buying process. It helps lenders assess your financial situation and determine how much mortgage you qualify for.

Key sections in the application form include personal information, employment details, income verification, and credit history. These areas provide a comprehensive view of your ability to repay the loan. Accurate completion of these sections accelerates the approval process.

Another important part is the declaration of assets and liabilities. This section helps lenders evaluate your overall financial health and debt obligations.

Details about the property you intend to purchase may also be required. This helps lenders understand the loan-to-value ratio and associated risks.

Finally, signatures and consent for credit checks are mandatory. This authorizes lenders to verify your creditworthiness and proceed with the evaluation.

Personal and Financial Information Required

Mortgage pre-approval application forms require detailed personal and financial information to assess your eligibility. This information helps lenders determine your borrowing capacity and creditworthiness.

You must provide identification details such as your full name, date of birth, and Social Security number. Financial disclosures include income sources, employment history, current debts, and assets to give a clear picture of your financial stability.

Documentation Checklist for Pre-Approval

The Mortgage Pre-Approval Application Form requires a detailed Documentation Checklist to ensure all necessary financial information is provided. Key documents include proof of income, such as pay stubs or tax returns, and identification like a driver's license or passport. Providing these documents promptly helps streamline the pre-approval process and increases the chances of mortgage approval.

Steps to Complete the Mortgage Pre-Approval Form

Completing a mortgage pre-approval application form is the first step toward securing financing for your new home.

Gather all necessary personal and financial documents before you begin to ensure a smooth application process. These typically include proof of income, credit information, and employment details.

Provide accurate personal information such as your full name, contact details, and Social Security number to verify your identity. Lenders use this data to perform a credit check and assess your eligibility.

Detail your employment history and current income sources to demonstrate your ability to repay the loan. Include recent pay stubs, tax returns, and employer contact information as requested.

List your current assets and liabilities, including savings, investments, debts, and monthly expenses. This helps lenders evaluate your financial stability and debt-to-income ratio.

Specify the loan amount you are seeking along with the type of mortgage and estimated property value. This information guides the lender in tailoring loan options to fit your needs.

Review all entered information carefully to avoid errors that could delay processing. Submit the completed form along with supporting documents either online or in person as specified by your lender.

After submission, monitor your email and phone for any additional requests or updates from the lender. Promptly respond to inquiries to keep the pre-approval process moving forward efficiently.

Receiving your pre-approval letter gives you a clear idea of your budget and strengthens your position when making an offer on a home. It confirms to sellers that you are a serious and qualified buyer.

Maintain communication with your lender throughout the home buying journey to address any changes in your financial situation. This ensures your pre-approval remains valid until closing.

Common Errors to Avoid in the Application

What are common errors to avoid in a mortgage pre-approval application form? Providing inaccurate information can delay the approval process or lead to rejection. Ensure all details are truthful and thoroughly reviewed before submission.

How can missing documentation affect your mortgage pre-approval? Incomplete paperwork often causes processing delays and may result in incomplete evaluations. Gather and submit all required documents to streamline your application.

Why is it important to disclose all sources of income on the application? Hiding or omitting income sources can be considered fraud and jeopardize your approval status. Transparency helps lenders accurately assess your financial situation.

What happens if you report inconsistent information on your application? Discrepancies can raise red flags, prompting further scrutiny or denial. Double-check all data for consistency across your submission.

Should you avoid credit report errors before applying? Unresolved errors can negatively impact your credit score and lender confidence. Review your credit report beforehand and dispute any inaccuracies to improve your chances.

How Lenders Assess Your Application

Lenders assess your mortgage pre-approval application by evaluating your credit score, income, and debt-to-income ratio to determine your financial reliability. They review employment history and verify documentation to ensure consistent and sufficient income. The assessment helps lenders decide the loan amount you qualify for and identify potential risks before approving your mortgage.

Tips for a Successful Mortgage Pre-Approval

Securing a mortgage pre-approval strengthens your position when house hunting and speeds up the buying process. Understanding the key tips can help you complete your mortgage pre-approval application form successfully.

- Maintain a strong credit score - Lenders assess your credit score to determine loan eligibility and interest rates, so keep your credit healthy and dispute any errors.

- Provide complete and accurate documentation - Submit all required documents such as income proof, tax returns, and identification to avoid delays in processing your application.

- Limit new debts before applying - Avoid taking on new loans or large purchases that could affect debt-to-income ratios and weaken your pre-approval chances.