Expense reimbursement form templates provide a streamlined way for employees to report and claim business-related expenses efficiently. These templates ensure accuracy and consistency in submitting expense reports while simplifying the approval process for finance teams. Utilizing well-designed forms reduces errors and accelerates reimbursement timelines.

Expense Reimbursement Form Template Sample PDF Viewer

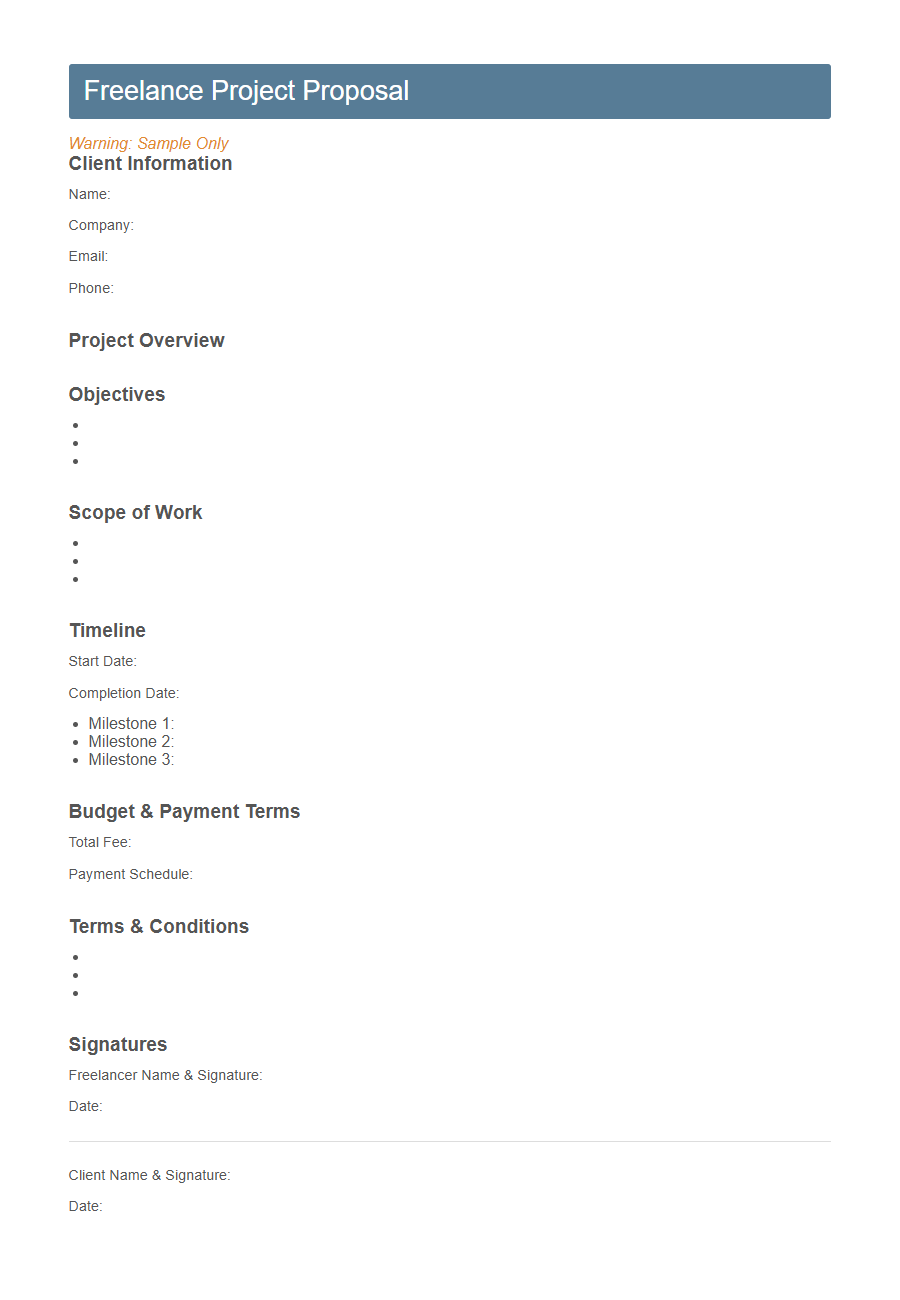

Image example of Expense Reimbursement Form Template:

Expense Reimbursement Form Template Samples

Freelance Project Proposal Template - PDF - HTML

Employee Onboarding Checklist Template - PDF - HTML

Social Media Content Calendar Template - PDF - HTML

Vendor Contract Approval - PDF - HTML

Influencer Collaboration Agreement Template - PDF - HTML

Remote Work Agreement Template - PDF - HTML

Monthly Marketing Report Template - PDF - HTML

Client Feedback Survey Template - PDF - HTML

Nonprofit Grant Application Template - PDF - HTML

Board Meeting Minutes Template - PDF - HTML

Event Sponsorship Request - PDF - HTML

Research Data Collection Sheet Template - PDF - HTML

Custom Order Confirmation - PDF - HTML

Podcast Guest Consent - PDF - HTML

Startup Equity Distribution Spreadsheet Template - PDF - HTML

What is an Expense Reimbursement Form Template?

An Expense Reimbursement Form Template is a pre-designed document used by employees to request repayment for business-related expenses. It streamlines the process of submitting, reviewing, and approving expense claims within an organization.

- Standardized Format - Ensures consistent and clear submission of expense details across the company.

- Itemized Expense Tracking - Allows detailed listing of individual costs such as meals, travel, and supplies.

- Proof of Expenditure - Provides sections to attach receipts and other supporting documents for verification.

Key Components of an Effective Reimbursement Form

An effective expense reimbursement form template clearly outlines the required information to ensure accurate and timely processing. Key components include employee details, date of expense, description, amount, and receipt attachment fields.

Incorporating approval signatures and reimbursement method options enhances accountability and streamlines payment.

Step-by-Step Guide to Completing the Form

An Expense Reimbursement Form Template streamlines the process of claiming business-related expenses. Following a clear step-by-step guide ensures accurate and timely reimbursement.

- Gather Receipts - Collect all relevant receipts and proof of payment before filling out the form.

- Fill in Personal and Expense Details - Enter your name, date, and detailed descriptions of each expense to maintain clarity.

- Submit for Approval - Review the form for accuracy and send it to the appropriate department or manager for approval and processing.

Common Mistakes to Avoid

Using an incomplete or incorrectly filled Expense Reimbursement Form Template often leads to processing delays and rejected claims. Failing to attach proper receipts or supporting documents can result in audit issues and payment denials. Ensuring accurate dates, expense descriptions, and totals helps maintain efficient and transparent reimbursement procedures.

Benefits of Using a Standardized Template

Why is using a standardized Expense Reimbursement Form Template beneficial for businesses? It simplifies the submission process by providing a clear and consistent format for all employees to follow. This reduces errors and accelerates approval times, improving overall efficiency.

How does a standardized template help in maintaining accurate financial records? It ensures that all necessary information is captured uniformly, making expense tracking and auditing more straightforward. Consistent data entry supports better budgeting and financial planning.

Can a standardized Expense Reimbursement Form Template enhance compliance with company policies? Yes, it helps enforce expense guidelines by clearly outlining required documentation and approval steps. This minimizes the risk of unauthorized or fraudulent claims, protecting company resources.

Customizing Your Expense Reimbursement Form

Customizing your expense reimbursement form ensures it meets your organization's specific needs and simplifies the submission process for employees.

Start by including fields relevant to your business, such as expense categories, date of expense, and payment methods. Tailor approval workflows and add company branding to maintain consistency and professionalism.

Digital vs. Paper Reimbursement Templates

Digital Expense Reimbursement Form Templates offer faster processing and easier tracking compared to traditional paper forms. Paper templates often lead to delays and increased risk of errors due to manual entry and physical handling. Switching to digital templates enhances accuracy, improves record-keeping, and supports environmental sustainability by reducing paper waste.

Integrating the Template with Accounting Software

Integrating an Expense Reimbursement Form Template with accounting software streamlines financial workflows while enhancing accuracy. This integration reduces manual data entry and accelerates the reimbursement process for employees.

- Seamless Data Transfer - Information from the form automatically populates the accounting system, minimizing errors and duplication.

- Real-Time Expense Tracking - Synchronization allows for instant visibility of submitted expenses within the company's financial records.

- Enhanced Reporting - Integration enables detailed expense reports generated directly from the accounting software for better financial analysis.

Integrating the template with accounting software improves efficiency and ensures precise expense management.

Legal and Compliance Considerations

An Expense Reimbursement Form Template must align with legal and compliance requirements to ensure proper documentation and accountability.

It is essential to include clear policies regarding eligible expenses, submission deadlines, and necessary receipts to comply with tax regulations and internal controls. Failure to adhere to these standards can result in financial discrepancies and legal liabilities for the organization.