A financial transaction authorization form template streamlines the approval process by clearly outlining authorized transactions and signatories. This form ensures secure and compliant handling of funds, reducing the risk of unauthorized activities. Organizations use these templates to maintain accurate records and enhance financial accountability.

Financial Transaction Authorization Form Template Sample PDF Viewer

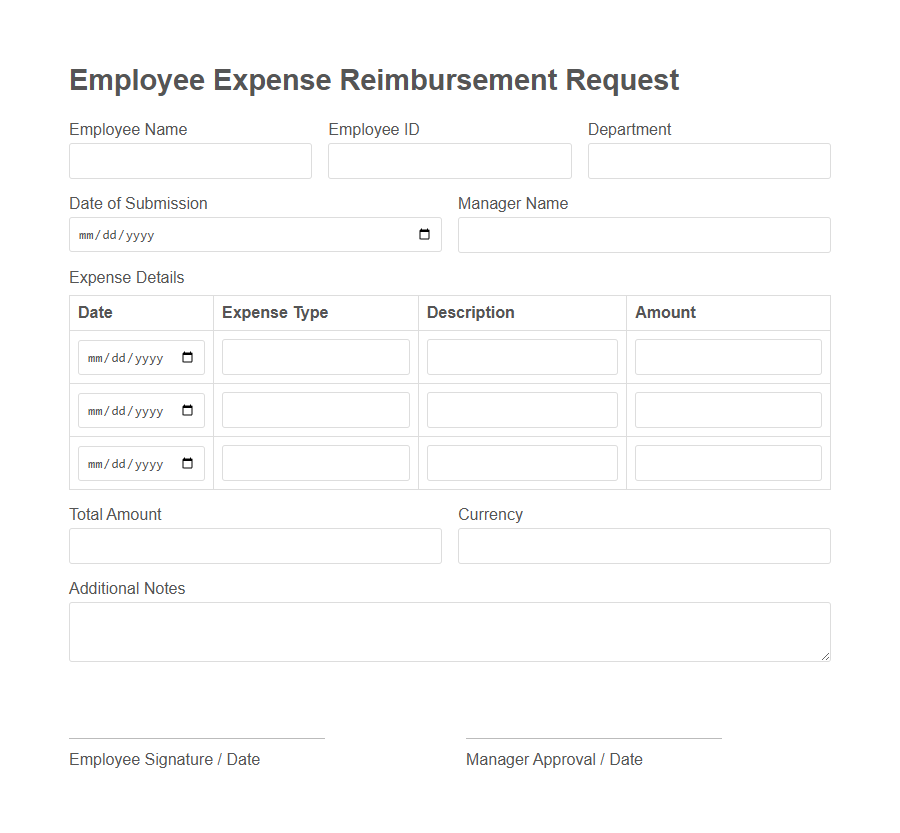

Image example of Financial Transaction Authorization Form Template:

Financial Transaction Authorization Form Template Samples

Employee Expense Reimbursement Request Template - PDF - HTML

Petty Cash Voucher Authorization Template - PDF - HTML

Vendor Payment Approval - PDF - HTML

Corporate Credit Card Usage - PDF - HTML

Wire Transfer Authorization Document Template - PDF - HTML

Internal Fund Transfer Request Template - PDF - HTML

Client Refund Approval - PDF - HTML

Budget Amendment Authorization Template - PDF - HTML

Purchase Request Authorization Template - PDF - HTML

Advance Payment Request - PDF - HTML

Capital Expenditure Approval Template - PDF - HTML

Grant Disbursement Authorization - PDF - HTML

Interdepartmental Charge Authorization Template - PDF - HTML

Introduction to Financial Transaction Authorization Forms

Financial Transaction Authorization Forms are essential documents used to approve and validate monetary transactions within an organization. They ensure that all financial activities are properly reviewed and authorized by designated personnel to maintain accountability and prevent unauthorized expenditures. These forms streamline the approval process, providing a clear record of consent for each transaction.

Importance of Authorization in Financial Transactions

Financial Transaction Authorization Form Templates play a crucial role in securing and validating monetary exchanges.

They ensure that only approved individuals can initiate or approve transactions, minimizing the risk of fraud and errors. This formal process strengthens accountability and maintains the integrity of financial operations.

Key Components of a Financial Transaction Authorization Form

A Financial Transaction Authorization Form includes essential details such as the transaction amount, date, and purpose to ensure clarity and accountability. It requires the authorized person's name, signature, and contact information to validate the approval process. The form also contains sections for authorization levels and any necessary supporting documentation to comply with organizational policies.

Types of Financial Transactions Requiring Authorization

Financial Transaction Authorization Forms are essential for ensuring proper approval and control over various monetary activities. They help maintain accountability and reduce the risk of unauthorized transactions.

- Wire Transfers - Require authorization to confirm the validity and destination of large electronic fund transfers.

- Expense Reimbursements - Need approval to verify that submitted expenses comply with company policies.

- Purchase Orders - Must be authorized to ensure that procurement aligns with budgetary constraints and organizational needs.

Benefits of Using a Standardized Authorization Form

Using a standardized financial transaction authorization form ensures consistency and accuracy in processing transactions, reducing errors and potential fraud. It streamlines the approval process by clearly outlining required information and authorizations, saving time for all parties involved.

This approach enhances accountability and provides a clear audit trail for financial activities.

How to Customize a Financial Transaction Authorization Form Template

Customizing a Financial Transaction Authorization Form Template ensures it meets your specific business needs.

Start by identifying the key information required, such as transaction details, authorizer's name, and approval hierarchy. Adjust the fields to reflect your organization's policies and compliance requirements for a streamlined authorization process.

Best Practices for Completing Authorization Forms

Filling out a Financial Transaction Authorization Form accurately ensures smooth processing and prevents delays. Following best practices enhances security and accountability in financial operations.

- Provide Clear and Complete Information - Ensure all required fields are filled out legibly and accurately to avoid processing errors.

- Verify Authorization Levels - Confirm that the signer has the proper authority to approve the transaction to maintain compliance with internal controls.

- Attach Supporting Documentation - Include relevant documents like invoices or contracts to validate the transaction and facilitate approval.

Common Mistakes to Avoid in Authorization Forms

Financial Transaction Authorization Form Templates are essential for securing approval on financial activities, but common errors can undermine their effectiveness. Understanding these mistakes helps ensure smooth and secure financial processes.

- Omitting Signature Fields - Missing signature lines can invalidate authorization and cause delays in processing.

- Vague Transaction Details - Lack of clear transaction descriptions leads to confusion and potential disputes.

- Incomplete Contact Information - Failure to include contact details hinders verification and follow-up communication.

Carefully designing authorization forms to avoid these pitfalls ensures compliance and fosters trust in financial operations.

Legal Considerations for Financial Authorization Templates

What legal considerations are essential for a Financial Transaction Authorization Form Template? Ensuring the template complies with relevant financial regulations protects both parties from potential disputes. Clear authorization language and signature requirements establish the form's validity and enforceability.