Nonprofit in-kind donation forms streamline the process of documenting donated goods and services, ensuring transparency and accuracy for record-keeping and tax purposes. These forms typically include detailed descriptions, estimated values, and donor information to facilitate acknowledgment and compliance. Utilizing clear and comprehensive templates helps nonprofits maintain organized records and strengthen donor relations.

Nonprofit In-Kind Donation Form Sample PDF Viewer

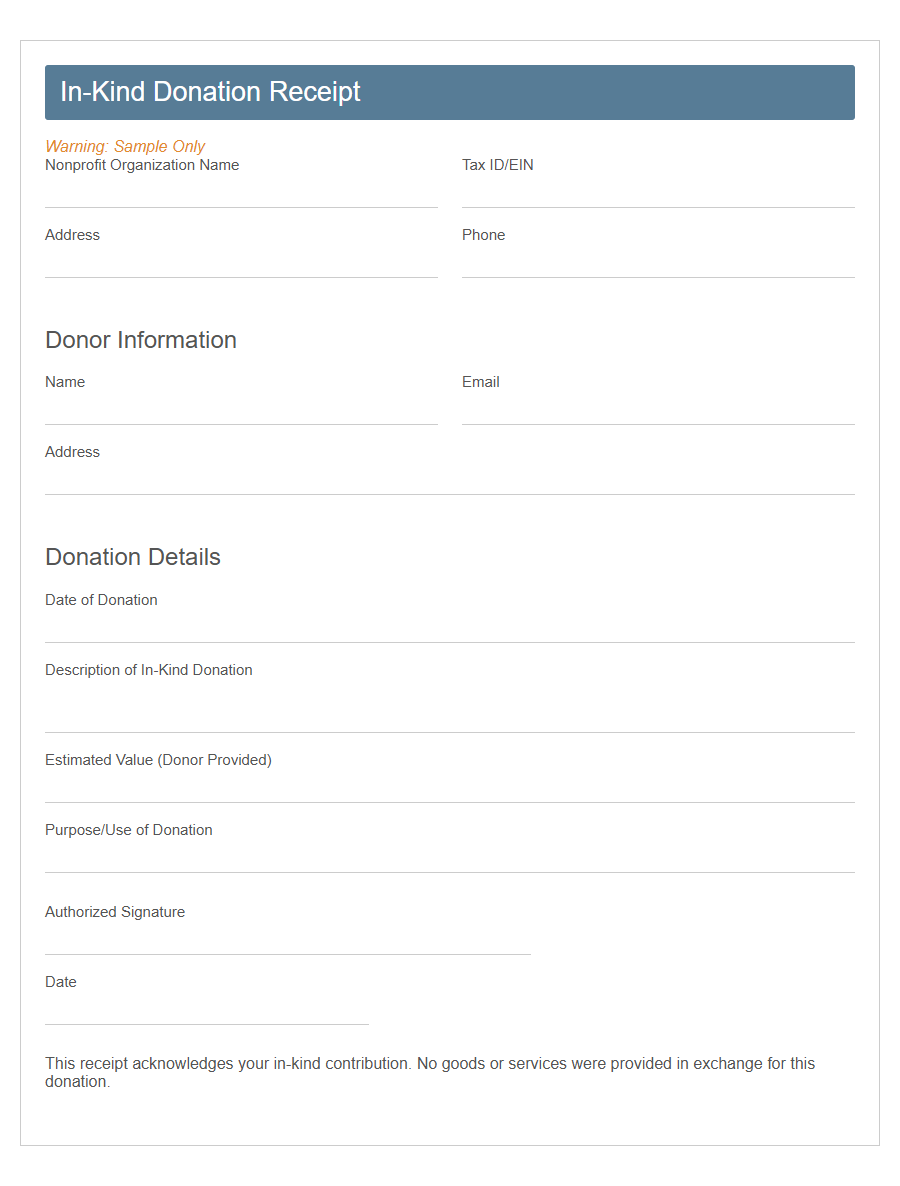

Image example of Nonprofit In-Kind Donation Form:

Nonprofit In-Kind Donation Form Samples

Nonprofit In-Kind Donation Receipt Template - PDF - HTML

Nonprofit In-Kind Goods & Services Donation Form - PDF - HTML

Nonprofit In-Kind Gift Acknowledgment Letter Template - PDF - HTML

Nonprofit In-Kind Donation Tracking Sheet - PDF - HTML

Nonprofit In-Kind Donation Pledge Form - PDF - HTML

Nonprofit In-Kind Donation Valuation Form - PDF - HTML

Nonprofit In-Kind Donation Thank You Letter Template - PDF - HTML

Nonprofit In-Kind Donation Drop-Off Form - PDF - HTML

Nonprofit In-Kind Food Donation Form - PDF - HTML

Nonprofit In-Kind Clothing Donation Form - PDF - HTML

Nonprofit In-Kind Equipment Donation Form - PDF - HTML

Nonprofit In-Kind Donation Tax Receipt Template - PDF - HTML

Nonprofit Event-Specific In-Kind Donation Form - PDF - HTML

Nonprofit In-Kind Donation Agreement Template - PDF - HTML

Nonprofit Volunteer In-Kind Service Donation Form - PDF - HTML

Understanding In-Kind Donations

Understanding in-kind donations is essential for nonprofits to track non-cash contributions accurately.

In-kind donations refer to goods or services donated instead of money, such as equipment, supplies, or volunteer time. Properly documenting these donations with a nonprofit in-kind donation form helps maintain transparency and ensures compliance with accounting and tax regulations.

Importance of In-Kind Donation Forms

In-kind donation forms play a crucial role in documenting non-monetary contributions accurately. They help organizations track the value and details of donated goods or services for transparency and tax purposes. Proper use of these forms ensures donors receive appropriate recognition and supports effective resource management within nonprofits.

Key Elements of an In-Kind Donation Form

An In-Kind Donation Form is essential for nonprofits to document non-cash contributions accurately. Key elements include donor information, description of the donated items, and estimated value.

This form ensures transparency and proper acknowledgment of gifts for both the nonprofit and the donor.

Types of In-Kind Donations Accepted

Nonprofit organizations rely on in-kind donations to support their missions effectively. These forms capture essential information about the types of goods or services contributed.

- Goods Donations - Tangible items such as clothing, food, and office supplies provided to the nonprofit.

- Service Donations - Professional services like legal advice, marketing, or event planning offered without charge.

- Property Donations - Real estate, equipment, or vehicles contributed to assist the nonprofit's operations.

Understanding the types of in-kind donations accepted helps ensure proper acknowledgment and utilization of contributions.

How to Fill Out an In-Kind Donation Form

How do I start filling out a nonprofit in-kind donation form? Begin by providing your full name and contact information in the designated fields to ensure proper communication. Make sure all personal details are accurate to avoid delays in processing your donation.

What information is needed to describe the donated items? List each donated item with a clear description, quantity, and estimated fair market value. This helps the nonprofit accurately record and acknowledge your contribution.

Where should I indicate the date of the donation? Enter the exact date when the items are donated in the specified section of the form. Accurate dating is important for tax and record-keeping purposes.

How do I confirm the nonprofit organization details on the form? Fill in the nonprofit's name, address, and contact details as requested to ensure proper documentation. Verify these details against your donation receipt or official nonprofit information.

What section covers the donor's signature and authorization? Sign and date the form in the space provided to validate your donation and confirm that the information is truthful. Your signature also helps the nonprofit comply with legal and tax requirements.

Legal and Tax Implications for Donors

Donating in-kind gifts to nonprofits requires careful attention to legal and tax implications for donors. Proper documentation through an In-Kind Donation Form ensures compliance and maximizes potential tax benefits.

- Tax Deductibility - Donors can claim a tax deduction for the fair market value of donated goods if properly documented by the nonprofit.

- Documentation Requirements - The In-Kind Donation Form serves as a critical record that supports tax filings and audits.

- Legal Liability - Donors must ensure donated items comply with laws and do not carry risks of liability or infringement issues.

Recordkeeping Best Practices for Nonprofits

Nonprofit in-kind donation forms are essential for accurate recordkeeping and donor acknowledgment. Keeping detailed records of in-kind contributions ensures compliance with IRS regulations and helps track the value and use of donated items. Clear documentation supports transparency and strengthens trust with donors and stakeholders.

Sample In-Kind Donation Form Template

A Nonprofit In-Kind Donation Form records donated goods or services instead of money.

This form helps organizations document contributions accurately for tax and inventory purposes. A Sample In-Kind Donation Form Template simplifies the process by providing a clear structure to capture donor information, item descriptions, and estimated values.

Tips for Encouraging In-Kind Donations

Encouraging in-kind donations can significantly benefit nonprofits by reducing costs and increasing resource availability. Clear communication and easy donation processes boost donor participation effectively.

- Make the donation process simple - Provide a clear and concise in-kind donation form to streamline contributions and reduce donor hesitation.

- Highlight the impact of in-kind gifts - Share specific examples of how donated items directly support your nonprofit's mission to motivate potential donors.

- Express gratitude promptly - Sending timely thank-you notes reinforces donor appreciation and encourages ongoing support.