A vehicle loan application form requires essential details such as personal information, employment status, income proof, and loan amount requested. Accurate completion of these sections helps lenders assess creditworthiness and streamline the approval process. Providing clear and truthful information increases the chances of securing favorable loan terms.

Vehicle Loan Application Form Sample PDF Viewer

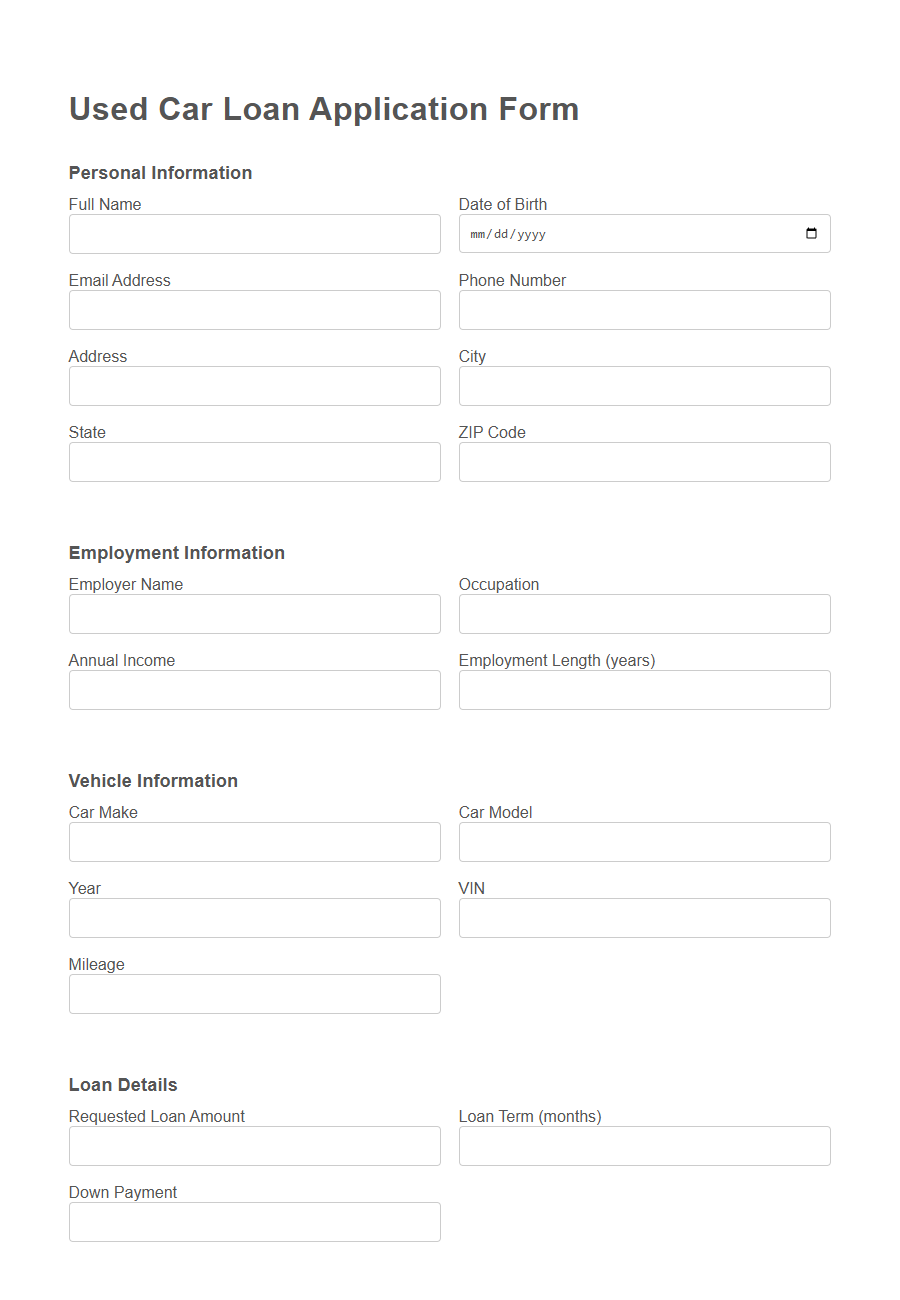

Image example of Vehicle Loan Application Form:

Vehicle Loan Application Form Samples

Used Car Loan Application Form - PDF - HTML

Electric Vehicle Financing Application Template - PDF - HTML

Motorcycle Loan Application Form - PDF - HTML

Commercial Fleet Vehicle Loan Application - PDF - HTML

Classic Car Loan Request Template - PDF - HTML

Agricultural Vehicle Loan Application Form - PDF - HTML

Student Vehicle Loan Application - PDF - HTML

Taxi/Commercial Ride-Sharing Vehicle Loan Form - PDF - HTML

Luxury Car Loan Application Template - PDF - HTML

Caravan/RV Financing Application Form - PDF - HTML

Emergency Vehicle Loan Request Form - PDF - HTML

Auto Loan Application for Expats - PDF - HTML

Vehicle Loan Application for Small Business Owners - PDF - HTML

Introduction to Vehicle Loan Application Forms

A Vehicle Loan Application Form is a crucial document for individuals seeking financial assistance to purchase a vehicle. It collects essential information needed by lenders to evaluate the borrower's eligibility and loan terms.

- Purpose - The form serves to formally request a loan and provides key details about the applicant's personal and financial background.

- Information Required - It typically includes sections for identification, employment, income, and vehicle details to assess creditworthiness.

- Loan Processing - Accurate completion of the form accelerates the approval process and helps secure favorable loan conditions.

Filling out a Vehicle Loan Application Form carefully is the first step towards obtaining a vehicle loan efficiently.

Importance of Vehicle Loan Applications

The vehicle loan application form is crucial for securing financial assistance to purchase a vehicle. It ensures the lender has all necessary information to evaluate the borrower's creditworthiness accurately.

- Facilitates loan approval - The form provides detailed personal and financial data needed to process and approve the loan efficiently.

- Ensures transparency - It helps both borrower and lender understand the terms and conditions clearly, reducing misunderstandings.

- Legal documentation - The application serves as an official record that protects the rights of both parties throughout the loan term.

Eligibility Criteria for Vehicle Loans

Vehicle loan eligibility criteria depend on factors like age, income, credit score, and employment status. Applicants must be within the specified age range, usually 18 to 65 years, and have a stable source of income. A good credit history increases the chances of approval, ensuring the borrower can repay the loan on time.

Key Sections of the Application Form

The Vehicle Loan Application Form is designed to collect essential information from applicants seeking financing for a vehicle purchase.

Key sections of the application form include Personal Information, Employment Details, Financial Information, Loan Amount Requested, and Vehicle Details. Each section gathers specific data required to assess the applicant's eligibility and loan approval prospects.

Required Documents for Submission

What documents are required to submit a vehicle loan application form? A completed application form must be accompanied by proof of identity and address. Applicants should also provide income verification and vehicle details to ensure smooth processing.

Step-by-Step Guide to Filling Out the Form

Filling out a vehicle loan application form properly ensures a smooth approval process. Follow this step-by-step guide to complete the form accurately and efficiently.

- Provide Personal Information - Enter your full name, address, contact number, and email to establish your identity and communication details.

- Detail Employment and Income - Supply information about your employer, job title, and monthly income to demonstrate your ability to repay the loan.

- Specify Vehicle Information - Include the make, model, year, and price of the vehicle you intend to purchase to help the lender assess the loan request.

Common Mistakes to Avoid

Filling out a vehicle loan application form requires careful attention to detail to avoid common mistakes that can delay approval. Incorrect or incomplete information, such as mismatched income details or missing identification, often leads to processing issues.

Double-check all entries before submitting your application to ensure accuracy and completeness.

Online vs. Offline Application Process

Applying for a vehicle loan can be done through online or offline methods, each offering distinct advantages.

Online application forms provide convenience and speed, allowing users to apply from anywhere at any time. Offline applications require physical presence at a bank or lending institution, often involving more paperwork and longer processing times.

Choosing between online and offline vehicle loan applications depends on the applicant's preference for ease, speed, and personal interaction with the lender.

Online forms streamline document submission and approval processes through digital platforms. Offline applications may offer face-to-face assistance, which can be beneficial for those unfamiliar with digital technology or needing personalized guidance.

Both methods ultimately achieve the same goal of securing a vehicle loan but differ in terms of accessibility and user experience.

Online applications suit tech-savvy applicants seeking quick approval, while offline applications cater to individuals who prefer traditional methods and direct service.

Tips for Quick Approval

Ensure all personal and financial information is accurate and complete to avoid delays in processing. Provide necessary documents such as proof of income, identity, and residence promptly. Maintain a good credit score to increase the chances of quick loan approval.