Nonprofit organizations often require a standardized method to track and reimburse expenses incurred by volunteers and staff. A well-designed nonprofit expense reimbursement form ensures transparency and accuracy in financial records. This article provides a comprehensive list of examples to help organizations streamline their reimbursement process effectively.

Nonprofit Expense Reimbursement Form Sample PDF Viewer

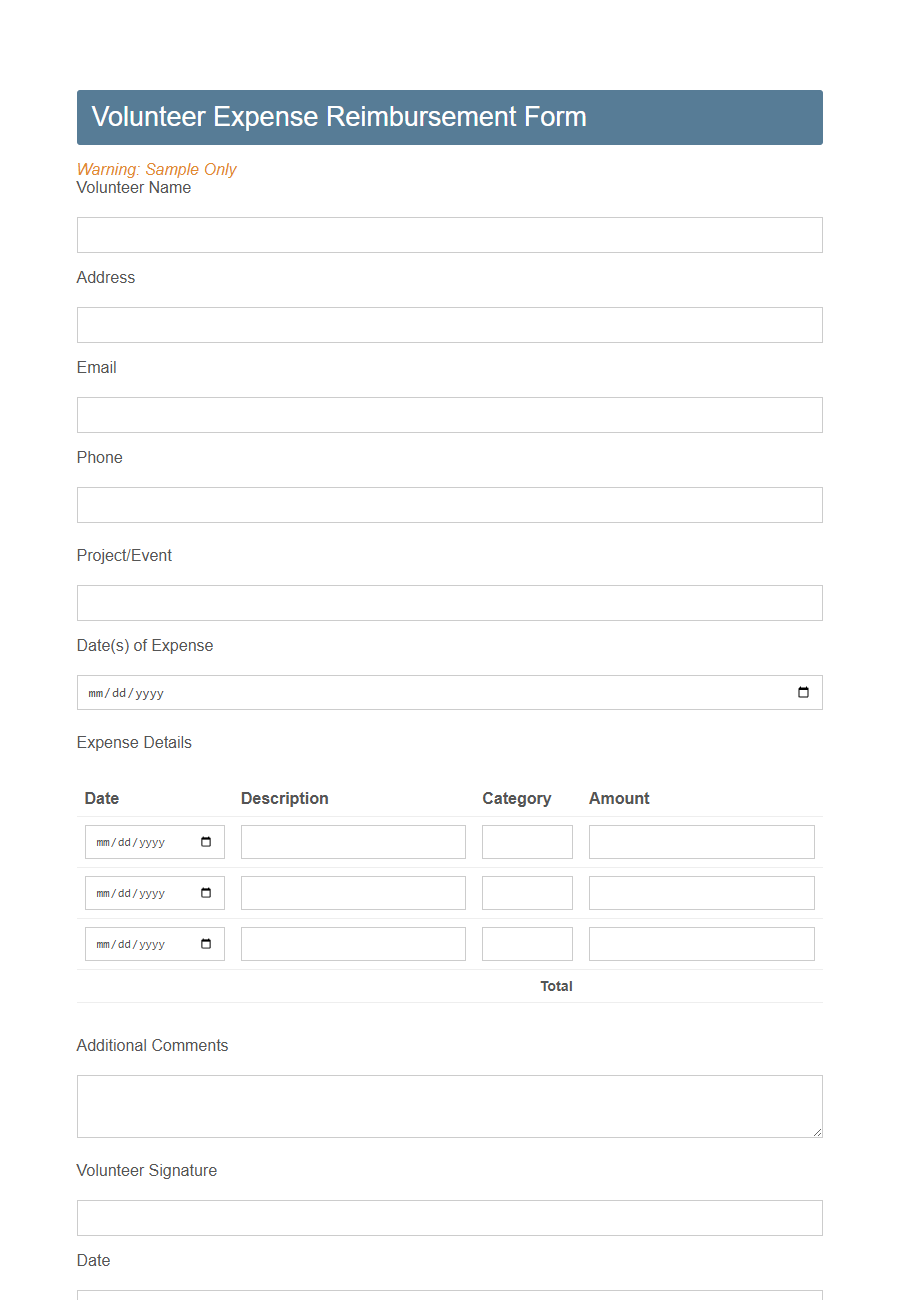

Image example of Nonprofit Expense Reimbursement Form:

Nonprofit Expense Reimbursement Form Samples

Nonprofit Volunteer Expense Reimbursement Form - PDF - HTML

Nonprofit Staff Travel Expense Reimbursement Form - PDF - HTML

Nonprofit Board Member Expense Reimbursement Template - PDF - HTML

Nonprofit Fundraising Event Expense Reimbursement Form - PDF - HTML

Nonprofit Grant Project Expense Reimbursement Sheet - PDF - HTML

Nonprofit Program-Specific Expense Reimbursement Form - PDF - HTML

Nonprofit Mileage Expense Reimbursement Template - PDF - HTML

Nonprofit International Travel Expense Reimbursement Form - PDF - HTML

Nonprofit Conference Attendance Expense Reimbursement Form - PDF - HTML

Nonprofit Donation Collection Expense Reimbursement Sheet - PDF - HTML

Nonprofit Virtual Event Expense Reimbursement Form - PDF - HTML

Nonprofit Training Workshop Expense Reimbursement Form - PDF - HTML

Nonprofit Youth Program Expense Reimbursement Template - PDF - HTML

Nonprofit Community Outreach Expense Reimbursement Form - PDF - HTML

Nonprofit Fellowship/Intern Expense Reimbursement Sheet - PDF - HTML

Understanding Nonprofit Expense Reimbursement Forms

Nonprofit expense reimbursement forms are essential tools for managing organizational finances by tracking and approving employee or volunteer expenses. These forms ensure transparency and accountability within nonprofit financial operations.

- Purpose - They document expenses incurred by staff or volunteers that require repayment from the organization's funds.

- Components - Expense reimbursement forms typically include details such as date, purpose of the expense, amount, and supporting receipts.

- Compliance - Proper completion and approval of these forms help nonprofits comply with internal policies and legal regulations for financial reporting.

Importance of Accurate Reimbursement Processes

Accurate reimbursement processes are essential for nonprofits to maintain financial integrity and trust.

They ensure that expenses are properly documented, verified, and reimbursed, preventing errors and potential fraud. Maintaining accuracy supports transparent financial reporting and helps nonprofits comply with regulatory requirements.

Key Components of an Expense Reimbursement Form

A Nonprofit Expense Reimbursement Form is essential for tracking and reimbursing expenses incurred by employees or volunteers. It ensures transparency and accountability within the organization's financial processes.

- Employee or Volunteer Information - This section collects the individual's name, department, and contact details to identify who is requesting reimbursement.

- Expense Details - It includes a clear description of each expense, date incurred, purpose, and relevant category for accurate record-keeping.

- Receipt Attachment - Proof of purchase such as receipts or invoices must be attached to validate the expenses claimed.

Completing a detailed and accurate expense reimbursement form helps nonprofits maintain proper financial controls and supports efficient budget management.

Commonly Reimbursed Nonprofit Expenses

Nonprofit Expense Reimbursement Forms streamline the process of getting money back for costs incurred on behalf of the organization.

Commonly reimbursed nonprofit expenses include travel costs, office supplies, and event-related expenses. These reimbursements ensure that staff and volunteers are not financially burdened while supporting the nonprofit's mission.

Eligibility Criteria for Expense Reimbursement

Expense reimbursement for nonprofit organizations applies only to expenses directly related to official duties or approved activities. Eligible expenses must be reasonable, necessary, and supported by valid receipts or documentation. Personal expenses and costs not pre-approved are typically excluded from reimbursement eligibility.

Step-by-Step Guide to Completing the Form

A Nonprofit Expense Reimbursement Form allows organizations to refund employees or volunteers for out-of-pocket expenses incurred during official activities. Completing the form accurately ensures timely and transparent reimbursement.

Start by filling in your personal and contact information at the top of the form.

List each expense separately, including the date, description, and amount spent. Attach all relevant receipts and documentation to support your claims.

Calculate the total amount requested and enter it in the designated field. Double-check that all entries are accurate before submitting.

Sign and date the form to certify that the expenses are legitimate and comply with nonprofit policies. Submit the completed form to the designated finance or accounting department for processing.

Required Documentation for Reimbursements

What documents are required for nonprofit expense reimbursements? Receipts or invoices must be submitted as proof of purchase. A detailed expense report outlining the purpose and date of the expense is also necessary.

Best Practices for Nonprofit Financial Compliance

A Nonprofit Expense Reimbursement Form should clearly document all expenses with itemized receipts to maintain transparency and accountability. Best practices include setting clear policies on eligible expenses and timely submission to ensure accurate financial tracking. Regular reviews and audits of these forms help nonprofits comply with regulatory requirements and uphold donor trust.

Frequently Asked Questions About Reimbursement

A Nonprofit Expense Reimbursement Form is used to repay employees or volunteers for expenses incurred on behalf of the organization. Understanding common questions about reimbursement helps ensure timely and accurate financial processing.

- What expenses are eligible for reimbursement? - Only expenses directly related to nonprofit activities and approved by the organization qualify for reimbursement.

- What documentation is required for filing a reimbursement claim? - Receipts or invoices must be submitted along with a completed reimbursement form to verify the expense.

- How long does it take to process a reimbursement? - Processing times vary but typically range from a few days up to two weeks after submission of complete documentation.