A payroll change form template simplifies updating employee payroll details such as salary, tax withholdings, and direct deposit information. Using this standardized document helps ensure accuracy and compliance with company policies and legal requirements. Employers can efficiently track modifications and maintain clear records for auditing purposes.

Payroll Change Form Template Sample PDF Viewer

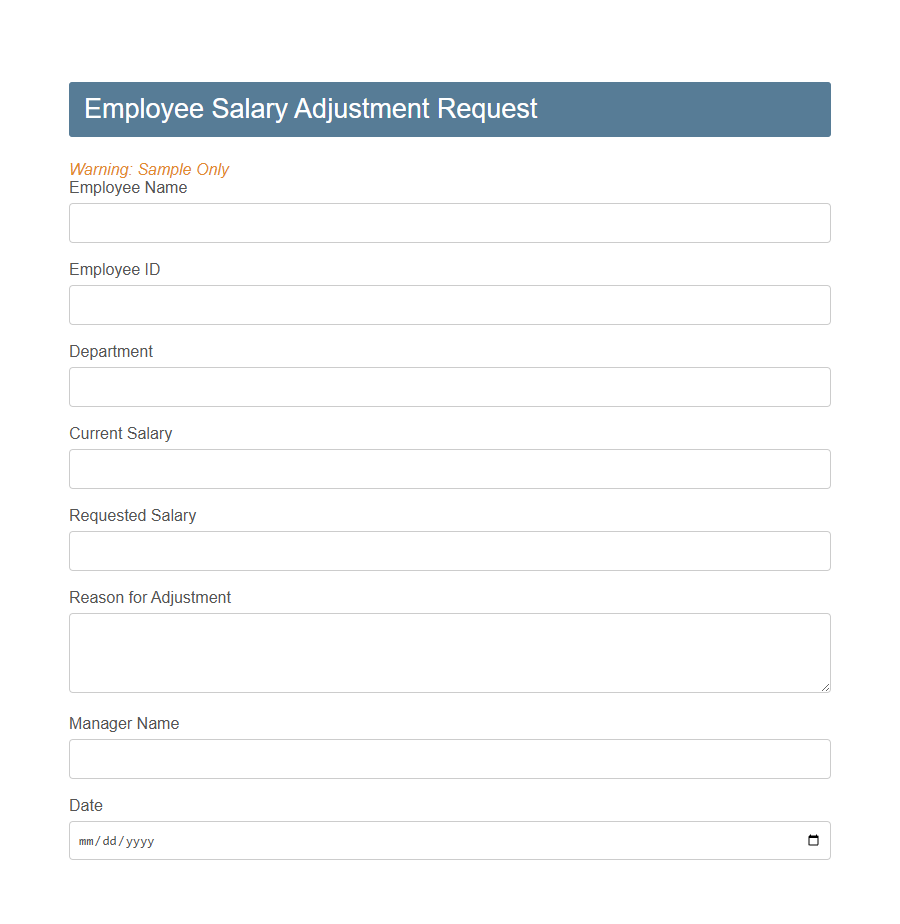

Image example of Payroll Change Form Template:

Payroll Change Form Template Samples

Employee Salary Adjustment Request Template - PDF - HTML

Bonus Authorization Change - PDF - HTML

Payroll Deduction Change Authorization Template - PDF - HTML

Job Title & Classification Payroll Update Template - PDF - HTML

Overtime Pay Change Approval - PDF - HTML

Direct Deposit Account Change - PDF - HTML

Tax Withholding Adjustment Request Template - PDF - HTML

Shift Differential Pay Change Template - PDF - HTML

Retroactive Pay Correction - PDF - HTML

Employee Leave Status Payroll Change Template - PDF - HTML

Garnishment/Child Support Payroll Deduction Template - PDF - HTML

Pay Frequency Change Request Template - PDF - HTML

Commission Structure Update - PDF - HTML

Introduction to Payroll Change Form Templates

A Payroll Change Form Template simplifies the process of updating employee payroll information efficiently. It ensures accuracy when making adjustments to salary, tax details, or direct deposit information. Utilizing a standardized template helps maintain consistent records and reduces administrative errors.

Importance of Using Payroll Change Forms

Payroll Change Form Templates play a crucial role in managing employee compensation accurately.

Using these forms ensures that any updates to salary, tax information, or benefits are properly documented and authorized. This reduces errors and streamlines payroll processing for both HR and finance departments.

Key Components of a Payroll Change Form Template

A Payroll Change Form Template is essential for accurately updating employee payroll information.

It ensures all modifications are documented systematically, reducing errors and maintaining compliance. Key components help streamline the process for HR and payroll departments.

Personal employee details are a crucial part of the template, including name, employee ID, and contact information.

These details identify the employee and prevent confusion during payroll updates, ensuring the correct individual's records are modified.

The section for payroll change specifics includes fields for the type of change, such as salary adjustment, tax withholding, or direct deposit information.

Clear categorization of changes allows payroll staff to process updates efficiently and verify that all necessary adjustments are made.

Authorization and approval fields are mandatory to confirm that changes are validated by the appropriate supervisors or HR personnel.

This control measure helps maintain payroll integrity and prevents unauthorized or accidental changes.

Date fields indicating when the change is requested and when it should take effect are also key components.

Tracking these dates ensures payroll modifications are implemented timely and accurately within the pay cycle.

Instructions or notes sections provide additional context or special conditions related to the payroll change.

These details improve communication and help payroll administrators properly address unique circumstances.

Common Reasons for Payroll Changes

A Payroll Change Form Template is essential for accurately documenting adjustments in employee compensation. It ensures that payroll updates are processed efficiently and recorded correctly.

- Salary Adjustment - Changes in employee salary due to promotions, demotions, or negotiated raises require formal documentation to update payroll records.

- Tax Withholding Updates - Modifications to employee tax withholding information, such as exemptions or filing status, affect payroll calculations and must be reflected accurately.

- Benefit Deductions - Adjustments in deductions for benefits like health insurance or retirement plans impact net pay and need proper authorization through the form.

How to Customize a Payroll Change Form Template

To customize a payroll change form template, start by identifying the specific payroll changes you need to track, such as salary adjustments, tax withholding updates, or benefits modifications. Next, modify the template fields to capture relevant employee details, change descriptions, effective dates, and approval signatures. Ensure the form layout is clear and concise to facilitate accurate data entry and streamline the approval process.

Step-by-Step Guide to Filling Out the Form

How do I start filling out a Payroll Change Form Template? Begin by entering your personal information, such as your full name, employee ID, and department. This ensures the form is accurately linked to your payroll records.

What details are needed for the payroll change request? Specify the type of change, like salary adjustment, tax withholding updates, or direct deposit information. Clearly outlining your request helps prevent processing errors.

Where should the effective date of the payroll change be indicated? Include the exact date when you want the change to take effect. This allows payroll to apply updates at the correct pay period.

How do I provide supporting documentation if required? Attach any necessary documents, such as a new tax form or authorization letter. Proper documentation validates the requested changes.

Who needs to approve the completed Payroll Change Form? Submit the form to your supervisor or HR department for review and authorization. Approval confirms that the change complies with company policies.

Ensuring Compliance and Data Security

A Payroll Change Form Template streamlines the process of updating employee payroll information while ensuring strict adherence to legal and regulatory requirements. Implementing such a template helps maintain compliance with tax laws and labor regulations, reducing the risk of costly penalties.

Using a secure Payroll Change Form Template also protects sensitive employee data from unauthorized access and potential breaches.

Tips for Streamlining Payroll Change Processes

Using a Payroll Change Form Template can simplify updating employee payroll information, reducing errors and saving time. Streamlining the payroll change process improves accuracy and enhances overall payroll management efficiency.

- Standardize the form layout - Create a consistent template to ensure all necessary information is captured clearly and uniformly.

- Automate data entry - Implement digital forms that auto-populate fields and integrate with payroll software to reduce manual input.

- Set approval workflows - Establish clear approval steps within the template process to prevent unauthorized or incomplete changes.

Implementing these tips helps maintain accurate payroll records and accelerates processing times.

Frequently Asked Questions about Payroll Change Forms

Payroll Change Form Templates simplify the process of updating employee payroll information accurately. They ensure consistent record keeping and reduce errors in payroll management.

- What is a Payroll Change Form? - It is a document used to request updates or corrections to an employee's payroll details.

- When should I use a Payroll Change Form? - Use it whenever there is a change in salary, tax withholding, direct deposit, or personal information.

- Who is responsible for submitting the Payroll Change Form? - Usually, the employee or HR department submits the form to ensure payroll information stays current.