An insurance verification form template streamlines the process of confirming coverage details and policy information. This ensures accurate record-keeping and prevents claim disputes between providers and clients. Various examples of these templates cater to different industries and verification needs, enhancing efficiency and compliance.

Insurance Verification Form Template Sample PDF Viewer

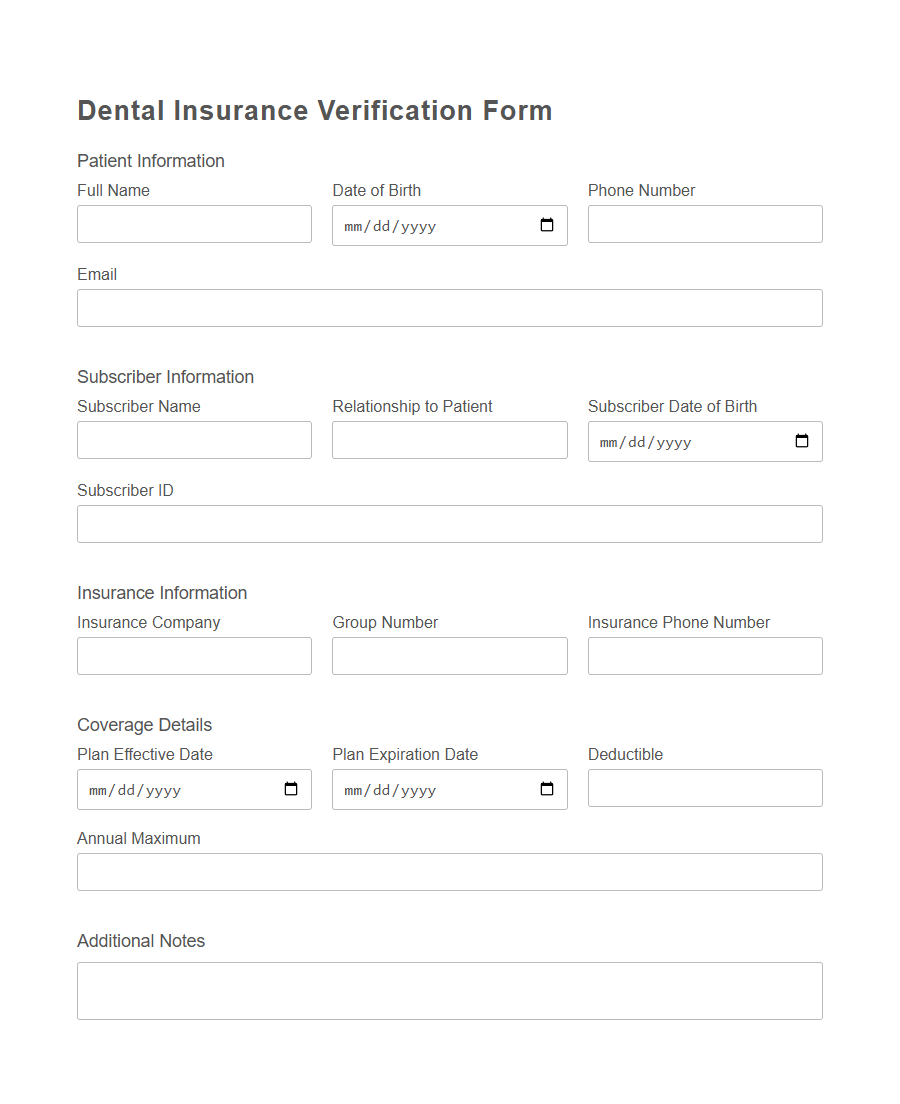

Image example of Insurance Verification Form Template:

Insurance Verification Form Template Samples

Dental Insurance Verification - PDF - HTML

Healthcare Provider Insurance Verification Template - PDF - HTML

Auto Insurance Verification Checklist Template - PDF - HTML

Life Insurance Policy Verification Form - PDF - HTML

Rental Property Insurance Verification Template - PDF - HTML

Pharmacy Insurance Coverage Verification Form - PDF - HTML

Mental Health Insurance Verification Template - PDF - HTML

Vision Insurance Verification Document - PDF - HTML

Physical Therapy Insurance Verification Form - PDF - HTML

Out-of-Network Insurance Verification Sheet - PDF - HTML

Chiropractic Insurance Verification Template - PDF - HTML

Homeowners Insurance Verification Statement - PDF - HTML

Student Health Insurance Verification Form - PDF - HTML

Specialist Referral Insurance Verification Template - PDF - HTML

Telehealth Insurance Eligibility Verification Form - PDF - HTML

Introduction to Insurance Verification Form Templates

Insurance verification form templates streamline the process of confirming a patient's insurance coverage before services are rendered. These templates ensure accuracy and efficiency by standardizing the information collection required for verification.

Using an insurance verification form template helps healthcare providers reduce claim denials and improve reimbursement timelines.

Importance of Insurance Verification in Business

Insurance verification forms play a crucial role in ensuring that businesses are protected against potential risks and liabilities. Accurate verification helps confirm that clients or partners have valid and adequate insurance coverage, reducing financial exposure. Implementing a standardized template streamlines the process, enhances compliance, and fosters trust in business transactions.

Key Components of an Insurance Verification Form

An Insurance Verification Form Template is an essential document used to confirm the details of an individual's or entity's insurance coverage. It ensures accuracy and helps streamline the verification process for all parties involved.

- Personal Information - Captures the insured's full name, date of birth, and contact details to accurately identify the policyholder.

- Insurance Provider Details - Includes the name of the insurance company, policy number, and coverage dates for verification purposes.

- Coverage Information - Specifies the types of coverage, limits, and deductibles to assess the scope of the insurance policy.

This form serves as a reliable tool to confirm insurance status and prevent any discrepancies during claims or service delivery.

Types of Insurance Verification Forms

Insurance verification form templates are essential tools for confirming a person's coverage details before providing services. These forms vary depending on the type of insurance and the specific information required by the service provider.

- Health Insurance Verification Form - This form collects information about medical coverage, including policy numbers and coverage limits.

- Auto Insurance Verification Form - Used to confirm vehicle insurance details such as policy validity, coverage types, and insured vehicle information.

- Property Insurance Verification Form - Documents the coverage status for homeowners or renters insurance to protect personal or real property.

Step-by-Step Guide to Filling Out the Template

Filling out an Insurance Verification Form Template ensures accurate and efficient processing of insurance details.

Begin by carefully entering the personal information of the insured, including full name, date of birth, and contact details. Verify that all data matches official identification to avoid delays in verification.

Next, input the insurance provider's name and policy number as they appear on the insurance card.

Double-check the policy period and coverage details to confirm the insurance is active and applicable to the intended service or claim. Accuracy in this section prevents claim denials and processing errors.

Include the provider's contact information and any relevant authorization numbers if required.

Confirm these details with the insurance company to ensure claims submitted are directed correctly and authorization is valid. This step supports smoother communication between service providers and insurers.

Finally, review the entire form for completeness and correctness before submitting.

Submitting an error-free Insurance Verification Form Template minimizes processing time and facilitates prompt insurance confirmation. Keep a copy for your records to reference in future communications or disputes.

Benefits of Using a Standardized Form

Using a standardized Insurance Verification Form Template streamlines the verification process for healthcare providers and insurers.

This template ensures all necessary information is consistently captured, reducing errors and saving time. It facilitates faster claim approvals and improves communication between parties involved.

Common Mistakes to Avoid in Insurance Verification Forms

Insurance verification forms are essential for confirming coverage and preventing claim denials. Avoiding common mistakes ensures accurate and efficient processing.

- Incomplete Information - Missing policy numbers or personal details can delay verification and claim approval.

- Incorrect Insurance Provider Details - Listing wrong or outdated insurer information leads to verification failures and communication errors.

- Lack of Signature or Authorization - Omitting required signatures can invalidate the form and hinder processing.

Customizing Your Insurance Verification Form Template

How can you customize your insurance verification form template to fit your specific needs? Tailoring the form ensures it captures all relevant information unique to your practice or business. Including fields that address particular insurance policies or client details improves accuracy and efficiency.

What elements should you consider when customizing your insurance verification form template? Focus on adding clear sections for policy numbers, provider contact information, and coverage limits. This helps streamline the verification process and reduces errors during data collection.

Why is it important to regularly update your customized insurance verification form template? Insurance policies and requirements frequently change, so keeping the form current ensures compliance and accuracy. Updated forms prevent delays in processing claims and improve overall workflow management.

Digital vs. Paper Insurance Verification Forms

Insurance verification form templates streamline the process of confirming coverage eligibility and details for patients or clients. Digital insurance verification forms offer faster data entry, easy access, and improved accuracy compared to traditional paper forms. Paper insurance verification forms, while familiar, often lead to delays and increased chances of errors due to manual handling and filing.