A co-signer application form template streamlines the process of securing a reliable guarantor for loans or leases. This template provides clear fields for personal information, financial details, and consent, ensuring all necessary data is collected efficiently. Using a standardized form helps prevent misunderstandings and speeds up approval timelines.

Co-Signer Application Form Template Sample PDF Viewer

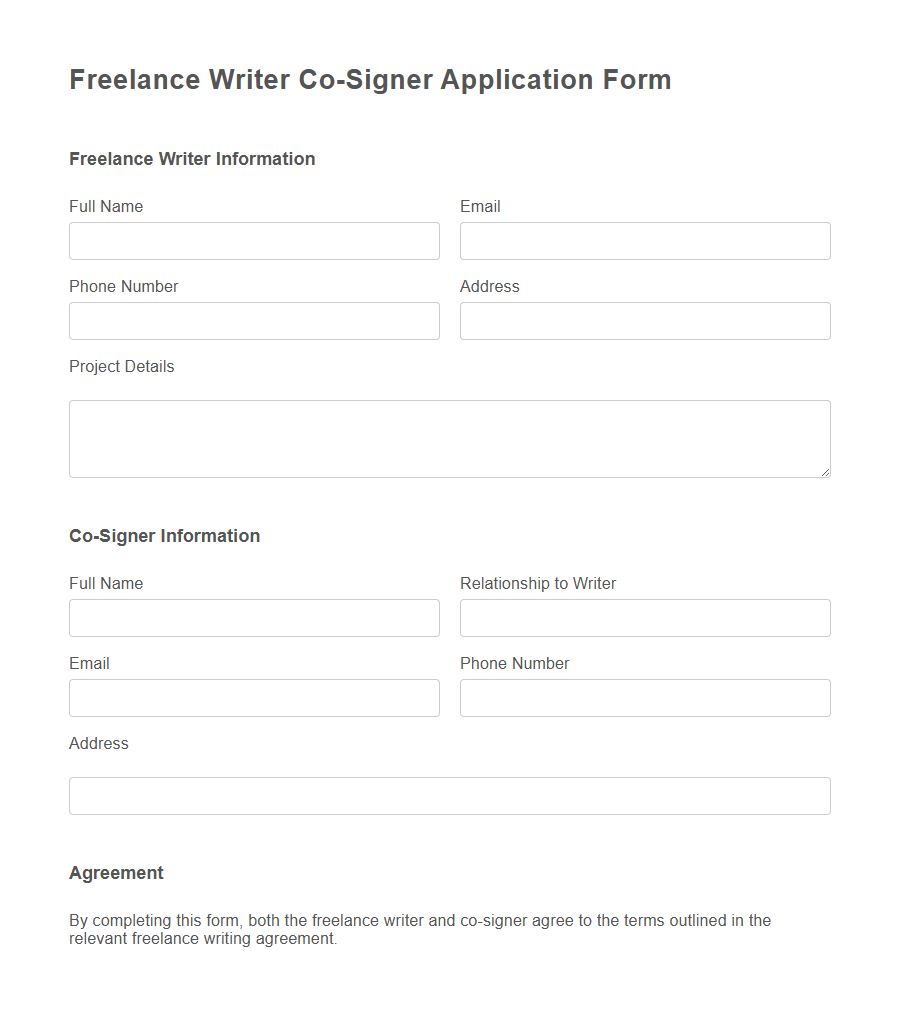

Image example of Co-Signer Application Form Template:

Co-Signer Application Form Template Samples

Freelance Writer Co-Signer Application - PDF - HTML

Student Housing Co-Signer Application - PDF - HTML

Car Lease Co-Signer Application - PDF - HTML

Commercial Equipment Rental Co-Signer Application - PDF - HTML

Startup Business Loan Co-Signer Application - PDF - HTML

Pet Rental Co-Signer Application - PDF - HTML

Short-Term Sublet Co-Signer Application - PDF - HTML

Mobile Home Park Co-Signer Application - PDF - HTML

Private School Tuition Co-Signer Application - PDF - HTML

Medical Equipment Loan Co-Signer Application - PDF - HTML

Event Venue Rental Co-Signer Application - PDF - HTML

Peer-to-Peer Loan Co-Signer Application - PDF - HTML

Micro-Apartment Co-Signer Application - PDF - HTML

Introduction to Co-Signer Application Forms

A Co-Signer Application Form is a crucial document used to gather essential information from individuals willing to support another party's financial obligation. It outlines personal details, financial status, and consent, ensuring the co-signer understands their responsibilities. This form helps lenders or landlords assess the co-signer's ability to back the primary applicant's commitments effectively.

Importance of a Co-Signer in Loan Applications

A co-signer application form template is essential for streamlining the loan approval process by clearly outlining the responsibilities and information of the co-signer. It ensures that lenders have all necessary details to assess the co-signer's ability to support the primary borrower.

The presence of a co-signer increases the likelihood of loan approval by providing additional financial security to the lender.

Key Sections in a Co-Signer Application Form

What are the key sections in a co-signer application form? A co-signer application form typically includes personal information, financial details, and consent statements. These sections ensure the lender can assess the co-signer's ability to support the loan.

Why is personal information crucial in a co-signer application form? This section collects basic details such as name, address, and contact information. It verifies the identity of the co-signer and their relationship to the primary borrower.

What financial details are necessary in the co-signer application form? Income, employment status, and credit history are critical components. These details help evaluate the co-signer's capacity to repay the loan if the primary borrower defaults.

How does the consent section function in the co-signer application form? It includes authorization for credit checks and agreement to loan terms. This protects the lender and confirms the co-signer's commitment to the loan obligations.

What role does the signature section play in the co-signer application form? The signature confirms that all information provided is accurate and that the co-signer accepts responsibility. It legally binds the co-signer to the terms of the loan agreement.

Essential Information Required from the Co-Signer

The Co-Signer Application Form Template collects crucial details to ensure the co-signer's responsibility and commitment are clearly documented. Accurate information from the co-signer helps lenders assess risk and verify identity effectively.

- Personal Identification - Includes full name, date of birth, and government-issued ID numbers to confirm the co-signer's identity.

- Contact Information - Requires phone number, email address, and current residential address for communication and verification purposes.

- Financial Details - Captures income, employment status, and credit history to evaluate the co-signer's ability to assume financial responsibility.

Collecting these essential details ensures the co-signer's role is transparent and legally binding throughout the loan process.

Legal Considerations for Co-Signer Agreements

Using a Co-Signer Application Form Template ensures clear documentation of responsibilities and obligations between parties involved in a co-signer agreement. Understanding the legal considerations embedded in these templates helps protect both the primary borrower and the co-signer from potential disputes.

- Consent and Authorization - The form must include a clear statement where the co-signer consents to the obligations and authorizes the verification of their credit information.

- Liability Clarification - Legal language should explicitly state that the co-signer is equally responsible for repayment if the primary borrower defaults.

- Disclosure Requirements - The template should comply with applicable laws by disclosing all terms, risks, and consequences to ensure informed consent.

How to Fill Out a Co-Signer Application Form

To fill out a co-signer application form, start by carefully entering your personal information such as full name, address, and contact details. Provide accurate financial details including income, employment status, and credit history to help verify your ability to support the primary applicant. Review all information for accuracy before submitting the form to ensure a smooth approval process.

Common Mistakes to Avoid in Co-Signer Forms

Co-signer application form templates are essential for securing a loan or lease when the primary applicant lacks sufficient credit history.

Common mistakes to avoid include incomplete personal information and unclear consent statements. These errors can delay approval or cause legal complications for both parties.

Customizing Your Co-Signer Application Template

Customizing your co-signer application form template ensures it meets your specific requirements.

Including fields that capture essential information about the co-signer helps streamline the approval process and reduces errors.

Tailor the template to reflect the nature of the agreement and any legal considerations.

Adding sections for terms, responsibilities, and signatures creates clarity for all parties involved.