A nonprofit expense reimbursement request form streamlines the process for staff and volunteers to recover costs related to organizational activities. This document ensures accurate tracking and accountability for funds spent on behalf of the nonprofit. Clear examples of expense categories and required documentation help simplify submission and approval procedures.

Nonprofit Expense Reimbursement Request Form Sample PDF Viewer

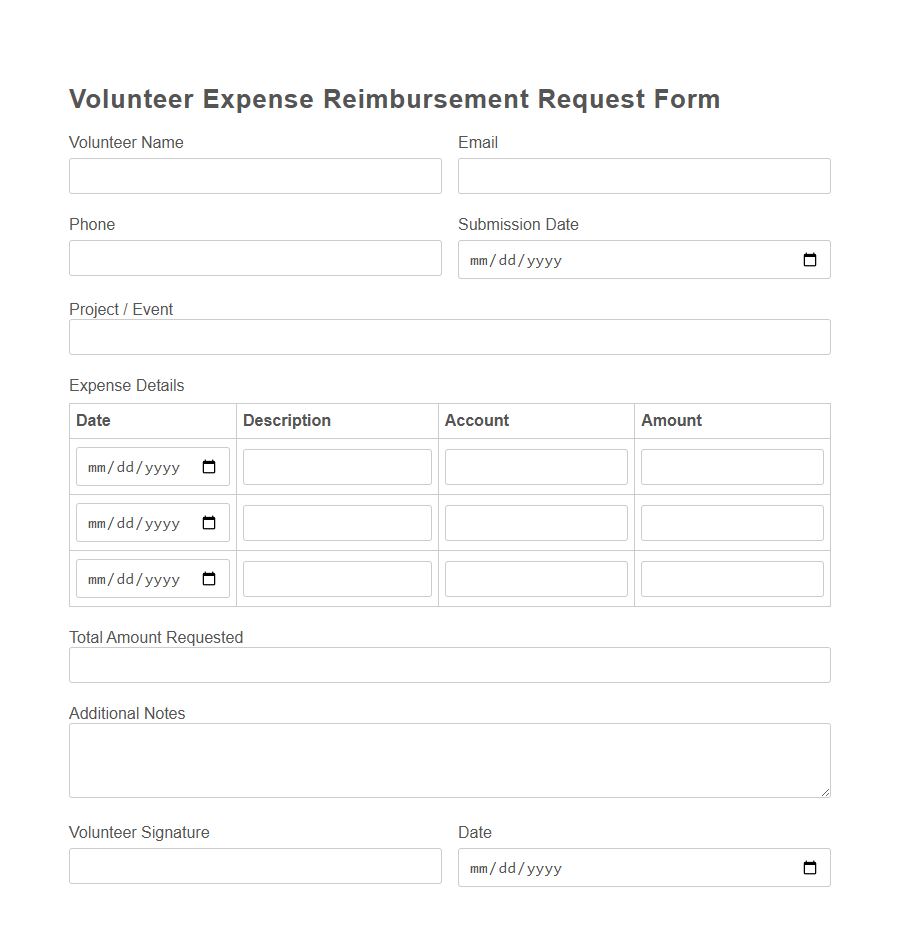

Image example of Nonprofit Expense Reimbursement Request Form:

Nonprofit Expense Reimbursement Request Form Samples

Nonprofit Volunteer Expense Reimbursement Request Form - PDF - HTML

Nonprofit Staff Travel Expense Reimbursement Template - PDF - HTML

Nonprofit Workshop Expenses Reimbursement Request Form - PDF - HTML

Nonprofit Program Supplies Reimbursement Form - PDF - HTML

Nonprofit Grant-Funded Expense Reimbursement Template - PDF - HTML

Nonprofit Event Expense Reimbursement Request Form - PDF - HTML

Nonprofit Board Member Expense Reimbursement Form - PDF - HTML

Nonprofit Speaker Honorarium Reimbursement Template - PDF - HTML

Nonprofit Mileage Reimbursement Request Form - PDF - HTML

Nonprofit Training Expense Reimbursement Form - PDF - HTML

Nonprofit Project Materials Reimbursement Form - PDF - HTML

Nonprofit Conference Attendance Reimbursement Template - PDF - HTML

Nonprofit Office Supply Reimbursement Request Form - PDF - HTML

Nonprofit Community Outreach Expense Reimbursement Form - PDF - HTML

Nonprofit Technology Equipment Reimbursement Template - PDF - HTML

Introduction to Nonprofit Expense Reimbursement

Nonprofit Expense Reimbursement Request Forms are essential tools for managing and tracking expenses incurred by staff or volunteers on behalf of the organization.

These forms ensure transparency and accountability by documenting the nature and amount of expenses. They help nonprofits maintain accurate financial records and comply with regulatory requirements.

Importance of Proper Expense Documentation

Proper documentation of expenses ensures transparency and accountability within nonprofit organizations, fostering trust among donors and stakeholders. Maintaining accurate records helps prevent errors and supports compliance with legal and tax requirements.

This practice safeguards the nonprofit's reputation and financial integrity.

Key Elements of a Reimbursement Request Form

A Nonprofit Expense Reimbursement Request Form must include detailed information about the expenses incurred, such as date, description, and amount. It should contain fields for the requester's name, contact information, and approval signatures to ensure proper authorization. Clear instructions for attaching receipts and submitting the form help streamline the reimbursement process and maintain transparency.

Eligible and Ineligible Expenses

The Nonprofit Expense Reimbursement Request Form helps track and manage costs related to organizational activities. It clearly defines which expenses qualify for reimbursement to ensure compliance and transparency.

- Eligible Expenses - These include costs directly related to nonprofit operations such as travel, meals, and office supplies necessary for events or programs.

- Ineligible Expenses - Personal expenses, fines, or costs unrelated to nonprofit objectives cannot be reimbursed under the policy.

- Documentation Required - Receipts and detailed explanations must accompany reimbursement requests to validate the expenses claimed.

Clear guidelines on eligible and ineligible expenses promote responsible spending and accountability within the nonprofit organization.

Step-by-Step Reimbursement Submission Process

The Nonprofit Expense Reimbursement Request Form simplifies the process of recovering expenses incurred during nonprofit activities. Following a clear step-by-step reimbursement submission process ensures prompt and accurate payment.

- Gather Receipts - Collect all original receipts and proof of payment related to nonprofit expenses.

- Complete the Form - Fill out the reimbursement form accurately, including expense details and personal information.

- Submit for Approval - Send the completed form and receipts to the designated approver or finance department for processing.

Approval Workflow for Expense Requests

The Nonprofit Expense Reimbursement Request Form streamlines the approval workflow for expense requests by ensuring all submissions are systematically reviewed by designated approvers. Each expense request follows a clear path from the employee to the finance department, allowing for prompt verification and authorization. This structured process enhances accountability and expedites reimbursement for nonprofit staff and volunteers.

Deadlines and Timelines for Reimbursement

What are the deadlines for submitting a Nonprofit Expense Reimbursement Request Form? Expense reimbursement requests must be submitted within 30 days of incurring the expense. Late submissions may result in delayed or denied reimbursement.

How long does the reimbursement process typically take after submitting the form? Once the request is received, nonprofit organizations usually process reimbursements within 15 business days. Timely submission and complete documentation help ensure faster payment.

Is there a timeline for approving expense reimbursements in nonprofits? Approval timelines vary but generally occur within 7 to 10 business days after submission. Prompt review depends on accurate and thorough expense details provided in the request form.

Common Mistakes to Avoid in Request Forms

Nonprofit Expense Reimbursement Request Forms are essential for tracking and approving expenses accurately.

Common mistakes in these forms include incomplete documentation and missing receipts. Such errors can delay reimbursements and complicate financial audits.

Tips for Streamlining Expense Reimbursements

Efficient handling of nonprofit expense reimbursement requests ensures timely financial management and maintains trust with staff and volunteers. Streamlining this process reduces administrative burdens and prevents delays in reimbursement.

- Implement a standardized form - Using a consistent expense reimbursement request form simplifies data collection and minimizes errors.

- Set clear submission deadlines - Establishing specific timeframes for expense submissions encourages prompt reporting and faster processing.

- Leverage digital tools - Utilizing online platforms for submitting and approving expenses accelerates workflow and improves record accuracy.