Revenue reporting forms are essential tools for accurately tracking and documenting income streams across various business sectors. These forms facilitate transparent financial analysis by capturing detailed transaction data, enabling effective decision-making. Properly structured examples of revenue reporting forms streamline the reporting process and enhance compliance with accounting standards.

Revenue Reporting Form Sample PDF Viewer

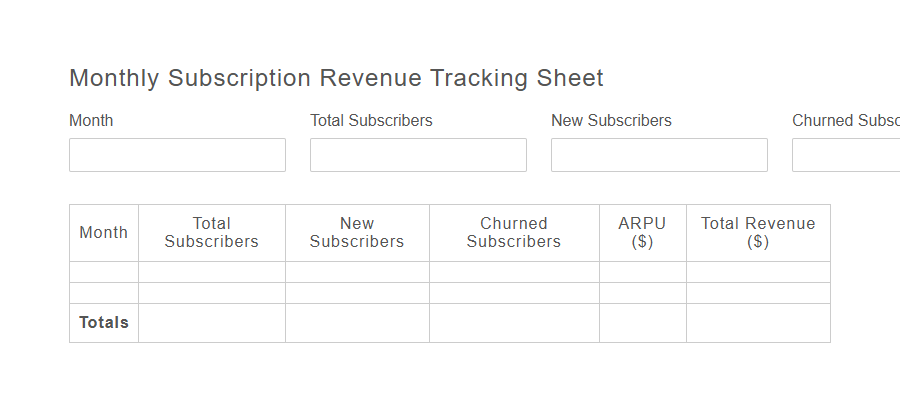

Image example of Revenue Reporting Form:

Revenue Reporting Form Samples

Monthly Subscription Revenue Tracking Sheet - PDF - HTML

Digital Product Sales Revenue Log - PDF - HTML

Affiliate Marketing Earnings Report Template - PDF - HTML

Freelance Service Invoice & Revenue Tracker - PDF - HTML

Online Course Revenue Breakdown Sheet - PDF - HTML

Etsy Shop Revenue Reporting Template - PDF - HTML

eBook Sales Revenue Statement - PDF - HTML

YouTube Channel Ad Revenue Tracker - PDF - HTML

Dropshipping Daily Revenue Report - PDF - HTML

SaaS User Revenue Growth Form - PDF - HTML

Coaching Session Revenue Analysis Template - PDF - HTML

Webinar Ticket Sales Revenue Sheet - PDF - HTML

Niche Blog Ad Revenue Recording Form - PDF - HTML

Understanding Revenue Reporting Forms

What is the purpose of a Revenue Reporting Form? A Revenue Reporting Form is designed to capture and document all sources of income for a business or organization. It helps ensure accurate financial tracking and compliance with reporting requirements.

How does a Revenue Reporting Form aid in financial management? By systematically recording revenue, the form provides clear insights into cash flow and business performance. This facilitates informed decision-making and effective budgeting.

Who typically uses Revenue Reporting Forms? Accountants, finance teams, and business managers commonly complete these forms to monitor earnings. They rely on the data to generate financial statements and reports.

What information is usually included in a Revenue Reporting Form? Key details such as dates, revenue sources, amounts received, and payment methods are recorded. This structured data collection supports transparency and audit readiness.

Why is accuracy important in Revenue Reporting Forms? Precise revenue reporting helps avoid discrepancies and potential legal issues. It ensures stakeholders have a reliable financial overview of the organization's income streams.

Importance of Accurate Revenue Reporting

Accurate revenue reporting is essential for business success.

It ensures transparent financial records and supports strategic decision-making. Precise data helps maintain compliance with regulations and builds trust with stakeholders.

Key Components of a Revenue Reporting Form

A Revenue Reporting Form is essential for accurately tracking a company's income from various sources. It ensures transparency and aids in financial analysis and decision-making.

- Revenue Details - Captures specific income streams and amounts to provide a clear picture of total revenue.

- Reporting Period - Specifies the time frame for which the revenue is being reported, ensuring accurate chronological tracking.

- Source Identification - Identifies the origin of the revenue, such as product sales, services, or external partnerships, for detailed analysis.

Types of Revenue Reporting Forms

Revenue reporting forms are essential tools used by businesses to document and track their income streams accurately. Different types of these forms cater to varied reporting needs and regulatory requirements.

- Sales Revenue Reporting Form - Records income generated from the sale of goods or services within a specific period.

- Cash Revenue Reporting Form - Tracks all cash inflows to monitor liquidity and daily earnings.

- Accrued Revenue Reporting Form - Captures revenue earned but not yet received in cash, reflecting future receivables.

Choosing the appropriate revenue reporting form ensures precise financial analysis and compliance with accounting standards.

Step-by-Step Guide to Completing a Revenue Reporting Form

Completing a Revenue Reporting Form accurately is essential for transparent financial tracking and compliance. This step-by-step guide simplifies the process to ensure correct and efficient reporting.

- Gather Required Financial Data - Collect all necessary revenue figures and supporting documents before starting the form.

- Fill in Basic Information - Enter company details and reporting period to establish the context of the report.

- Report Revenue Amounts - Input precise revenue numbers into designated sections, ensuring accuracy and consistency.

- Review and Verify Entries - Double-check all information for errors or missing data to maintain report integrity.

- Submit the Form - Follow organizational procedures to officially submit the completed revenue reporting form on time.

Common Mistakes in Revenue Reporting

Common mistakes in revenue reporting include inaccurate data entry, leading to misstated earnings. Companies often overlook the timing of revenue recognition, causing discrepancies in financial statements. Failure to reconcile revenue figures with supporting documents can result in reporting errors and compliance issues.

Digital Tools for Revenue Reporting

Revenue reporting forms are essential for accurately tracking a company's financial performance and ensuring compliance with regulatory requirements. Digital tools for revenue reporting streamline data collection, improve accuracy, and enable real-time analysis of revenue streams. These technologies enhance decision-making by providing detailed insights and automating complex reporting processes.

Compliance and Legal Considerations

Revenue reporting forms must adhere to strict compliance standards to ensure accurate financial disclosures and prevent legal liabilities. Proper documentation and timely submission are critical to meeting regulatory requirements and avoiding penalties.

Understanding legal considerations helps organizations maintain transparency and build trust with stakeholders.

Best Practices for Revenue Documentation

Accurate revenue reporting forms are essential for transparent financial documentation.

Best practices for revenue documentation include maintaining detailed transaction records and ensuring timely updates to the reporting system. Consistent verification and reconciliation processes help prevent errors and improve financial accountability.