Automobile insurance claim form templates streamline the process of reporting vehicle damage and filing claims efficiently. These templates typically include sections for personal information, details of the accident, vehicle damage description, and witness statements. Utilizing a well-structured claim form ensures accurate information submission and faster claim resolution.

Automobile Insurance Claim Form Template Sample PDF Viewer

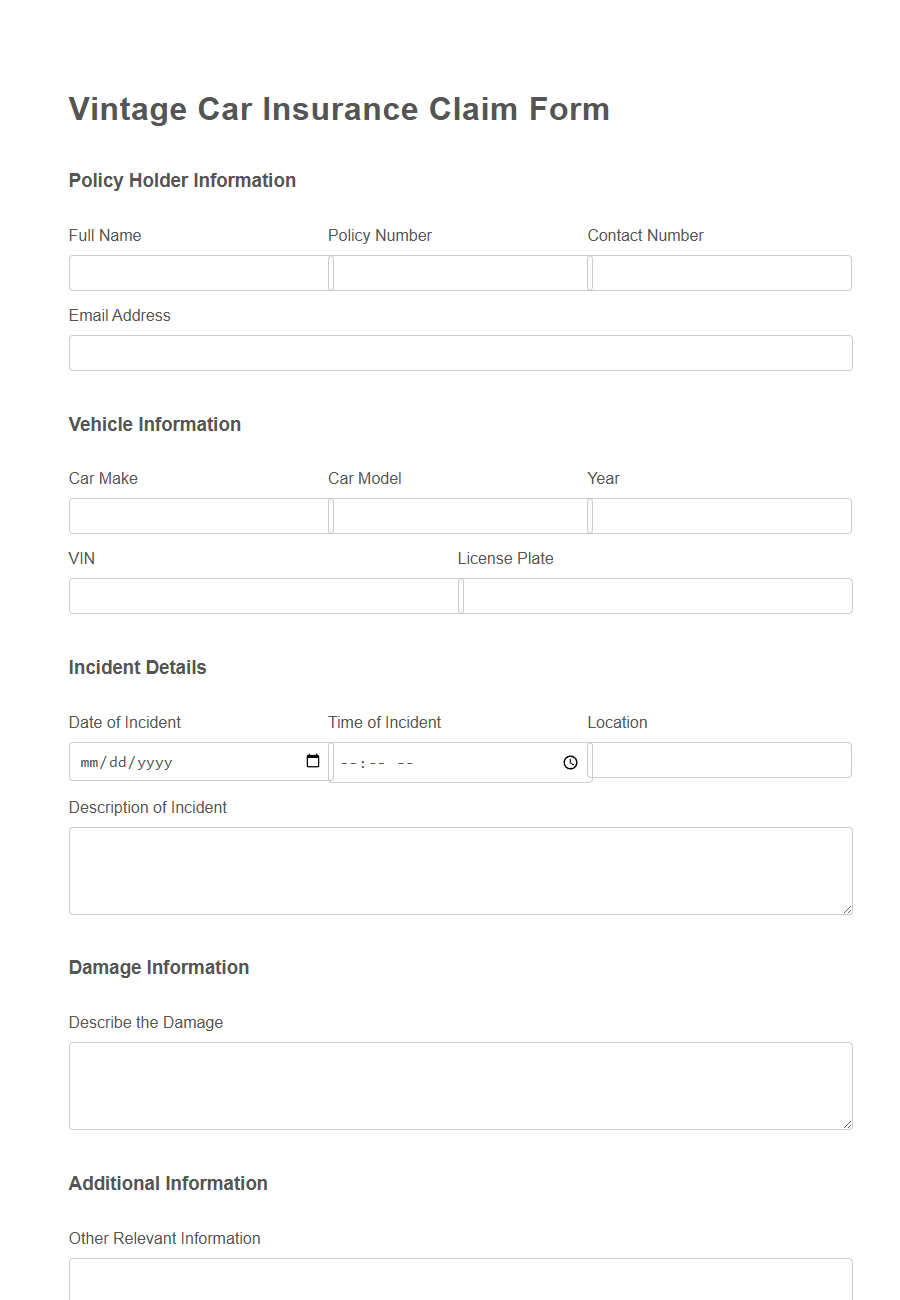

Image example of Automobile Insurance Claim Form Template:

Automobile Insurance Claim Form Template Samples

Vintage Car Insurance Claim - PDF - HTML

Electric Vehicle Accident Report Template - PDF - HTML

Commercial Fleet Accident Claim Template - PDF - HTML

Rideshare Driver Insurance Claim Form - PDF - HTML

Motorcycle Theft Claim Document Template - PDF - HTML

Classic Car Restoration Insurance Claim Form - PDF - HTML

Rental Car Damage Claim Template - PDF - HTML

Luxury Car Vandalism Report Template - PDF - HTML

Taxi Service Accident Claim Form - PDF - HTML

Auto Glass Breakage Insurance Claim Template - PDF - HTML

Off-Road Vehicle Insurance Incident Form - PDF - HTML

Auto Parts Theft Insurance Claim Form - PDF - HTML

RV (Recreational Vehicle) Insurance Claim Template - PDF - HTML

Understanding Automobile Insurance Claim Forms

Understanding automobile insurance claim forms is essential for a smooth and efficient claims process. These forms require accurate details about the vehicle, accident, and policyholder to ensure proper evaluation. Filling out the form correctly helps speed up the approval and settlement of the insurance claim.

Importance of a Comprehensive Claim Form Template

A comprehensive automobile insurance claim form template ensures all necessary information is accurately captured, facilitating a smooth and efficient claims process. It minimizes errors and delays, helping both the insurer and the claimant resolve issues quickly.

Using a detailed claim form template is essential for speeding up claim assessments and improving communication between parties.

Key Sections in an Automobile Insurance Claim Form

What are the key sections in an automobile insurance claim form? The primary sections typically include personal information, vehicle details, and incident description. These sections help ensure accurate processing and validation of the claim.

Why is it important to provide detailed personal information in the claim form? Personal details such as name, contact information, and policy number establish the identity of the claimant. This information allows the insurance company to access the correct policy and communicate effectively throughout the claim process.

What vehicle details must be included in the claim form? Essential details include the make, model, registration number, and vehicle identification number (VIN). Accurate vehicle information helps verify coverage and assess the extent of damage or loss.

How does the incident description section contribute to the claim? This section requires a clear and concise account of the accident or damage, including date, time, location, and circumstances. Providing precise details supports the insurer's evaluation of liability and claim validity.

Why is documentation of witnesses and involved parties necessary? Listing witness names and contact information, along with details of other parties, helps corroborate the event. This evidence can aid in resolving disputes and expediting claim approval.

Essential Information Required from Policyholders

Filing an automobile insurance claim requires providing specific essential information to ensure a smooth and efficient process. Policyholders must accurately complete the claim form template with all necessary details to facilitate timely assessment and settlement.

- Policyholder Information - This includes the full name, contact details, and policy number to verify the insurance coverage.

- Accident Details - Date, time, location, and a brief description of the incident are required to understand the circumstances of the claim.

- Vehicle Information - Details such as make, model, registration number, and damage extent help evaluate the claim accurately.

Steps to Fill Out an Insurance Claim Form Accurately

Filling out an automobile insurance claim form accurately is essential for a smooth and timely claims process. Careful attention to detail ensures all necessary information is correctly provided.

- Gather all required documents - Collect your insurance policy, accident report, photos, and any relevant medical or repair bills before starting the form.

- Provide accurate personal information - Enter your name, contact details, and policy number exactly as they appear on your insurance documents to avoid delays.

- Detail the accident clearly - Describe the date, time, location, and nature of the incident factually, including the names and contact information of other parties involved.

Review the form thoroughly to ensure all information is correct before submitting it to your insurance provider.

Common Mistakes to Avoid on Claim Forms

Filling out an automobile insurance claim form accurately is crucial for a smooth claim process.

Common mistakes include missing or incorrect information, which can delay or invalidate your claim. Ensuring all details such as policy number, date of the incident, and contact information are correctly entered prevents unnecessary complications.

Sample Automobile Insurance Claim Form Template

A sample automobile insurance claim form template provides a clear structure for reporting vehicle damage or accidents. It helps streamline the claim process by organizing essential information efficiently.

- Personal Information Section - Collects the insured's contact details and policy number to verify identity and coverage.

- Accident Details Section - Records the date, time, location, and description of the incident for accurate claim assessment.

- Vehicle and Damage Information - Documents the vehicle details and extent of damage to facilitate repair estimates and claim approval.

Best Practices for Submitting Claim Forms

When submitting an automobile insurance claim form, ensure all required fields are accurately completed to avoid processing delays. Attach supporting documents such as accident reports, photos, and repair estimates to strengthen your claim. Submit the form promptly to comply with your insurer's deadlines and increase the chances of a swift settlement.

Digital vs. Paper Claim Form Templates

Automobile insurance claim form templates are essential for reporting accidents and processing claims efficiently.

Digital claim form templates offer faster submission and automated data validation, reducing errors and speeding up the claims process. Paper claim form templates provide a familiar, tangible option but often involve manual handling, leading to slower processing times.