A subcontractor prequalification form helps evaluate the qualifications, experience, and financial stability of subcontractors before awarding contracts. This list of examples highlights essential criteria such as safety records, insurance coverage, past project performance, and compliance with industry standards. Using these examples ensures a thorough and consistent assessment process to select the most reliable subcontractors.

Subcontractor Prequalification Form Sample PDF Viewer

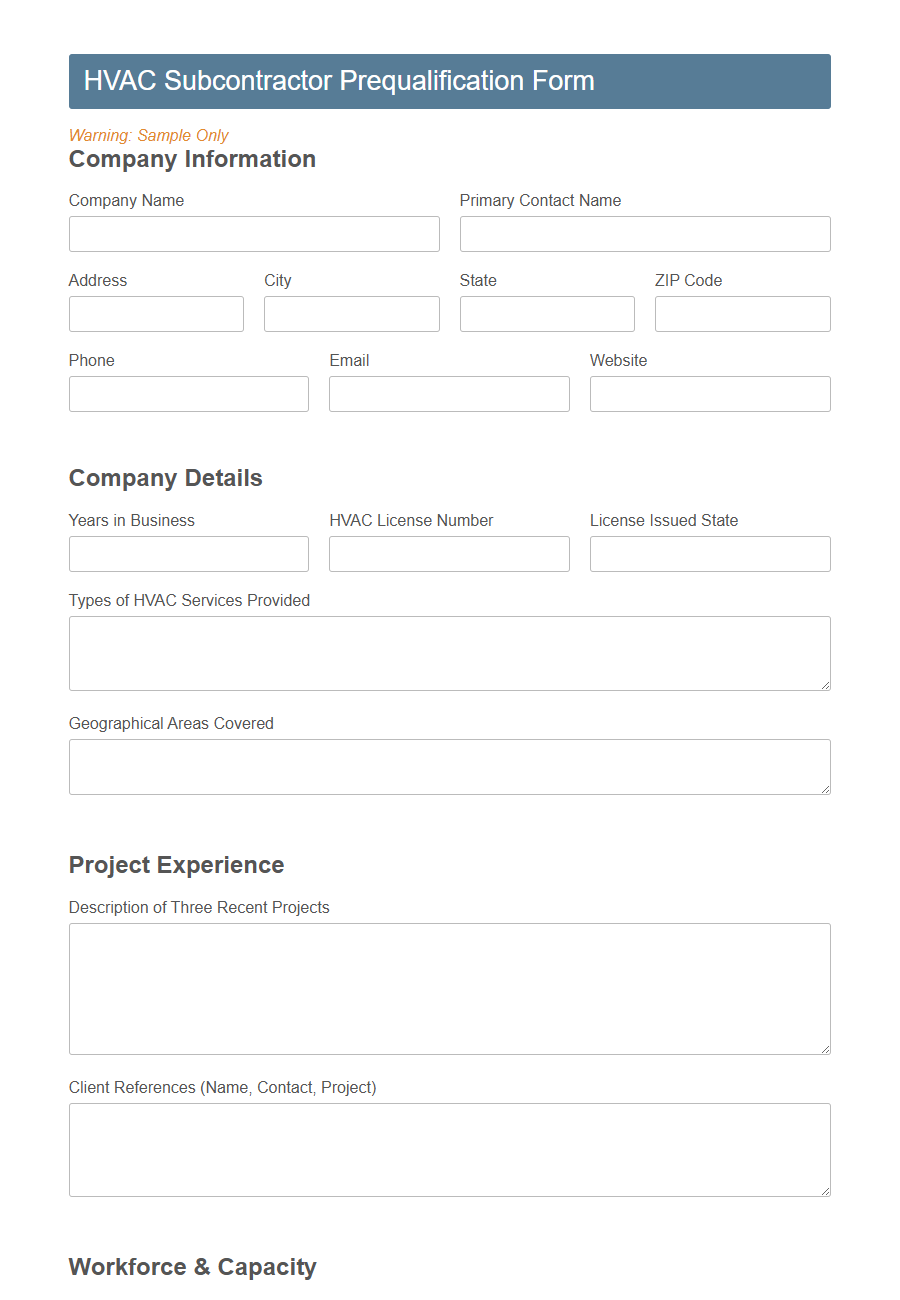

Image example of Subcontractor Prequalification Form:

Subcontractor Prequalification Form Samples

HVAC Subcontractor Prequalification Form - PDF - HTML

Electrical Subcontractor Prequalification Form - PDF - HTML

Plumbing Subcontractor Prequalification Form - PDF - HTML

Demolition Subcontractor Prequalification Form - PDF - HTML

Landscaping Subcontractor Prequalification Form - PDF - HTML

Roofing Subcontractor Prequalification Form - PDF - HTML

Painting Subcontractor Prequalification Form - PDF - HTML

Concrete Subcontractor Prequalification Form - PDF - HTML

Fire Protection Subcontractor Prequalification Form - PDF - HTML

Steel Erection Subcontractor Prequalification Form - PDF - HTML

Millwork Subcontractor Prequalification Form - PDF - HTML

Glazing Subcontractor Prequalification Form - PDF - HTML

Asphalt Paving Subcontractor Prequalification Form - PDF - HTML

Drywall Subcontractor Prequalification Form - PDF - HTML

Elevator Installation Subcontractor Prequalification Form - PDF - HTML

Introduction to Subcontractor Prequalification

Subcontractor prequalification is a critical process used to assess the capabilities and reliability of potential subcontractors before project engagement.

It ensures that subcontractors meet the required standards for safety, quality, financial stability, and experience. This process helps mitigate risks and promotes successful project outcomes by selecting qualified partners.

Purpose of a Prequalification Form

The Subcontractor Prequalification Form serves to assess the capabilities, experience, and financial stability of potential subcontractors before awarding contracts. It ensures that only qualified and reliable subcontractors are considered for a project, reducing risks and enhancing quality control.

This process helps project managers make informed decisions and maintain project timelines and standards.

Key Components of the Form

The Subcontractor Prequalification Form is essential for evaluating a subcontractor's qualifications before project engagement. It ensures that only capable and compliant subcontractors are selected.

- Company Information - Collects basic details such as company name, contact information, and years in business to verify legitimacy.

- Financial Stability - Requests financial statements and bonding capacity to assess economic reliability.

- Safety Record - Includes past safety performance data and certifications to evaluate workplace safety standards.

Essential Business Information Required

Subcontractor prequalification forms collect essential business information to assess a contractor's capability and reliability. This information ensures that only qualified subcontractors are considered for projects.

- Business Identification - Includes the company name, address, and contact details to verify the subcontractor's legitimacy.

- Licensing and Certifications - Details about valid licenses and industry certifications confirm compliance with legal and professional standards.

- Financial Stability - Financial statements or credit references demonstrate the subcontractor's ability to manage project costs responsibly.

Providing comprehensive business information helps streamline the selection process and mitigate project risks.

Safety and Compliance Criteria

The Subcontractor Prequalification Form evaluates safety and compliance criteria to ensure all contractors adhere to industry standards and regulatory requirements. It assesses factors such as safety training programs, incident history, and adherence to OSHA regulations. This process minimizes risks and promotes a secure and compliant work environment for all project participants.

Financial Stability Assessment

How do you evaluate the financial stability of a subcontractor during prequalification? Assessing financial stability involves reviewing financial statements, credit history, and liquidity ratios to ensure the subcontractor can meet project demands. This evaluation helps mitigate risks related to payment delays or project interruptions.

Past Performance and Experience

The Subcontractor Prequalification Form evaluates a contractor's past performance and experience to ensure project success.

It gathers detailed information about previous projects, including scope, timelines, and client satisfaction. This helps to identify reliable subcontractors with a proven track record of quality work and timely delivery.

Documentation and Certification Needs

The Subcontractor Prequalification Form requires detailed documentation to verify a subcontractor's qualifications and project experience. Essential certifications, such as OSHA safety compliance and relevant trade licenses, must be submitted to ensure adherence to industry standards. Proper documentation and certification help mitigate risks and confirm the subcontractor's capability to meet project requirements.

Benefits of Prequalifying Subcontractors

Subcontractor prequalification forms streamline the selection process by ensuring only capable and reliable contractors are considered. This step reduces project risks and enhances overall work quality.

- Improved Risk Management - Prequalification helps identify subcontractors with proven safety and compliance records, minimizing potential project hazards.

- Enhanced Project Efficiency - Selecting qualified subcontractors leads to smoother workflows and timely project completion.

- Cost Control - Thorough evaluation of subcontractors prevents unforeseen expenses by confirming financial stability and capability.