A corporate client account setup form streamlines the onboarding process by gathering essential company details, financial information, and authorized contact data. Accurate completion of this form ensures smooth account management and compliance with legal requirements. Firms benefit from a standardized template that captures all necessary information for efficient client relationship handling.

Corporate Client Account Setup Form Sample PDF Viewer

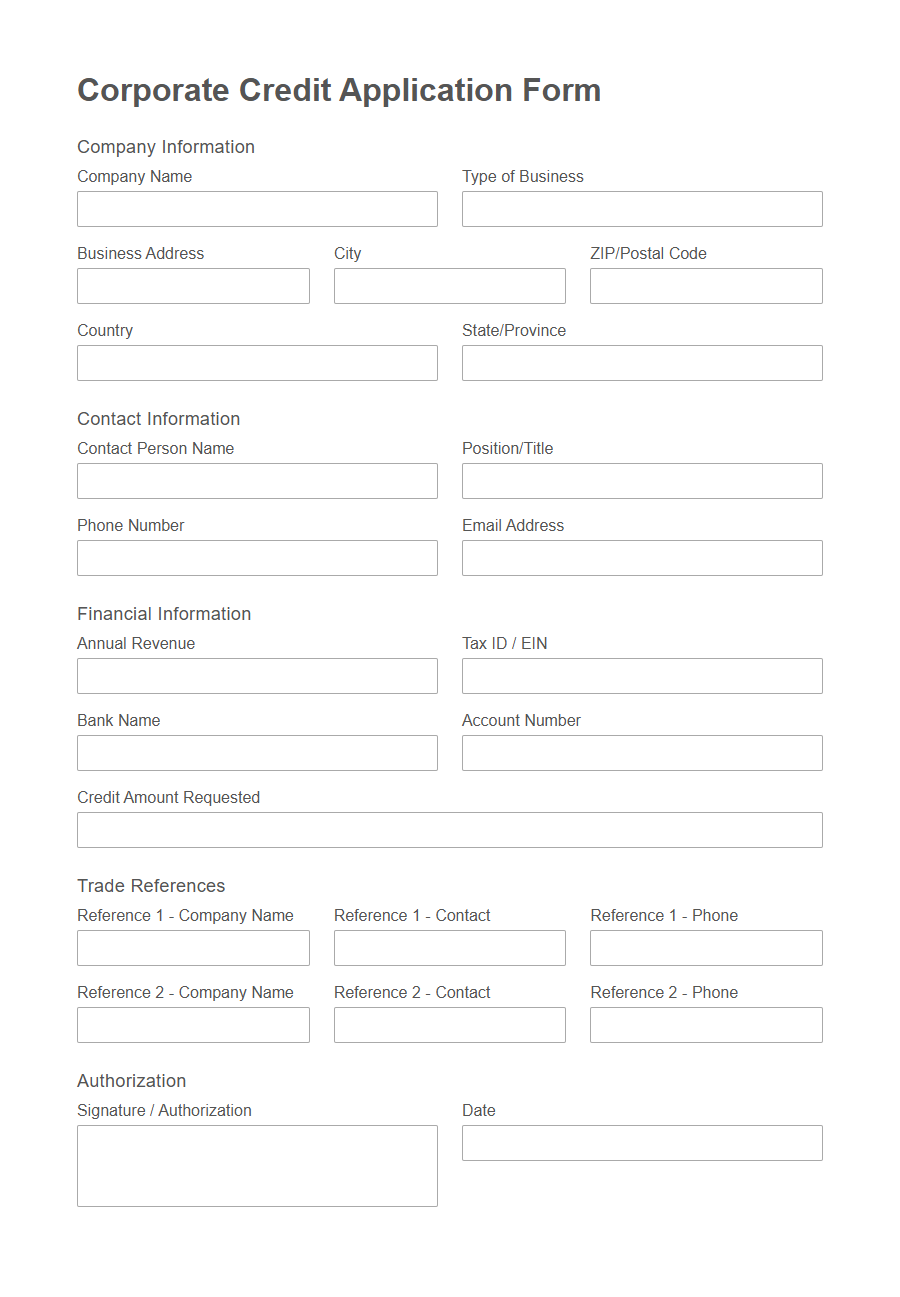

Image example of Corporate Client Account Setup Form:

Corporate Client Account Setup Form Samples

Corporate Credit Application - PDF - HTML

Business Entity Verification Document Template - PDF - HTML

Corporate KYC (Know Your Customer) Form - PDF - HTML

Board Resolution for Account Opening Template - PDF - HTML

Corporate Banking Mandate Form - PDF - HTML

Beneficial Owner Declaration Form - PDF - HTML

Authorized Signatory Specimen Card Template - PDF - HTML

FATCA/CRS Self-Certification Form (Corporate) - PDF - HTML

Corporate Account Information Update Form - PDF - HTML

Company Structure Chart Submission Template - PDF - HTML

Legal Representative Identification Form - PDF - HTML

Corporate Client Risk Assessment Questionnaire - PDF - HTML

Corporate Account Closure Request Template - PDF - HTML

Memorandum and Articles Submission Form - PDF - HTML

Foreign Corporate Client Onboarding Document Checklist - PDF - HTML

Introduction to Corporate Client Account Setup

Setting up a corporate client account is a crucial step for businesses to streamline their financial transactions and maintain organized records. This process ensures that companies can access tailored services and benefit from specialized account features designed to meet their unique needs.

The Corporate Client Account Setup Form collects essential information to establish and verify the client's business identity accurately.

Importance of a Comprehensive Setup Form

A Corporate Client Account Setup Form is essential for establishing clear communication and managing expectations between the business and its clients. A comprehensive setup form ensures accuracy, compliance, and streamlined operations from the outset.

- Ensures accurate information collection - Capturing detailed client data minimizes errors and facilitates smooth future interactions.

- Supports regulatory compliance - Thorough documentation helps meet legal and industry-specific requirements effectively.

- Enhances operational efficiency - A well-structured form reduces delays and simplifies account management processes.

Key Information Required from Corporate Clients

The Corporate Client Account Setup Form gathers essential information to establish a business relationship efficiently.

Key information required from corporate clients includes company details, authorized signatories, and financial data. This ensures compliance with regulatory standards and facilitates smooth account management.

Company Identification and Legal Documentation

The Corporate Client Account Setup Form requires precise Company Identification and Legal Documentation to ensure compliance and accurate record-keeping.

Company Identification includes details such as the registered company name, business registration number, and official address. Legal Documentation involves submitting certified copies of incorporation certificates, tax identification documents, and authorized signatory proofs.

Authorized Signatories and Contact Persons

Who are the Authorized Signatories required in the Corporate Client Account Setup Form? Authorized Signatories are individuals designated by the corporation to legally operate the account and make binding decisions. Their information must be accurately provided to ensure smooth account management and compliance.

Why is listing Contact Persons important in the Corporate Client Account Setup Form? Contact Persons serve as primary points of communication between the corporation and the financial institution. Providing clear contact details helps facilitate efficient correspondence and timely responses to account-related matters.

Banking and Financial Details Collection

The Corporate Client Account Setup Form is designed to efficiently gather essential banking and financial details to ensure smooth transaction processing. It collects information such as bank account numbers, authorized signatories, and credit terms to facilitate secure and accurate financial operations. This structured data collection supports compliance, risk management, and streamlined account management for corporate clients.

Compliance and Regulatory Requirements

The Corporate Client Account Setup Form is essential for ensuring adherence to compliance and regulatory requirements throughout the onboarding process. It collects detailed information to verify client identity and assess risk accurately.

- Know Your Customer (KYC) Compliance - The form gathers critical identification and business information to meet KYC standards and prevent fraudulent activities.

- Anti-Money Laundering (AML) Measures - It includes questions designed to detect and mitigate potential money laundering risks in accordance with regulatory frameworks.

- Regulatory Reporting Obligations - The collected data supports timely and accurate reporting to regulatory authorities, maintaining transparency and legal compliance.

Proper completion of the Corporate Client Account Setup Form safeguards both the institution and client by ensuring all regulatory requirements are fulfilled.

Digital Submission and Security Measures

The Corporate Client Account Setup Form is designed for easy digital submission, allowing clients to complete and submit their information securely online. Advanced encryption protocols safeguard all data during transmission to prevent unauthorized access. This ensures a fast, efficient, and protected onboarding process for corporate clients.

Common Challenges in Account Setup

Setting up a corporate client account involves multiple complex steps that can delay the onboarding process. Companies often face obstacles related to documentation, compliance, and communication during account setup.

- Incomplete Documentation - Missing or incorrect paperwork slows down verification and approval processes.

- Regulatory Compliance - Navigating legal requirements can be challenging, leading to potential delays or rejections.

- Communication Gaps - Lack of clear coordination between client and service provider causes misunderstandings and prolonged setup time.