An insurance reinstatement request form template simplifies the process of restoring a lapsed policy by providing a standardized format for submission. This template ensures all necessary information is accurately captured to expedite approval and reduce processing time. Using well-crafted examples helps policyholders understand how to complete the form correctly, enhancing the chances of a successful reinstatement.

Insurance Reinstatement Request Form Template Sample PDF Viewer

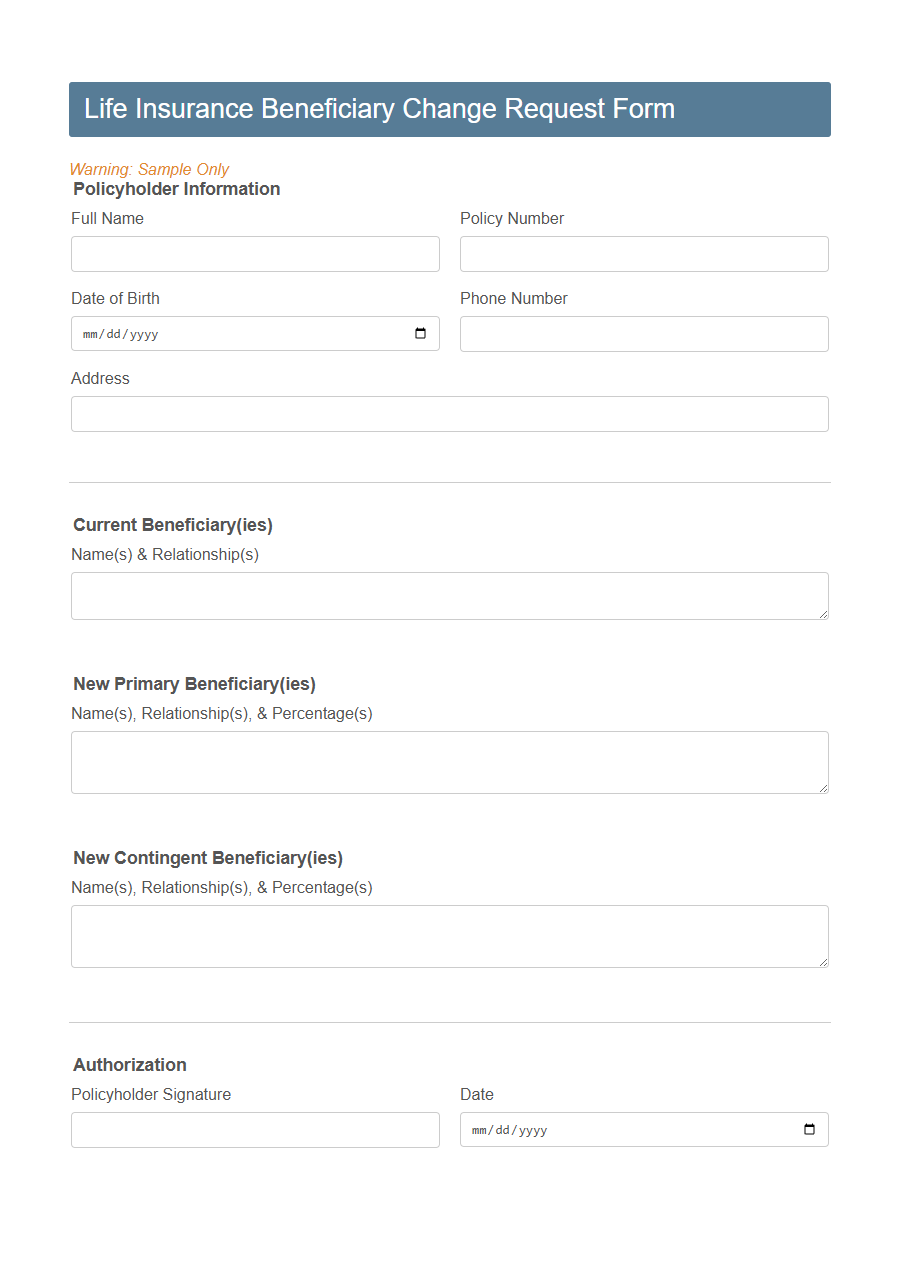

Image example of Insurance Reinstatement Request Form Template:

Insurance Reinstatement Request Form Template Samples

Life Insurance Beneficiary Change Request - PDF - HTML

Auto Insurance Policy Cancellation Request - PDF - HTML

Health Insurance Claim Appeal Letter Template - PDF - HTML

Homeowners Insurance Property Damage Report Template - PDF - HTML

Travel Insurance Refund Claim - PDF - HTML

Business Interruption Insurance Proof of Loss - PDF - HTML

Pet Insurance Reimbursement Request - PDF - HTML

Renters Insurance Policy Endorsement Request Template - PDF - HTML

Disability Insurance Monthly Income Verification Template - PDF - HTML

Term Life Insurance Conversion Request - PDF - HTML

Group Health Insurance Enrollment Change - PDF - HTML

Workers’ Compensation Incident Report Template - PDF - HTML

Professional Liability Insurance Claim Notification Template - PDF - HTML

Introduction to Insurance Reinstatement

Insurance reinstatement is the process of restoring a lapsed insurance policy to active status.

An Insurance Reinstatement Request Form Template simplifies this process by providing a standardized method for policyholders to formally request the reactivation of their coverage. Using this form ensures all necessary information is captured accurately, helping both the insurer and insured expedite the reinstatement procedure.

What Is an Insurance Reinstatement Request Form?

An Insurance Reinstatement Request Form is a document used to reactivate a lapsed insurance policy. It allows policyholders to formally request the insurer to restore their coverage after a period of non-payment or cancellation.

- Purpose of the Form - It enables policyholders to resume their insurance protection without purchasing a new policy.

- Information Required - The form typically collects personal details, policy information, and reasons for reinstatement.

- Submission Process - The completed form must be submitted to the insurance company for evaluation and approval.

Key Components of a Reinstatement Request Form

An Insurance Reinstatement Request Form Template helps policyholders restore lapsed insurance coverage efficiently. It simplifies the communication process between the insured and the insurer to resume protection without starting a new policy.

- Policyholder Information - Includes the insured's name, policy number, and contact details to verify identity and policy specifics.

- Reason for Lapse - Explains why the insurance coverage lapsed, providing context for the reinstatement request.

- Payment Details - Specifies the amount due and payment method to ensure the financial aspect of reinstatement is clear and complete.

When to Use an Insurance Reinstatement Form

When should you use an Insurance Reinstatement Request Form? Use this form when your insurance policy has lapsed due to missed payments. It helps you formally request to reactivate your coverage without starting a new policy.

Step-by-Step Guide to Completing the Form

Completing an Insurance Reinstatement Request Form requires careful attention to detail to ensure a smooth process. This form is essential for reactivating a lapsed insurance policy by providing necessary personal and policy information.

Begin by filling out your personal details accurately, including your full name, contact information, and policy number.

Next, provide the reason for the policy lapse and any relevant dates. Ensure all fields are completed without omissions to avoid delays.

Review the form carefully before submission to verify all information is correct and complete.

Sign and date the form where required to authorize the request formally. Submit the completed form to your insurance provider through the designated channel.

Required Documentation and Supporting Evidence

The Insurance Reinstatement Request Form Template requires precise documentation to verify the validity of the request. Commonly needed documents include the original policy details, proof of identity, and evidence of premium payments or missed payments. Supporting evidence such as medical reports or financial statements may also be necessary to expedite the reinstatement process.

Common Mistakes to Avoid

When filling out an Insurance Reinstatement Request Form Template, avoid leaving any mandatory fields blank to prevent delays in processing. Ensure all personal and policy information matches exactly with the original documents to avoid discrepancies. Double-check signatures and dates, as missing or incorrect entries can lead to rejection of the request.

Tips for a Successful Reinstatement Request

Submitting an Insurance Reinstatement Request Form correctly increases the chances of approval. Careful attention to detail helps avoid delays in restoring your coverage.

- Complete All Required Fields - Ensure every section of the form is filled out accurately to prevent processing issues.

- Attach Supporting Documents - Include any necessary proof of payment or identification to strengthen your request.

- Review Policy Details - Double-check your policy number and personal information to match insurer records exactly.

Following these tips streamlines the reinstatement process and helps you regain insurance protection quickly.